S-1: General form of registration statement for all companies including face-amount certificate companies

Published on September 30, 2013

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| FORM S-1 |

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

ANTRIABIO, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 000-51563 | 27-3440894 | ||

|

(State or other jurisdiction of incorporation) |

(Commission file number) |

(IRS Employer Identification No.) |

890 Santa Cruz Avenue

Menlo Park, CA 94025

(650) 241-9330

(Address, including zip code, and telephone number, including area code of registrant’s principal executive offices)

AntriaBio, Inc.

Attn: Nevan Elam, CEO

890 Santa Cruz Avenue

Menlo Park, CA 94025

(650) 241-9330

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of communications to:

Dorsey & Whitney LLP

Attn: Michael L. Weiner

1400 Wewetta Street, Suite 400

Denver, CO 80202

(303) 352-1156

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act: ¨ a large accelerated filer,¨ an accelerated file,¨ a non-accelerated filer, or x a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act)

Calculation of Registration Fee

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (1)(2) |

Amount of Registration Fee |

||||||

|

Units consisting of: (i) Series A Convertible Preferred Stock, $0.001 par value per share (ii) Warrants to purchase common stock Shares

of common stock issuable upon conversion of the Series A Convertible Preferred Stock |

||||||||

| Total | $ | 12,000,000 | $ | 1,637 | ||||

| (1) | Estimated solely for the purpose of calculating the registration fees pursuant to rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Pursuant to Rule 416, this registration statement shall be deemed to cover the additional securities (i) to be offered or issued in connection with any provision of any securities purported to be registered hereby to be offered pursuant to terms that provide for a change in the amount of securities being offered or issued to prevent dilution resulting from stock splits, stock dividends, or similar transactions and (ii) of the same class as the securities covered by this registration statement issued or issuable prior to completion of the distribution of securities covered by this registration statement as a result of a stock split, or a stock dividend on, the registered securities. |

| 2 |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED SEPTEMBER 30, 2013

ANTRIABIO, INC.

Up to [ ] units consisting of [ ] shares of Series A Convertible Preferred Stock and [ ] Warrants

[ ] Shares of Common Stock underlying the Series A Convertible Preferred Stock

[ ] shares of common stock underlying the Warrants

[ ] Shares of Common Stock issuable upon the payment of the 8% annual dividend payment to the holders of the Series A Convertible Preferred Stock

We are offering [ ] units to purchasers in this offering, with each unit consisting of (1) one share of Series A Convertible Preferred Stock which is convertible into approximately [ ] shares of our common stock, and (2) one warrant exercisable for [ ] shares of common stock at an exercise price of $[ ] per share. This prospectus also covers up to [ ] shares of common stock issuable upon conversion of the Series A Convertible Preferred Stock, up to [ ] shares of common stock issuable upon exercise of the warrants and up to [ ] shares of common stock issuable in connection with the 8% annual dividend payment to the holders of the Series A Convertible Preferred Stock. The Series A Convertible Preferred Stock will have a stated dividend rate of 8% per annum, payable in cash, or at our election and subject to certain conditions described in this prospectus, in shares of our common stock.

The units will be sold for a purchase price equal to $[ ] per unit. Units will not be issued or certified. The shares of Series A Convertible Preferred Stock and the warrants are immediately separable and will be issued separately. Subject to certain ownership limitations, the Series A Convertible Preferred Stock is convertible at any time at the option of the holder into shares of our common stock at a conversion price of $[ ] per share. Subject to certain ownership limitations, the warrants are exercisable beginning [ ] and expire on the sixth anniversary of the date of issuance.

For a more detailed description of the Series A Convertible Preferred Stock, see the section entitled “Description of Securities - Series A Convertible Preferred Stock” beginning on page 34 of this prospectus. For a more detailed description of the warrants, see the section entitled “Description of Securities – Warrants” beginning on page 36 of this prospectus. For a more detailed description of our common stock, see the section entitled “Description of Securities – Common Stock” beginning on page 33 of this prospectus.

| 3 |

Our common stock is currently quoted on the OTCQB under the symbol “ANTB.” The last reported sale price of our common stock on September 27, 2013 was $0.60 per share.

We have retained Ladenburg Thalmann & Co., Inc. (the “Placement Agent”) to act as our exclusive placement agent in connection with this offering and to use its “best efforts” to solicit offers to purchase the units. See “Plan of Distribution” beginning on page 37 of this prospectus for more information regarding this agreement.

There is no public trading for the Series A Convertible Preferred Stock or warrants and we do not expect one to develop. In addition, we do not intend to apply for listing of the Series A Convertible Preferred Stock or warrants on any national securities exchange.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” on page 14 of this prospectus and those contained in any related free writing prospectuses that we have authorized for use in connection with this offering and in our Securities and Exchange Commission filings that are incorporated by reference into this prospectus.

| Per Unit | Total | ||||||

| Public offering price | $ | [ ] | $ | [ ] | |||

| Placement Agent fees (1) | $ | [ ] | $ | [ ] | |||

| Proceeds, before expenses, to us | $ | [ ] | $ | [ ] |

| (1) | In addition, we have agreed to issue to the Placement Agent warrants to purchase a number of shares of common stock equal to 2% of the aggregate number of shares of common stock issuable upon conversion of the Series A Convertible Preferred Stock sold in this offering and to reimburse the expenses of the Placement Agent as described in the Plan of Distribution herein. |

The Placement Agent is not purchasing or selling any units pursuant to this offering, nor are we requiring any minimum purchase or sale of any specific number of units. Because there is no minimum offering amount required as a condition to the closing of this offering, the actual public offering amount, placement agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth above. We expect that delivery of the units being offered pursuant to this prospectus will be made to purchasers on or about [ ].

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Ladenburg Thalmann & Co., Inc.

The date of this prospectus is ______________, 2013

| 4 |

TABLE OF CONTENTS

| Page | ||

| ABOUT THE PROSPECTUS | 6 | |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 6 | |

| PROSPECTUS SUMMARY | 7 | |

| SUMMARY FINANCIAL DATA | 14 | |

| RISK FACTORS | 14 | |

| USE OF PROCEEDS | 32 | |

| DILUTION | 32 | |

| DESCRIPTION OF SECURITIES | 33 | |

| PLAN OF DISTRIBUTION | 37 | |

| DESCRIPTION OF BUSINESS | 40 | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 48 | |

| MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 52 | |

| CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 54 | |

| DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 54 | |

| EXECUTIVE COMPENSATION | 57 | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 61 | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE. | 63 | |

| LEGAL MATTERS | 64 | |

| EXPERTS | 65 | |

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | 65 | |

| ADDITIONAL INFORMATION | 66 | |

| PART II – INFORMATION NOT REQUIRED IN PROSPECTUS | II-1 | |

| SIGNATURES | II-5 |

You may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus or that this prospectus is correct as of any time after its date.

Some of the industry and market data contained in this prospectus are based on independent industry publications or other publicly available information, while other information is based on our internal sources. Although we believe that each source is reliable as of its respective date, the information contained in such sources has not been independently verified, and neither we, nor the Placement Agent can assure you as to the accuracy or completeness of this information.

| 5 |

ABOUT THE PROSPECTUS

In this prospectus, the “Company,” “AntriaBio,” “we,” “us,” and “our” and similar terms refer to AntriaBio, Inc. References to our “common stock” refer to the common stock, par value $0.001 per share, of AntriaBio, Inc.

You should read this prospectus together with additional information described under the headings “Where You Can Find More Information.” If there is any inconsistency between the information in this prospectus and the documents incorporated by reference herein, you should rely on the information in this prospectus.

You should rely only on the information contained in or incorporated by reference in this prospectus. Neither we nor the placement agent have authorized any other person to provide information different from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information appearing in this prospectus is accurate as of the dates on the cover page, regardless of time of delivery of the prospectus or any sale of securities. Our business, financial condition, results of operation and prospects may have changed since those dates.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Information set forth in this prospectus and the information it incorporates by reference may contain various “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All information relative to future markets for our products and trends in and anticipated levels of revenue, gross margins and expenses, as well as other statements containing words such as “believe,” “project,” “may,” “will,” “anticipate,” “target,” “plan,” “estimate,” “expect” and “intend” and other similar expressions constitute forward-looking statements. These forward-looking statements are subject to business, economic and other risks and uncertainties, both known and unknown, and actual results may differ materially from those contained in the forward-looking statements. Examples of risks and uncertainties that could cause actual results to differ materially from historical performance and any forward-looking statements include, but are not limited to, the risks described under the heading “Risk Factors” beginning on page 14 of this prospectus, in our most recent Annual Report on Form 10-K, as well as any subsequent filings with the United States Securities and Exchange Commission. Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements. Also, these forward-looking statements represent our estimates and assumptions only as of the date such forward-looking statements are made. You should read carefully this prospectus and any related free writing prospectuses that we have authorized for use in connection with this offering, together with the information incorporated herein or therein by reference as described under the heading “Where You Can Find More Information,” completely and with the understanding that our actual future results may be materially different from what we expect. We hereby qualify all of our forward-looking statements by these cautionary statements. Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

| 6 |

PROSPECTUS SUMMARY

This summary is not complete and does not contain all of the information you should consider before investing in the securities offered by this prospectus. You should read this summary together with the entire prospectus, including our financial statements, the notes to those financial statements, and the other documents identified under the headings “Where You Can Find More Information” in this prospectus before making an investment decision. See the Risk Factors section of this prospectus on page 14 for a discussion of the risks involved in investing in our securities.

ANTRIABIO, INC.

Our Company

We are an early-stage development company focused on developing and commercializing proprietary technology to be used with active pharmaceutical ingredients to create sustained release injectable formulations. Our lead product candidate is AB101, which is a potential once-a-week basal insulin injection for the diabetes market. Our second potential product candidate is AB201, which is a long acting glucagon-like peptide-1 and is a product concept that is in the early stages of development. Our strategy is to develop AB101 for the diabetes market and other product candidates using our proprietary sustained release formulation capabilities with known pharmaceutical agents and United States Food and Drug Administration ("FDA") approved delivery technologies. We believe that this strategy increases the probability of technical success while reducing safety concerns, approval risks and development costs. We also believe that our approach can result in differentiated, patent-protected products that provide significant benefits to patients and physicians.

Two distinct aspects set apart our technology from others. One, the drug is PEGylated in a site-specific manner. Two, the PEGylated insulin is encapsulated in biodegradable microspheres made from poly(lactide-glycolide) co-polymer using a novel emulsification device. Our intellectual property covers both aspects. Microspheres prepared this way have a uniform distribution of the drug inside, compared to others where islands or pockets of drug are typically observed.

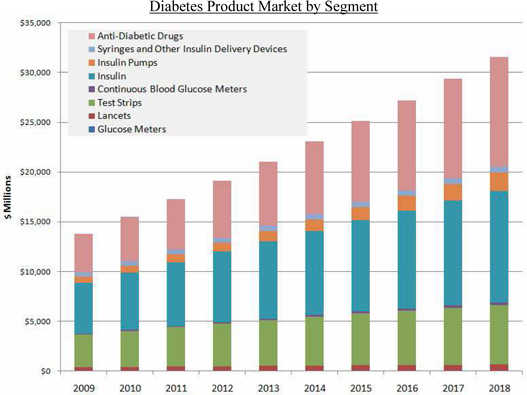

The Market

Diabetes is a chronic, life-threatening disease for which there is no known cure. In normal, healthy individuals, the pancreas produces sufficient insulin to ensure proper control of glucose levels. The pancreas produces a steady, low level of insulin known as “basal” insulin, which regulates blood glucose levels between meals and during the nighttime. After a person eats a meal, blood glucose levels rise rapidly and the pancreas responds with a marked and transient increase in insulin secretion, the prandial insulin release, to bring glucose levels back to the normal range.

Diabetes is marked by high levels of blood glucose (hyperglycemia) resulting from defects in insulin production, insulin action or both. According to the International Diabetes Federation, approximately 366 million people suffer from the disease worldwide and this number is expected to reach approximately 550 million by 2030 as a result of an aging population, diets and lifestyles. In the United States ("US") alone, the American Diabetes Association and the Centers for Disease Control and Prevention estimate that there are 25.8 million people with diabetes, of which an estimated seven million are currently undiagnosed. Furthermore, the diagnosed and undiagnosed diabetes population, which is estimated to be 8.3% of the US population in 2011, is expected to grow by almost two million new cases each year. Complications associated with diabetes include, but are not limited to, heart disease, kidney disease, eye disease, neurological deterioration and amputations.

| 7 |

Our Products and Technology

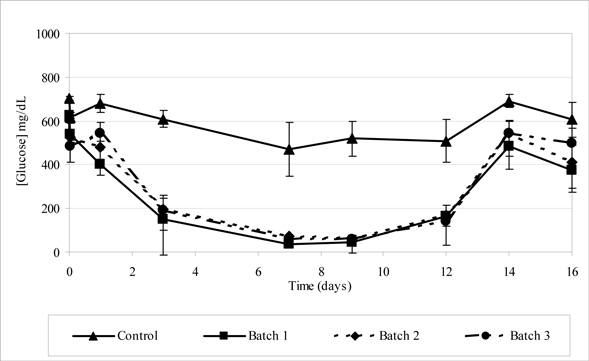

AB101

AB101 is a PEGylated basal insulin that has been formulated in biodegradable microspheres to be injected weekly to treat patients with Type 1 and Type 2 diabetes who require basal insulin to control hyperglycemia. AB101 is currently in preclinical development and we plan on initiating clinical trials outside the US this year. The weekly injection has been designed with a release profile to result in low, but sustained, insulin levels that will supplement the effects of endogenous and exogenous insulin and complement the effects of orally administered hypoglycemic agents.

We believe that a once-a-week injection of AB101, if approved, will result in greater patient compliance and set a new standard in basal insulin therapy. In North America, basal insulin already commands a 47% share of total insulin usage. Currently, each year Sanofi-Aventis sells more than $5 billion of Lantus, a daily injectable basal insulin therapy while Novo Nordisk sells more than $2 billion a year of its twice daily injectable basal insulin Levemir. Our once-a-week injection would provide seven days of basal insulin coverage with the potential to significantly improve the treatment paradigm. Furthermore, there is an opportunity for AB101 to enter new markets outside of North America where basal insulin has limited penetration. Basal insulin represents 36% of all insulin use in Europe, 29% of all insulin use in Japan and Korea, 13% of all insulin use in China, and 26% of all insulin use in rest of world. Further, as a result of AB101’s weekly injection profile, it has the potential to be used in diabetic patients who are using oral agents, but not insulin (regular or basal). According to the United States Centers for Disease Control, 58% of all individuals with diabetes use oral medications only, and 16% use no medication at all. It is generally believed that the reluctance to initiate insulin therapy is a result of resistance to take multiple injections for both regular and current long-acting insulin as well as the multiple finger sticks needed to monitor blood glucose levels.

We have completed most of the critical analytical methods for AB101 and we have successfully scaled production to support our development needs through early Phase 2 clinical studies. We have also conducted various preclinical studies with the AB101 formulation with the objective of demonstrating a desirable insulin release profile along with favorable handling characteristics.

AB201 (Long acting GLP-1)

AB201 is a long acting glucagon-like peptide-1 and is a product concept that is in the early stages of development. Glucagon-like peptide-1 (“GLP”) is a naturally occurring peptide in the intestine that helps control glucose levels by stimulating the pancreas to produce insulin, reducing the amount of glucose that is produced by the liver, reducing the rate at which the stomach digests food and empties into the small intestine (gastric emptying) and curbing the appetite and the amount of food that is consumed. Endogenous GLP production is reduced in patients with Type 2 diabetes and as a result there is a growing market for synthetic analogs of the peptide.

We believe that our technology has the potential to support development of a long-acting GLP that could be differentiated in terms of dosing frequency (once per month dosing as opposed to daily or weekly dosing), improved kinetics (reduced burst and thus potentially more favorable adverse event profile or reduced dose) and reduced immunogenicity (PEGylated native glucagon-like peptide-1 may be less immunogenic than glucagon-like peptide-1 analogs).

| 8 |

Intellectual Property

Our patent strategy is to augment our current portfolio by continually applying for patents on new developments and obtaining licenses where necessary for promising product candidates and related technologies. Our issued patents and patent applications provide protection for our core technologies. One of our central patents and patent applications is for the bio-conjugation of bioactive agents including insulin (PCT Publication WO 2004/091494). The technology underlying this patent consists of methods to achieve site-specific PEGylation of insulin and similar proteins and it is approved in Europe and Australia. Patents are pending in the US, Canada, Japan, China, Hong Kong, Brazil and India. In addition, we intend to file a variety of other patent applications to protect our intellectual property.

Our Strategy

As a precursor to clinical studies, in 2013 we will study the pharmacokinetics and pharmacodynamics of AB101 in two animal species. We are currently making preparations to fill and finish preclinical AB101 material that was preserved and acquired from PR Pharmaceuticals, Inc. (“PRP”). Further, we believe that we have enough AB101 clinical material to support our Phase 1 through early Phase 2 trials, but we anticipate needing additional material to finalize our Phase 2 study. In 2014 we plan on making new supplies of AB101 clinical material to support the end of Phase 2 study and follow-on studies.

If our preclinical studies are successful, we will conduct two clinical trials outside the US in approximately 40 patients to determine the safety, dose and indications of efficacy of AB101. The first study we intend to conduct is a Phase 1 single ascending dose safety/pharmacokinetics/pharmacodynamics study in 10-20 patients with Type 1 diabetes. In this trial, individuals will receive a single dose of subcutaneously injected AB101 and the primary outcome is the presence of hyperglycemic episodes, if any. We plan to initiate this study in 2nd half of calendar year 2014 and have final results by the end of 4th quarter of 2014. The second study will be a Phase 2 trial in approximately 20 Type 1 diabetes patients to compare the glucose-lowering effect of AB101 with that of Lantus. We plan on initiating this study in 4th quarter of 2014 and have final results by the end of 2nd quarter of 2015. Following these successful initial trials, we plan to bring the following plans to completion through the FDA approval. We will seek approval for AB101 in various jurisdictions including in the US where we would conduct new Phase 1 and 2 studies and then commence larger Phase 3 trials after which we intend to file a new drug application (“NDA”) with the FDA.

We believe that a critical milestone for our Company is demonstrating that AB101 is safe and efficacious in the initial Phase 1 and 2 studies. On the basis of these trials, we believe that we will have an opportunity to explore strategic relationships with third parties which, among other things, may provide us with a source of financing and augment our capabilities.

Recent Developments

The European Patent Office has issued communication that our patent application has been allowed. We are currently in the process of determining which countries within the European Union to separately file in.

Corporate Information

Our principal executive offices are located at 890 Santa Cruz Avenue, Menlo Park, CA 94025, and our telephone number is (650) 241-9330. Our internet address is http://www.antriabio.com. The information on our website is not incorporated by reference into this prospectus, and you should not consider it part of this prospectus.

| 9 |

The Offering

| Issuer | AntriaBio, Inc. | |

| Securities being offered by us | [ ] units, with each unit consisting of (1) one share of Series A Convertible Preferred Stock and (2) one warrant exercisable for [ ] shares of common stock. Units will not be issued or certificated. The shares of Series A Convertible Preferred Stock and the warrants are immediately separable and will be issued separately. | |

| Offering Price | $[ ] per unit | |

| Description of Series A Convertible Preferred Stock | Each unit includes one share of Series A Convertible Preferred Stock. Series A Convertible Preferred Stock has a liquidation preference. See “Description of Securities – Series A Convertible Preferred Stock” beginning on page 34. | |

| Conversion Price of Series A Convertible Preferred Stock | $ [ ] | |

| Shares of common stock underlying the shares of Series A Convertible Preferred Stock included in units | Based on an assumed conversion price of $[ ], which was [ ]% of the last reported sale price for our common stock on _________, 2013, [ ] shares. | |

| Subject to certain ownership limitations, the Series A Convertible Preferred Stock is convertible at any time at the option of the holder into shares of our common stock at a conversion ratio determined by dividing the offering price by a conversion price of $[ ] per share. The conversion price is subject to adjustment in the case of stock splits, stock dividends, combination of shares and similar recapitalization transactions. | ||

| Dividends | Until the third anniversary of the date of issuance of the Series A Convertible Preferred Stock, each holder of the Series A Convertible Preferred Stock is entitled to receive dividends at the rate of 8% per annum of the original offering price for each share of Series A Convertible Preferred Stock held by such holder. We can elect to pay the dividends in cash or, subject to certain equity conditions, in duly authorized, validly issued, fully paid and non-assessable shares of common stock, or a combination thereof. If we pay the dividends in shares of common stock, the shares used to pay the dividends will be valued at 90% of the average volume weighted average price (“VWAP”) for the 20 consecutive trading days ending on the trading day immediately prior to the applicable dividend payment date. |

| 10 |

| Anti-Dilution Protection | In addition, the Series A Convertible Preferred Stock will be subject to anti-dilution provisions until the earlier of (1) for 25 trading days during any 30 consecutive trading days period, the volume weighted average price of the Company’s common stock exceeds $[ ], (2) the underlying common stock is up-listed to the NYSE MKT or NASDAQ exchange, or (3) one year from the execution of the Securities Purchase Agreement. | |

| Conversion Rights | Subject to certain ownership limitations, the Series A Convertible Preferred Stock is convertible at any time at the option of the holder into shares of our common stock at a conversion ratio determined by dividing the offering price by a conversion price of $[ ] per share. The conversion price is subject to adjustment in the case of stock splits, stock dividends, combinations of shares and similar recapitalization transactions. | |

| Subject to certain equity conditions, the Series A Convertible Preferred Stock will automatically convert into common stock on the earliest of: (i) should the underlying Company common stock trade at 150% of the conversion price for any 25 of 30 consecutive trading days (subject to volume restrictions) while there is an effective registration statement, or (ii) on the date the underlying Company common stock is up listed to the NYSE MKT or NASDAQ exchange, or (iii) 36 months from the date of the execution of the securities purchase agreements. | ||

| Covenants |

As long as any shares of Series A Convertible Preferred Stock are outstanding, we may not, without the affirmative vote of the holders of 50.1% or more of the then outstanding shares of the Series A Convertible Preferred Stock, (1) alter or change adversely the powers, preferences or rights given to the Series A Convertible Preferred Stock or alter or amend the certificate of designation, (2) authorize or create any class of stock ranking as to dividends, redemption or distribution of assets upon liquidation senior to, or otherwise pari passu with, the Series A Convertible Preferred Stock, (3) amend our certificate of incorporation or other charter documents in any manner that adversely affects any rights of the holders of Series A Convertible Preferred Stock, (4) increase the number of authorized shares of Series A Convertible Preferred Stock, or (5) enter into any agreement with respect to any of the foregoing. |

| 11 |

| Liquidation Preference | Upon any liquidation, dissolution or winding up of the Company after payment or provision for payment of debts and other liabilities of the Company, but before any distribution or payment is made to the holders of any junior securities, the holders of Series A Convertible Preferred Stock shall be entitled to be paid out of the assets of the Company available for distribution to its stockholders an amount equal to the offering price per share, after which any remaining assets of the Company shall be distributed among the holders of the other class or series of stock. | |

| Description of Warrants | Each unit includes a warrant to purchase [ ] shares of common stock. Warrants will entitle the holder to purchase shares of common stock for an exercise price equal to $[ ] per share of our common stock. The warrants will be exercisable beginning [ ], 2013 and expire on the sixth anniversary of the initial issuance date. See “Description of Securities – Warrants” beginning on page 36. | |

| Warrant Anti-Dilution Adjustments | The exercise price and the number of shares issuable upon exercise of the warrants is subject to appropriate adjustment in the event of recapitalization events, stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our common stock, and also upon any distributions of assets, including cash, stock or other property to our stockholders. | |

| Fundamental Transactions | In the event we consummate a merger or consolidation with or into another person or other reorganization event in which our common shares are converted or exchanged for securities, cash or other property, or we sell, lease, license, assign, transfer, convey or otherwise dispose of all or substantially all of our assets or another person acquires a majority of our outstanding common shares, then following such event, the holders of the Series A Convertible Preferred Stock and warrants will be entitled to receive upon conversion or exercise, as applicable, the same kind and amount of securities, cash or property which the holders would have received had they converted or exercised, as applicable, such securities immediately prior to such fundamental transaction. |

| 12 |

| Shares of common stock outstanding before this offering | 40,000,000 shares | |

| Common stock to be outstanding after this offering, including shares of common stock underlying shares of Series A Convertible Preferred Stock, included in units | [ ] shares | |

| Use of Proceeds | Assuming all units are sold, we estimate that the net proceeds, before offering expenses, to us from this offering will be approximately $[ ] million. We intend to use the net proceeds received from the sale of the securities for furthering our clinical trials and efforts to obtain regulatory approval for AB101, developing our other product candidates, research and development and general corporate purposes. See “Use of Proceeds.” | |

| Limitations on Beneficial Ownership | Subject to limited exceptions, the Company will not permit the conversion of the Series A Convertible Preferred Stock or exercise of the warrants of any holder, if after such conversion or exercise such holder would beneficially own more than 4.99% of the shares of common stock then outstanding. | |

| Risk Factors | Investing in our securities involves a high degree of risk. See the “Risk Factors” section of this prospectus on page 14 and in the documents we incorporate by reference in this prospectus for a discussion of factors you should consider carefully before deciding to invest in our securities. |

The number of shares of common stock outstanding before and after the offering is based on 40,000,000 shares outstanding as of September 25, 2013 and excludes:

| · | 110,000 shares of common stock issuable upon the exercise of outstanding warrants with a weighted average exercise price of $0.85 per share; |

| · | 248,542 shares of common stock issuable upon the exercise of outstanding warrants with a weighted average exercise price of $0.33 per share; |

| 13 |

| · | 1,400,000 shares of common stock issuable upon the exercise of outstanding warrants with an exercise price that will be determined at the time of a qualified financing. |

| · | 9,050,000 shares of common stock issuable upon the exercise of outstanding options with a weighted average exercise price of $0.75 per share. |

| · | [ ] shares of common stock issuable upon the conversion of outstanding convertible notes with a conversion price per share to be determined at the time of a qualified financing and [ ] shares of common stock issuable for warrants issued with the conversion of the outstanding convertible notes; and |

| · | [ ] shares of common stock issuable upon exercise of warrants to be issued in connection with this offering. |

SUMMARY FINANCIAL DATA

The following selected financial information is derived from the Company’s Financial Statements appearing elsewhere in this Prospectus and should be read in conjunction with the Company’s Financial Statements, including the notes thereto, appearing elsewhere in this Prospectus.

Summary of Operations

| Year Ended June 30, 2013 |

Six Month Period Ended June 30, 2012 |

Year Ended December 31, 2011 |

||||||||||

| Revenues | $ | - | $ | - | $ | - | ||||||

| Loss from Operation | $ | (6,106,881 | ) | $ | (227,901 | ) | $ | (392,976 | ) | |||

| Net Loss | $ | (6,727,457 | ) | $ | (398,209 | ) | $ | (590,215 | ) | |||

| Net loss per common share (basic and diluted) | $ | (0.18 | ) | $ | (0.01 | ) | $ | (0.02 | ) | |||

| Weighted average common shares outstanding | 37,227,407 | 35,284,000 | 35,284,000 | |||||||||

Statement of Financial Position

| June 30, 2013 | June 30, 2012 | |||||||

| Cash | $ | 527 | $ | 25,878 | ||||

| Total Assets | $ | 1,103,971 | $ | 1,068,561 | ||||

| Working Capital | $ | (4,450,634 | ) | $ | (1,288,913 | ) | ||

| Long Term Debt | $ | - | $ | - | ||||

| Stockholders’ Deficit | $ | (4,162,212 | ) | $ | (1,288,913 | ) | ||

RISK FACTORS

An investment in us involves a high degree of risk. You should consider carefully the following information about these risks before deciding to purchase any of our securities. If any of the events or developments described below actually occurs, our business, results of operations and financial condition would likely suffer. In these circumstances, you may lose all or part of your investment. In addition, it is also possible that other risks and uncertainties that affect our business may arise or become material in the future.

| 14 |

Risks Related to Our Business

We will need substantial additional capital to fund our operations and if we fail to obtain additional capital, we may be unable to complete the development and commercialization of our product candidates or continue our research and development programs

Our operations will consume substantial amounts of cash. We expect to spend substantial amounts on research and development, including amounts spent on conducting preclinical activities, clinical trials for our product candidates, manufacturing, clinical trial materials, and expanding our research and development program. We expect that our cash used by operations will continue to increase for the next several years. If we are unable to raise additional capital when required or on acceptable terms, we may have to significantly delay, scale back or discontinue one or more of our drug development or research and development programs. We also may be required to:

| · | seek collaborators for our product candidates at an earlier stage than otherwise would be desirable and on terms that are less favorable than might otherwise be available; and |

| · | relinquish, license or otherwise dispose of rights to technologies, product candidates or products that we would otherwise seek to develop or commercialize ourselves on terms that are less favorable than might otherwise be available. |

We rely on a single product candidate and if the market for AB101 does not develop as we anticipate, our revenues may decline or fail to grow, which would adversely affect our operating results

Initially, we expect to derive all of our revenues, if any, from AB101. There is no current market for AB101, as it is a pre-clinical drug candidate, so it is uncertain whether AB101 will achieve and sustain high levels of demand and market acceptance. Our success will depend to a substantial extent on the willingness of consumers to accept AB101 as a viable treatment option for diabetes. Failure of consumers to accept AB101 would significantly adversely affect our revenues and profitability.

We are at an early stage of development as a company and we do not have, and may never have, any products that generate significant revenues

We are at an early stage of development as a proprietary product specialty pharmaceutical company and we do not have any commercial products. Our existing product candidates will require extensive additional clinical evaluation, regulatory review, significant marketing efforts and substantial investment before they could provide us with any revenues. Our efforts may not lead to commercially successful products, for a number of reasons, including:

| · | our product candidates may not prove to be safe and effective in clinical trials; |

| · | we may not be able to obtain regulatory approvals for our product candidates or approved uses may be narrower than we seek; |

| · | we may not have adequate financial or other resources to complete the development and commercialization of our product candidates; or |

| · | any products that are approved may not be accepted or reimbursed in the marketplace. |

We do not expect to be able to market any of our product candidates for a number of years. If we are unable to develop, receive approval for, or successfully commercialize any of our product candidates, we will be unable to generate significant revenues. If our development programs are delayed, we may have to raise additional capital or reduce or cease our operations.

| 15 |

We have never generated any revenues and may never become profitable

We expect to incur substantial operating losses for the next several years as we pursue our clinical trials and research and development efforts. To become profitable, we must successfully develop, manufacture and market our product candidates, either alone or in conjunction with possible collaborators. We may never have any revenues or become profitable.

We may experience delays in our clinical trials that could adversely affect our financial position and our commercial prospects

We cannot be certain when our currently planned clinical trials will begin or be completed, if at all. Many factors affect patient enrollment, including the size of the patient population, the proximity of patients to clinical sites, the eligibility criteria for the trial, competing clinical trials and new drugs approved for the conditions we are investigating. Other companies may be conducting clinical trials or may announce plans for future trials that will be seeking patients with the same indications as those we are studying. As a result of all of these factors, our trials may take longer to enroll patients than we anticipate. Delays in patient enrollment in the trials may increase our costs and slow down our product development and approval process. Our product development costs will also increase if we need to perform more or larger clinical trials than planned. Any delays in completing our clinical trials will delay our ability to generate revenue from product sales, and we may have insufficient capital resources to support our operations. Even if we do have sufficient capital resources, our ability to become profitable will be delayed.

Adverse events in our clinical trials may force us to stop development of our product candidates or prevent regulatory approval of our product candidates

Our product candidates may produce serious adverse events. These adverse events could interrupt, delay or halt clinical trials of our product candidates and could result in the FDA, or other regulatory authorities requesting additional preclinical data or denying approval of our product candidates for any or all targeted indications. An institutional review board, independent data safety monitoring board, the FDA, other regulatory authorities or the Company itself may suspend or terminate clinical trials at any time. We cannot assure you that any of our product candidates will prove safe for human use.

If our product candidates do not meet safety or efficacy endpoints in clinical evaluations, they will not receive regulatory approval and we will be unable to market them

The regulatory review approval process typically is expensive, takes many years and the timing of any approval cannot be accurately predicted. If we fail to obtain regulatory approval for our current or future product candidates, we will be unable to market and sell such products and therefore may never be profitable.

As part of the regulatory approval process, we must conduct preclinical studies and clinical trials for each product candidate to demonstrate safety and efficacy. The number of preclinical studies and clinical trials that will be required varies depending on the product candidate, the indication being evaluated, the trial results and regulations applicable to any particular product candidate.

The results of preclinical studies and initial clinical trials of our product candidates do not necessarily predict the results of later-stage clinical trials. Product candidates in later stages of clinical trials may fail to show the desired safety and efficacy despite having progressed through initial clinical trials. We cannot assure you that the data collected from the preclinical studies and clinical trials of our product candidates will be sufficient to support FDA or other regulatory approval. In addition, the continuation of a particular study after review by an independent data safety monitoring board does not necessarily indicate that our product candidate will achieve the clinical endpoint.

| 16 |

The FDA and other regulatory agencies can delay, limit or deny approval for many reasons, including:

| · | a product candidate may not be safe or effective; |

| · | the manufacturing processes or facilities we have selected may not meet the applicable requirements; and |

| · | changes in their approval policies or adoption of new regulations may require additional work. |

Any delay in, or failure to receive or maintain, approval for any of our products could prevent us from ever generating meaningful revenues or achieving profitability.

Our product candidates are prone to the risks of failure inherent in drug development. Before obtaining regulatory approvals for the commercial sale of any product candidate for a target indication, we must demonstrate with substantial evidence gathered in preclinical and well-controlled clinical studies, and, with respect to approval in the US, to the satisfaction of the FDA and, with respect to approval in other countries, similar regulatory authorities in those countries, that the product candidate is safe and effective for use for that target indication and that the manufacturing facilities, processes and controls are adequate.

Despite our efforts, our product candidates may not:

| · | offer therapeutic or other improvement over existing, comparable therapeutics; |

| · | be proven safe and effective in clinical studies; |

| · | meet applicable regulatory standards; |

| · | be capable of being produced in sufficient quantities at acceptable costs; |

| · | be successfully commercialized; or |

| · | obtain favorable reimbursement. |

We are not permitted to market AB101 or any of our other product candidates in the US until we receive approval of a new drug application, or approval of a biologics license application, from the FDA, or in any foreign countries until we receive the requisite approval from such countries. We have not submitted a new drug application or biologics license application or received marketing approval for any of our product candidates.

Preclinical testing and clinical studies are long, expensive and uncertain processes. We may spend several years completing our testing for any particular product candidate, and failure can occur at any stage. Negative or inconclusive results or adverse medical events during a clinical study could also cause the FDA or us to terminate a clinical study or require that we repeat it or conduct additional clinical studies. Additionally, data obtained from a clinical study is susceptible to varying interpretations and the FDA or other regulatory authorities may interpret the results of our clinical studies less favorably than we do. The FDA and equivalent foreign regulatory agencies have substantial discretion in the approval process and may decide that our data is insufficient to support a marketing application and require additional preclinical, clinical or other studies.

| 17 |

Our current supply of AB101 may be insufficient in terms of quality and quantity which would delay preclinical trials

We acquired a supply of AB101 through the acquisition of assets from PRP. We have contracted to have this supply filled for use in our preclinical trials. If the supply has expired or has other quality issues that make it unusable, we could not use it in our preclinical trials. Any inability to use our supply of AB101 would cause delays and increase costs.

Our limited operating history makes it difficult to evaluate our business and prospects

Our operations to date have been limited to organizing and staffing our company and acquiring product and technology rights. We have not demonstrated an ability to perform preclinical testing, conduct clinical trials, hire staff, obtain regulatory approval for or commercialize a product candidate. Consequently, any predictions about our future performance may not be as accurate as they could be if we had a history of successfully hiring staff, or testing, developing and commercializing pharmaceutical products.

Due to our reliance on contract research organizations or other third parties to conduct clinical trials, we are unable to directly control the timing, conduct and expense of our clinical trials

We plan to rely primarily on third parties to conduct our clinical trials. As a result, we will have less control over the conduct of the clinical trials, the timing and completion of the trials, the required reporting of adverse events and the management of data developed through the trial than would be the case if we were to rely entirely upon our own staff. Communicating with outside parties can also be challenging, potentially leading to mistakes as well as difficulties in coordinating activities. Outside parties may have staffing difficulties, may undergo changes in priorities or may become financially distressed, adversely affecting their willingness or ability to conduct our trials. We may experience unexpected increased costs that are beyond our control. Problems with the timeliness or quality of the work of a contract research organization may lead us to seek to terminate the relationship and use an alternative service provider. However, making this change may be costly and may delay our trials, and contractual restrictions may make such a change difficult or impossible. Additionally, it may be impossible to find a replacement organization that can conduct our trials in an acceptable manner and at an acceptable cost.

Our competitors may develop and market drugs that are less expensive, more effective or safer than our product candidates

The pharmaceutical market is highly competitive. For our product candidates that use currently approved active ingredients, we will face competition from the existing delivery method with each product candidate for which we are able to obtain approval. Additionally, other pharmaceutical and biotechnology companies may be developing improved formulations of the same drugs that will compete with products we are developing. It is possible that our competitors will develop and market products that are less expensive, more effective or safer than our future products or that will render our products obsolete. We expect that competition from pharmaceutical and biotechnology companies, universities and public and private research institutions will increase. Many of these competitors have substantially greater financial, technical, research and other resources than we do. We may not have the financial resources, technical and research expertise or marketing, distribution or support capabilities to compete successfully.

| 18 |

Because the results of preclinical testing or earlier clinical studies are not necessarily predictive of future results none of the product candidates we advance into clinical studies may have favorable results in later clinical studies or receive regulatory approval

Success in preclinical testing and early clinical studies does not ensure that later clinical studies will generate adequate data to demonstrate the efficacy and safety of an investigational drug or biologic. A number of companies in the pharmaceutical and biotechnology industries, including those with greater resources and experience, have suffered significant setbacks in Phase 3 clinical studies, even after seeing promising results in earlier clinical studies. We do not know whether any clinical studies we may conduct will demonstrate adequate efficacy and safety to result in regulatory approval to market any of our product candidates. If later stage clinical studies do not produce favorable results, our ability to achieve regulatory approval for any of our product candidates may be adversely impacted. Even if we believe that our product candidates have performed satisfactorily in preclinical testing and clinical studies, we may nonetheless fail to obtain FDA approval for our product candidates.

After the completion of our clinical studies, we cannot predict whether or when we will obtain regulatory approval to commercialize our product candidates and we cannot, therefore, predict the timing of any future revenue from these product candidates

Even if we achieve positive clinical results and file for regulatory approval, we cannot commercialize any of our product candidates until the appropriate regulatory authorities have reviewed and approved the applications for such product candidates. We cannot assure you that the regulatory agencies will complete their review processes in a timely manner or that we will obtain regulatory approval for any product candidate we develop. Satisfaction of regulatory requirements typically takes many years, is dependent upon the type, complexity and novelty of the product and requires the expenditure of substantial resources. In addition, we may experience delays or rejections based upon additional government regulation from future legislation or administrative action or changes in FDA policy during the period of product development, clinical studies and FDA regulatory review.

Even if our product candidates receive regulatory approval, they may still face future development and regulatory difficulties

Even if US regulatory approval is obtained, the FDA may still impose significant restrictions on a product’s indicated uses or marketing or impose ongoing requirements for potentially costly post-approval studies or post-market surveillance. For example, the label ultimately approved, if any, may include restrictions on use. Further, the FDA may require that long-term safety data may need to be obtained as a post-market requirement. Our product candidates will also be subject to ongoing FDA requirements governing the labeling, packaging, storage, distribution, safety surveillance, advertising, promotion, recordkeeping and reporting of safety and other post-market information. In addition, manufacturers of drug products and their facilities are subject to continual review and periodic inspections by the FDA and other regulatory authorities for compliance with current good manufacturing practices and regulations. If we or a regulatory agency discovers previously unknown problems with a product, such as adverse events of unanticipated severity or frequency, or problems with the facility where the product is manufactured, a regulatory agency may impose restrictions on that product, the manufacturing facility or us, including requiring recall or withdrawal of the product from the market or suspension of manufacturing. If we, our product candidates or the manufacturing facilities for our product candidates fail to comply with applicable regulatory requirements, a regulatory agency may:

| · | issue warning letters or untitled letters; |

| · | seek an injunction or impose civil or criminal penalties or monetary fines; |

| 19 |

| · | suspend or withdraw regulatory approval; |

| · | suspend any ongoing clinical studies; |

| · | refuse to approve pending applications or supplements to applications filed by us; |

| · | suspend or impose restrictions on operations, including costly new manufacturing requirements; or |

| · | seize or detain products, refuse to permit the import or export of products, or require us to initiate a product recall. |

The occurrence of any event or penalty described above may inhibit our ability to commercialize our products and generate revenue.

The Asset Purchase Agreement includes contingent payments that link the amount of consideration paid by us as consideration for the PRP assets to the development of AB101 which could decrease our working capital

We agreed to pay contingent consideration up to a maximum of $44,000,000 for any of the following events that occur within five years of the Asset Purchase: (i) $2,000,000, if and when we initiate Phase 2b clinical studies for AB101; (ii) $2,000,000, if we license AB101 to a commercial pharmaceutical company; (iii) $5,000,000, if and when we initiate Phase 3 clinical studies for AB101; (iv) $10,000,000, if and when the FDA or EMEA approves the marketing and sale of AB101; and (v) $25,000,000, if and when the cumulative sales of AB101 in a 12 month period exceeds $500,000,000. These contingent payments could reduce the amount of capital we have available to us to expand our business or develop our other product lines.

If any of our product candidates for which we receive regulatory approval does not achieve broad market acceptance, the revenue that we generate from its sales, if any, will be limited

The commercial success of our product candidates for which we obtain marketing approval from the FDA or other regulatory authorities will depend upon the acceptance of these products by the medical community, including physicians, patients and health care payers. The degree of market acceptance of any of our approved products will depend on a number of factors, including:

| · | demonstration of clinical safety and efficacy compared to other products; |

| · | the prevalence and severity of any adverse effects; |

| · | limitations or warnings contained in a product’s FDA-approved labeling; |

| · | availability of alternative treatments; |

| · | pricing and cost-effectiveness; |

| · | the effectiveness of our or any future collaborators’ sales and marketing strategies; |

| 20 |

| · | our ability to obtain and maintain sufficient third-party coverage or reimbursement from government health care programs, including Medicare and Medicaid; and |

| · | the willingness of patients to pay out-of-pocket in the absence of third-party coverage. |

If our product candidates are approved, but do not achieve an adequate level of acceptance by physicians, health care payers and patients, we may not generate sufficient revenue from these products, and we may not become or remain profitable. In addition, our efforts to educate the medical community and third-party payers on the benefits of our product candidates may require significant resources and may never be successful.

Recently enacted and future legislation or regulatory reform of the health care system in the US and foreign jurisdictions may affect our ability to sell our products profitably

Our ability to commercialize our future products successfully, alone or with collaborators, will depend in part on the extent to which reimbursement for the products will be available from government and health administration authorities, private health insurers and other third-party payers. The continuing efforts of the US and foreign governments, insurance companies, managed care organizations and other payers of health care services to contain or reduce health care costs may adversely affect our ability to set prices for our products which we believe are fair, and our ability to generate revenues and achieve and maintain profitability.

Specifically, in both the US and some foreign jurisdictions, there have been a number of legislative and regulatory proposals to change the health care system in ways that could affect our ability to sell our products profitably. In March 2010, President Obama signed into law the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act, or collectively, the Health Care Reform Law, a sweeping law intended to broaden access to health insurance, reduce or constrain the growth of healthcare spending, enhance remedies against fraud and abuse, add new transparency requirements for healthcare and health insurance industries, impose new taxes and fees on the health industry and impose additional health policy reforms.

We will not know the full effects of the Health Care Reform Law until applicable federal and state agencies issue regulations or guidance under the new law. Although it is too early to determine the effect of the Health Care Reform Law, the new law appears likely to continue the pressure on pharmaceutical pricing, especially under the Medicare program, and also may increase our regulatory burdens and operating costs. We expect further federal and state proposals and health care reforms to continue to be proposed by legislators, which could limit the prices that can be charged for the products we develop and may limit our commercial opportunity.

Also in the US, the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, also called the Medicare Modernization Act, or MMA, changed the way Medicare covers and pays for pharmaceutical products. The legislation expanded Medicare coverage for drug purchases by the elderly and introduced a new reimbursement methodology based on average sales prices for drugs. In addition, this legislation authorized Medicare Part D prescription drug plans to use formularies where they can limit the number of drugs that will be covered in any therapeutic class. As a result of this legislation and the expansion of federal coverage of drug products, we expect that there will be additional pressure to contain and reduce costs. These cost reduction initiatives and other provisions of this legislation could decrease the coverage and price that we receive for any approved products and could seriously harm our business. While the MMA applies only to drug benefits for Medicare beneficiaries, private payors often follow Medicare coverage policy and payment limitations in setting their own reimbursement rates, and any reduction in reimbursement that results from the MMA may result in a similar reduction in payments from private payors.

| 21 |

The continuing efforts of government and other third-party payors to contain or reduce the costs of health care through various means may limit our commercial opportunity. It will be time-consuming and expensive for us to go through the process of seeking reimbursement from Medicare and private payors. Our products may not be considered cost-effective, and government and third-party private health insurance coverage and reimbursement may not be available to patients for any of our future products or sufficient to allow us to sell our products on a competitive and profitable basis. Our results of operations could be adversely affected by the MMA, the Health Care Reform Law, and additional prescription drug coverage legislation, by the possible effect of this legislation on amounts that private insurers will pay and by other health care reforms that may be enacted or adopted in the future. In addition, increasing emphasis on managed care in the US will continue to put pressure on the pricing of pharmaceutical products. Cost control initiatives could decrease the price that we or any potential collaborators could receive for any of our future products and could adversely affect our profitability.

In some foreign countries, including major markets in the European Union and Japan, the pricing of prescription pharmaceuticals is subject to governmental control. In these countries, pricing negotiations with governmental authorities can take six to 12 months or longer after the receipt of regulatory marketing approval for a product. To obtain reimbursement or pricing approval in some countries, we may be required to conduct a clinical study that compares the cost effectiveness of our product candidates to other available therapies. Such pharmacoeconomic studies can be costly and the results uncertain. Our business could be harmed if reimbursement of our products is unavailable or limited in scope or amount or if pricing is set at unsatisfactory levels.

We face potential product liability exposure, and, if successful claims are brought against us, we may incur substantial liability

The use of our product candidates in clinical studies and the sale of any products for which we obtain marketing approval expose us to the risk of product liability claims. Product liability claims might be brought against us by consumers, health care providers, pharmaceutical companies or others selling or otherwise coming into contact with our products. If we cannot successfully defend ourselves against product liability claims, we could incur substantial liabilities. In addition, regardless of merit or eventual outcome, product liability claims may result in:

| · | impairment of our business reputation; |

| · | withdrawal of clinical study participants; |

| · | costs of related litigation; |

| · | distraction of management’s attention from our primary business; |

| · | substantial monetary awards to patients or other claimants; |

| · | the inability to commercialize our product candidates; and |

| · | decreased demand for our product candidates, if approved for commercial sale. |

| 22 |

Our product liability insurance coverage for our clinical studies may not be sufficient to reimburse us for all expenses or losses we may suffer. Moreover, insurance coverage is becoming increasingly expensive, and, in the future, we may not be able to maintain insurance coverage at a reasonable cost or in sufficient amounts to protect us against losses due to liability. If and when we obtain marketing approval for any of our product candidates, we intend to expand our insurance coverage to include the sale of commercial products; however, we may be unable to obtain this product liability insurance on commercially reasonable terms. On occasion, large judgments have been awarded in class action lawsuits based on drugs that had unanticipated adverse effects. A successful product liability claim or series of claims brought against us could cause our stock price to decline and, if judgments exceed our insurance coverage, could decrease our cash and adversely affect our business.

If we use hazardous and biological materials in a manner that causes injury or violates applicable law, we may be liable for damages

Our research and development activities involve the controlled use of potentially hazardous substances, including toxic chemical and biological materials. We could be held liable for any contamination, injury or other damages resulting from these hazardous substances. In addition, our operations produce hazardous waste products. While third parties are responsible for disposal of our hazardous waste, we could be liable under environmental laws for any required cleanup of sites at which our waste is disposed. Federal, state, foreign and local laws and regulations govern the use, manufacture, storage, handling and disposal of these hazardous materials. If we fail to comply with these laws and regulations at any time, or if they change, we may be subject to criminal sanctions and substantial civil liabilities, which may harm our business. Even if we continue to comply with all applicable laws and regulations regarding hazardous materials, we cannot eliminate the risk of accidental contamination or discharge and our resultant liability for any injuries or other damages caused by these accidents.

Any failure by our third-party manufacturers on which we rely to produce our preclinical and clinical drug supplies and on which we intend to rely to produce commercial supplies of any approved product candidates may delay or impair our ability to commercialize our product candidates

We intend to rely upon a small number of third-party manufacturers and active pharmaceutical ingredient formulators for the manufacture of our material for preclinical and clinical testing purposes and intend to continue to do so in the future. We also expect to rely upon third parties to produce materials required for the commercial production of our product candidates if we succeed in obtaining necessary regulatory approvals. If we are unable to arrange for third-party manufacturing sources, or do so on commercially unreasonable terms, we may not be able to complete development of our product candidates or market them.

Reliance on third-party manufacturers entails risks to which we would not be subject if we manufactured product candidates ourselves, including reliance on the third party for regulatory compliance and quality assurance, the possibility of breach of the manufacturing agreement by the third party because of factors beyond our control (including a failure to synthesize and manufacture our product candidates in accordance with our product specifications) and the possibility of termination or nonrenewal of the agreement by the third party, based on its own business priorities, at a time that is costly or damaging to us. In addition, the FDA and other regulatory authorities require that our product candidates be manufactured according to current good manufacturing practices and similar foreign standards. Any failure by our third-party manufacturers to comply with current good manufacturing practices or failure to scale up manufacturing processes, including any failure to deliver sufficient quantities of product candidates in a timely manner, could lead to a delay in, or failure to obtain, regulatory approval of any of our product candidates. In addition, such failure could be the basis for action by the FDA to withdraw approvals for product candidates previously granted to us and for other regulatory action, including recall or seizure, total or partial suspension of production or injunction.

| 23 |

We rely on our manufacturers to purchase from third-party suppliers the materials necessary to produce our product candidates for our clinical studies. There are a small number of suppliers for certain capital equipment and raw materials that we use to manufacture our drugs. Such suppliers may not sell these raw materials to our manufacturers at the times we need them or on commercially reasonable terms. We do not have any control over the process or timing of the acquisition of these raw materials by our manufacturers. Moreover, we currently do not have any agreements for the commercial production of these raw materials. Although we generally do not begin a clinical study unless we believe we have a sufficient supply of a product candidate to complete the clinical study, any significant delay in the supply of a product candidate or the raw material components thereof for an ongoing clinical study due to the need to replace a third-party manufacturer could considerably delay completion of our clinical studies, product testing and potential regulatory approval of our product candidates. If our manufacturers or we are unable to purchase these raw materials after regulatory approval has been obtained for our product candidates, the commercial launch of our product candidates would be delayed or there would be a shortage in supply of such product candidates, which would impair our ability to generate revenues from the sale of our product candidates.

Because of the complex nature of our compounds, our manufacturers may not be able to manufacture our compounds at a cost or in quantities or in a timely manner necessary to make commercially successful products. If we successfully commercialize any of our drugs, we may be required to establish large-scale commercial manufacturing capabilities. In addition, as our drug development pipeline increases and matures, we will have a greater need for clinical study and commercial manufacturing capacity. We have no experience manufacturing pharmaceutical products on a commercial scale and some of these suppliers will need to increase their scale of production to meet our projected needs for commercial manufacturing, the satisfaction of which on a timely basis may not be met.

If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to market and sell our product candidates, we may be unable to generate any revenue

We do not currently have an organization for the sales, marketing and distribution of pharmaceutical products and the cost of establishing and maintaining such an organization may exceed the cost-effectiveness of doing so. In order to market any products that may be approved by the FDA, we must build our sales, marketing, managerial and other non-technical capabilities or make arrangements with third parties to perform these services. If we are unable to establish adequate sales, marketing and distribution capabilities, whether independently or with third parties, we may not be able to generate product revenue and may not become profitable. We will be competing with many companies that currently have extensive and well-funded marketing and sales operations. Without an internal team or the support of a third party to perform marketing and sales functions, we may be unable to compete successfully against these more established companies.

Guidelines and recommendations published by various organizations may adversely affect the use of any products for which we may receive regulatory approval

Government agencies issue regulations and guidelines directly applicable to us and to our product candidates. In addition, professional societies, practice management groups, private health or science foundations and organizations involved in various diseases from time to time publish guidelines or recommendations to the medical and patient communities. These various sorts of recommendations may relate to such matters as product usage and use of related or competing therapies. For example, organizations like the American Heart Association have made recommendations about therapies in the cardiovascular therapeutics market. Changes to these recommendations or other guidelines advocating alternative therapies could result in decreased use of any products for which we may receive regulatory approval, which may adversely affect our results of operations.

| 24 |

Our management team is incomplete and we rely on our Chief Executive Officer and Chief Scientific Officer

Our management team is incomplete and we are continuing to search for and recruit managers for our business. Currently, we rely on our Chief Executive Officer and Chief Scientific Officer. There can be no assurance that we will be able to find and successfully recruit qualified managers. If we lose our Chief Executive Officer and Chief Scientific Officer or cannot recruit additional qualified managers, we are unlikely to have success in developing and commercializing our drug development assets.

Risks Related to Our Intellectual Property

If our or our licensors’ patent positions do not adequately protect our product candidates or any future products, others could compete with us more directly, which would harm our business

Our commercial success will depend in part on our and our licensors’ ability to obtain additional patents and protect our existing patent positions, particularly those patents for which we have secured exclusive rights, as well as our ability to maintain adequate protection of other intellectual property for our technologies, product candidates and any future products in the US and other countries. If we or our licensors do not adequately protect our intellectual property, competitors may be able to use our technologies and erode or negate any competitive advantage we may have, which could materially harm our business, negatively affect our position in the marketplace, limit our ability to commercialize our product candidates and delay or render impossible our achievement of profitability. The laws of some foreign countries do not protect our proprietary rights to the same extent as the laws of the US, and we may encounter significant problems in protecting our proprietary rights in these countries.

The patent positions of biotechnology and pharmaceutical companies, including our patent position, involve complex legal and factual questions, and, therefore, validity and enforceability cannot be predicted with certainty. Patents may be challenged, deemed unenforceable, invalidated or circumvented. We and our licensors will be able to protect our proprietary rights from unauthorized use by third parties only to the extent that our proprietary technologies, product candidates and any future products are covered by valid and enforceable patents or are effectively maintained as trade secrets.

The degree of future protection for our proprietary rights is uncertain, and we cannot ensure that:

| · | we or our licensors were the first to make the inventions covered by each of our pending patent applications; |