10-Q: Quarterly report [Sections 13 or 15(d)]

Published on February 12, 2026

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the quarterly period ended

or

For the transition period from to

Commission File Number:

(Exact Name of Registrant as Specified in its Charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices) | (Zip Code) |

(

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.). ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, and an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ |

|

|

Smaller reporting company | |

|

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 17(a)(2)(B) of the Securities Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

The registrant had

Table of Contents

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2025 (the “Report”) contains statements reflecting assumptions, expectations, projections, intentions or beliefs about future events that are intended as “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements included or incorporated by reference in this Report, other than statements of historical fact, that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. These statements appear in a number of places, including, but not limited to “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements represent our reasonable judgment of the future based on various factors and using numerous assumptions and are subject to known and unknown risks, uncertainties and other factors that could cause our actual results and financial position to differ materially from those contemplated by the statements. You can identify these statements by the fact that they do not relate strictly to historical or current facts, and use words such as “anticipate”, “believe”, “estimate”, “expect”, “forecast”, “may”, “should”, “plan”, “project” and other words of similar meaning. In particular, these include, but are not limited to, statements relating to the following:

| ● | our ability to obtain regulatory approvals for our therapeutics in development; |

| ● | our expectations regarding clinical development and the timeline to complete clinical studies; |

| ● | our projected operating or financial results, including anticipated cash flows to be used in operating activities; |

| ● | our expectations regarding capital expenditures, research and development (“R&D”) expenses and the timing of milestone payments required under license agreements; |

| ● | our beliefs and assumptions relating to our liquidity position, including our ability to obtain additional financing; |

| ● | our future dependence on third-party manufacturers or strategic partners to manufacture any of our pharmaceutical drugs and diagnostics that receive regulatory approval; and |

| ● | our ability to identify strategic partners and enter into license, co-development, collaboration or similar arrangements. |

Any or all of our forward-looking statements may turn out to be wrong. They can be affected by inaccurate assumptions or by known and unknown risks, uncertainties and other factors including, but not limited to, the risks described in Part II, Item 1A. Risk Factors, of this Report as well as “Risk Factors” described in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended June 30, 2025 (the “2025 Form 10-K”), filed with the Securities and Exchange Commission (“SEC”) on September 17, 2025.

In addition, there may be other factors that could cause our actual results to be materially different from the results referenced in the forward-looking statements, some of which are included elsewhere in this Report, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Many of these factors will be important in determining our future results. Consequently, no forward-looking statement can be guaranteed. Our future results may vary materially from those expressed or implied in any forward-looking statements. All forward-looking statements contained in this Report are qualified in their entirety by this cautionary statement. Forward-looking statements speak only as of the date they are made, and we disclaim any obligation to update any forward-looking statements to reflect events or circumstances after the date of this Report, except as otherwise required by applicable law.

ii

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

Rezolute, Inc.

Unaudited Condensed Consolidated Balance Sheets

(In Thousands, Except Number of Shares and Par Value)

| December 31, | June 30, | ||||

| 2025 | | 2025 | |||

Assets | ||||||

Current assets: |

| | | |||

Cash and cash equivalents | $ | | $ | | ||

Investments in marketable debt securities | | | ||||

Prepaid expenses and other | | | ||||

Total current assets |

| |

| | ||

Long-term assets: | ||||||

Deposits and other | | | ||||

Right-of-use assets |

| |

| | ||

Property and equipment, net |

| |

| | ||

Total assets | $ | | $ | | ||

Liabilities and Shareholders' Equity |

| |

| | ||

Current liabilities: |

| |

| | ||

Accounts payable | $ | | $ | | ||

Accrued liabilities: |

|

| ||||

Accrued clinical and other | | | ||||

Compensation and benefits | | | ||||

Current portion of operating lease liabilities | | | ||||

Total current liabilities |

| |

| | ||

Long-term liabilities: | ||||||

Operating lease liabilities, net of current portion |

| |

| | ||

Embedded derivative liability | | | ||||

Total liabilities |

| |

| | ||

Commitments and contingencies (Notes 5, 9 and 10) |

| |

| | ||

Shareholders' equity: |

| |

| | ||

Preferred stock, $ |

|

| ||||

Common stock, $ |

| |

| | ||

Additional paid-in capital |

| |

| | ||

Accumulated other comprehensive income (loss) | | ( | ||||

Accumulated deficit |

| ( |

| ( | ||

Total shareholders’ equity |

| |

| | ||

Total liabilities and shareholders’ equity | $ | | $ | | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

1

Rezolute, Inc.

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Loss

(In Thousands, Except Share and Per Share Amounts)

Three Months Ended | Six Months Ended | |||||||||||

December 31, | December 31, | |||||||||||

| 2025 | | 2024 | | 2025 | | 2024 | |||||

Operating expenses: |

| |

| | |

| | |||||

Research and development |

| $ | |

| $ | | $ | | $ | | ||

General and administrative |

| |

| | |

| | |||||

Total operating expenses |

| |

| | |

| | |||||

Operating loss |

| ( |

| ( | ( |

| ( | |||||

Non-operating income (expense): |

| |

| | |

| | |||||

Interest and other income, net | | | | | ||||||||

Income (loss) from change in fair value of embedded derivative liability | — | | ( | ( | ||||||||

Total non-operating income, net |

| |

| | |

| | |||||

Net loss | ( | ( | ( | ( | ||||||||

Other comprehensive income (loss): | ||||||||||||

Net unrealized gain (loss) on marketable debt securities | ( | ( | | | ||||||||

Comprehensive loss | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Net loss per common share: | ||||||||||||

Basic and diluted | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Weighted average number of common shares outstanding: |

|

| ||||||||||

Basic and diluted | | | |

| | |||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

2

Rezolute, Inc.

Unaudited Condensed Consolidated Statements of Shareholders’ Equity

Six Months Ended December 31, 2025 and 2024

(In Thousands, Except Number of Shares)

| Accumulated | ||||||||||||||||

Additional | Other | Total | |||||||||||||||

| Common Stock | Paid-in | Comprehensive |

| Accumulated | Shareholders' | |||||||||||

| Shares | | Amount | | Capital | | Income (Loss) | | Deficit | | Equity | ||||||

Six Months Ended December 31, 2025: | |||||||||||||||||

Balances, June 30, 2025 | | $ | | $ | | $ | ( | $ | ( | $ | | ||||||

Issuance of common stock upon exercise of stock options | | | | — | — | | |||||||||||

Share-based compensation | — | — | | — | — | | |||||||||||

Cashless exercise of pre-funded warrants | | | ( | — | — | — | |||||||||||

Other comprehensive income | — | — | — | | — | | |||||||||||

Net loss |

| — |

| — |

| — |

| — |

| ( |

| ( | |||||

Balances, December 31, 2025 | | $ | | $ | | $ | | $ | ( | $ | | ||||||

Six Months Ended December 31, 2024: | |||||||||||||||||

Balances, June 30, 2024 | | $ | | $ | | $ | ( | $ | ( | $ | | ||||||

Gross proceeds from issuance of common stock for cash in 2024 Private Placement | | | | — | — | | |||||||||||

Commissions and other offering costs | — | — | ( | — | — | ( | |||||||||||

Issuance of common stock upon exercise of stock options | | | | — | — | | |||||||||||

Share-based compensation | — | — | | — | — | | |||||||||||

Cashless exercise of pre-funded warrants | | | ( | — | — | — | |||||||||||

Other comprehensive income | — | — | — | | — | | |||||||||||

Net loss | — | — | — | — | ( | ( | |||||||||||

Balances, December 31, 2024 | | $ | | $ | | $ | | $ | ( | $ | | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

Rezolute, Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(In Thousands)

| Six Months Ended | |||||

December 31, | ||||||

| 2025 | | 2024 | |||

Cash Flows From Operating Activities: |

| |

| | ||

Net loss | $ | ( | $ | ( | ||

Share-based compensation expense | | | ||||

Loss from change in fair value of embedded derivative liability | | | ||||

Non-cash lease expense | | | ||||

Accretion of discounts and amortization of premiums on marketable debt securities, net | ( | ( | ||||

Depreciation expense | | | ||||

Changes in operating assets and liabilities: |

|

| | |||

Decrease (increase) in prepaid expenses, deposits, and other assets |

| |

| ( | ||

Decrease in accounts payable |

| ( |

| ( | ||

(Decrease) increase in accrued liabilities | ( | | ||||

Net cash used in operating activities | ( |

| ( | |||

Cash Flows From Investing Activities: |

| |||||

Purchase of marketable debt securities | ( | ( | ||||

Proceeds from maturities of marketable debt securities | | | ||||

Net cash used in investing activities |

| ( |

| ( | ||

Cash Flows From Financing Activities: |

| | | |||

Proceeds from exercise of stock options | | | ||||

Gross proceeds from issuance of common stock in 2024 Private Placement | — | | ||||

Payment of offering costs | ( | ( | ||||

Net cash provided by financing activities |

| |

| | ||

Net decrease in cash and cash equivalents | ( | ( | ||||

Cash and cash equivalents at beginning of period |

| |

| | ||

Cash and cash equivalents at end of period | $ | | $ | | ||

Supplementary Cash Flow Information: |

|

| | |||

Cash paid for interest | $ | — | $ | — | ||

Cash paid for income taxes | — | — | ||||

Cash paid for amounts included in the measurement of operating lease liabilities | | | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

Note 1 — Nature of Operations and Summary of Significant Accounting Policies

Nature of Operations

Rezolute, Inc. (the “Company”) is a late-stage rare disease company focused on significantly improving outcomes for individuals with hypoglycemia caused by hyperinsulinism (“HI”). The Company’s primary clinical asset, ersodetug, is a potential treatment that the Company believes could be a treatment for all forms of HI, including congenital HI and tumor HI. The Company is currently enrolling in a Phase 3 clinical trial for a tumor HI indication (“upLIFT”). In December 2025, the Company reported its Phase 3 clinical trial in congenital HI (“sunRIZE”) did not meet its primary or key secondary endpoints. The Company will be meeting with the Food and Drug Administration (“FDA”) prior to the end of calendar Q1 2026 to discuss the study results and discuss a potential path forward.

Basis of Presentation

The accompanying unaudited interim financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), and the rules and regulations of the SEC for interim financial information, including the instructions to Form 10-Q and Article 8 of Regulation S-X.

The condensed consolidated balance sheet as of June 30, 2025, has been derived from the Company’s audited consolidated financial statements. The unaudited interim financial statements should be read in conjunction with the 2025 Form 10-K, which contains the Company’s audited financial statements and notes thereto, together with Management’s Discussion and Analysis of Financial Condition and Results of Operations for the fiscal year ended June 30, 2025.

The Company’s Chief Executive Officer also serves as the Company’s chief operating decision maker (“CODM”) for purposes of allocating resources and assessing performance based on financial information of the Company. Since its inception, the Company has determined that its activities as a clinical stage biopharmaceutical company are classified as a single reportable operating segment.

Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted, pursuant to the rules and regulations of the SEC for interim financial reporting. Accordingly, the interim financial statements do not include all information and footnote disclosures necessary for a comprehensive presentation of financial position, results of operations, and cash flows. It is management’s opinion, however, that all material adjustments (consisting of normal recurring adjustments) that are necessary for a fair financial statement presentation have been made. The interim results for the three and six months ended December 31, 2025, are not necessarily indicative of the financial condition and results of operations that may be expected for any future interim period or for the fiscal year ending June 30, 2026.

Consolidation

The Company has

5

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make judgments, estimates and assumptions that affect the reported amounts in the unaudited condensed consolidated financial statements and the accompanying notes. The Company bases its estimates and assumptions on current facts, historical experience, and various other factors that it believes are reasonable under the circumstances, to determine the carrying values of assets and liabilities that are not readily apparent from other sources. The Company’s significant accounting estimates include, but are not necessarily limited to, determination if an allowance for credit losses or impairment is required for marketable debt securities, the fair value of an embedded derivative liability, fair value of share-based compensation, management’s assessment of going concern, and estimates related to clinical trial accrued liabilities. Actual results could differ from those estimates.

Risks and Uncertainties

The Company's operations may be subject to significant risks and uncertainties including financial, operational, regulatory and other risks associated with a clinical stage company, including the potential risk of business failure discussed in Note 2.

Significant Accounting Policies

The Company’s significant accounting policies are described in Note 1 to the financial statements in Item 8 of the 2025 Form 10-K.

Recent Accounting Pronouncements Not Yet Adopted

In December 2023, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2023-09, Income Taxes (Topic 740) – Improvements to Income Tax Disclosures. ASU 2023-09 requires disclosure of additional income tax information, primarily related to the rate reconciliation and income taxes paid. This ASU is intended to enhance the transparency and decision usefulness of income tax disclosures. ASU 2023-09 is effective for annual periods beginning after December 15, 2024. The Company is required to adopt ASU 2023-09 in its annual financial statements for the fiscal year ended June 30, 2026, and for interim periods thereafter. The Company does not expect the adoption of ASU 2023-09 will have a material impact on its consolidated financial statements.

In November 2024, the FASB issued ASU 2024-03, Income Statement – Reporting Comprehensive Income – Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses. ASU 2024-03 is intended to enhance disclosures by requiring public entities to disclose specified information about certain costs and expenses. ASU 2024-03 is effective for annual periods beginning after December 15, 2026. The Company is required to adopt ASU 2024-03 in its annual financial statements for the fiscal year ending June 30, 2028, and for interim periods thereafter. The Company does not expect the adoption of ASU 2024-03 will have a material impact on its consolidated financial statements.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not currently expected to have a material impact on the Company’s consolidated financial statements upon adoption.

Note 2 — Liquidity

The Company is in the clinical stage and has not yet generated any revenues. For the six months ended December 31, 2025, the Company incurred a net loss of $

6

As of December 31, 2025, the Company has total liabilities of $

As discussed in Note 15, management approved a reduction in workforce on December 11, 2025 that resulted in the termination of employment of

Management believes the Company’s cash and cash equivalents and investments in marketable debt securities will be adequate to meet the Company’s contractual obligations and carry out ongoing clinical trials and other planned activities for at least 12 months from the issuance date of the unaudited condensed consolidated financial statements as of December 31, 2025.

Note 3 — Investments in Marketable Debt Securities

Investments in marketable debt securities are accounted for as available-for-sale investments at fair value. The Company only invests in liquid, high-quality debt securities. Nonetheless, all of these investments are subject to interest rate and credit risk that may result in fluctuations in the fair value of the investments. To minimize exposure due to an adverse shift in interest rates, the Company generally invests in securities with expected maturities of

During the six months ended December 31, 2025, marketable debt securities for $

Accrued interest receivable on all marketable debt securities amounted to $

For the six months ended December 31, 2025, the Company did

December 31, 2025 | ||||||||||||

Gross Unrealized | ||||||||||||

Amortized Cost | | Gains | | Losses | | Fair Value | ||||||

Corporate commercial paper | $ | | $ | | $ | ( | $ | | ||||

Obligations of U.S. government agencies | | | — | | ||||||||

U.S. Treasury obligations | | — | ( | | ||||||||

Corporate notes and bonds | | | ( | | ||||||||

Total | $ | | $ | | $ | ( | $ | | ||||

7

June 30, 2025 | ||||||||||||

Gross Unrealized | ||||||||||||

Amortized Cost | | Gains | | Losses | | Fair Value | ||||||

Corporate commercial paper | $ | | $ | | $ | ( | $ | | ||||

Obligations of U.S. government agencies | | — | ( | | ||||||||

U.S. Treasury obligations | | — | ( | | ||||||||

Corporate notes and bonds | | | ( | | ||||||||

Total | $ | | $ | | $ | ( | $ | | ||||

Note 4 — Operating Leases

The carrying value of all right-of-use assets and operating lease liabilities is as follows (in thousands):

December 31, | June 30, | |||||

| 2025 | | 2025 | |||

Right-of-use assets | $ | | $ | | ||

Operating lease liabilities: |

| |

| | ||

Current | $ | | $ | | ||

Long-term |

| |

| | ||

Total | $ | | $ | | ||

For the three and six months ended December 31, 2025 and 2024, operating lease expense is included under the following captions in the accompanying unaudited condensed consolidated statements of operations and comprehensive loss (in thousands):

Three Months Ended | Six Months Ended | |||||||||||

December 31, | December 31, | |||||||||||

| 2025 | | 2024 | 2025 | | 2024 | ||||||

Research and development | $ | | $ | | $ | | $ | | ||||

General and administrative |

| |

| |

| |

| | ||||

Total | $ | | $ | | $ | | $ | | ||||

As of December 31, 2025, the weighted average remaining lease term under operating leases was

Fiscal year ending June 30, | | | |

Remainder of fiscal year 2026 | $ | | |

2027 | | ||

2028 | | ||

Total lease payments | | ||

Less imputed interest |

| ( | |

Present value of operating lease liabilities | $ | |

8

Note 5 — License Agreements

XOMA License Agreement

In December 2017, the Company entered into a license agreement that has been subsequently amended (“XOMA License Agreement”) with XOMA Corporation (“XOMA”), through its wholly-owned subsidiary, XOMA (U.S.) LLC, pursuant to which XOMA granted an exclusive global license to the Company to develop and commercialize XOMA 358 (formerly X358 or RZ358, now ersodetug) for all indications.

To date the Company has paid a total of $

ActiveSite License Agreement

In August 2017, the Company entered into a Development and License Agreement (the “ActiveSite License Agreement”) with ActiveSite Pharmaceuticals, Inc. (“ActiveSite”) pursuant to which the Company acquired the rights to ActiveSite’s Plasma Kallikrein Inhibitor program (“PKI Portfolio”). The Company initially focused on the development of RZ402 as a therapy for diabetic macular edema (“DME”). Following the completion of a Phase 2 clinical study for RZ402, the Company decided to pause the program to focus its resources on ersodetug. The Company is currently exploring the use of the PKI Portfolio to develop therapies for different indications. To date the company has paid a total of $

Note 6 — Embedded Derivative Liability

On April 14, 2021, the Company entered into a $

Concurrently with the execution of the Loan Agreement, the Company entered into an exit fee agreement (the “Exit Fee Agreement”) that provides for a fee of

9

Note 7 — Shareholders’ Equity

Quarterly Changes in Shareholders' Equity

The following table presents changes in shareholders’ equity for the three months ended December 31, 2025 and 2024 (in thousands, except number of shares):

Accumulated | |||||||||||||||||

Additional | Other | Total | |||||||||||||||

Common Stock | Paid-in | Comprehensive | Accumulated | Shareholders' | |||||||||||||

| Shares | | Amount | | Capital | | Income (Loss) | | Deficit | | Equity | ||||||

Three Months Ended December 31, 2025: | |||||||||||||||||

Balances, September 30, 2025 |

| | $ | | $ | | $ | | $ | ( | $ | | |||||

Issuance of common stock upon exercise of stock options | | | | — | — | | |||||||||||

Share-based compensation expense | — | — | | — | — | | |||||||||||

Cashless exercise of pre-funded warrants | | | ( | — | — | — | |||||||||||

Other comprehensive loss | — | — | — | ( | — | ( | |||||||||||

Net loss |

| — |

| — |

| — |

| — |

| ( |

| ( | |||||

Balances, December 31, 2025 | | $ | | $ | | $ | | $ | ( | $ | | ||||||

Three Months Ended December 31, 2024: | |||||||||||||||||

Balances, September 30, 2024 | | $ | | $ | | $ | | $ | ( | $ | | ||||||

Issuance of common stock upon exercise of stock options | | | | — | — | | |||||||||||

Share-based compensation expense | — | — | | — | — | | |||||||||||

Cashless exercise of pre-funded warrants | | | ( | — | — | — | |||||||||||

Other comprehensive loss | — | — | — | ( | — | ( | |||||||||||

Net loss | — | — | — | — | ( | ( | |||||||||||

Balances, December 31, 2024 |

| | $ | | $ | | $ | | $ | ( | $ | | |||||

Pre-Funded Warrants

Between October 2021 and April 2025, the Company issued fully vested pre-funded warrants (“PFWs”) exercisable to purchase an aggregate of

The PFWs are exercisable at any time, subject to the then effective ownership blocker percentage (the “OBP”) as elected by each of the holders of PFWs. The OBP is a percentage designated by the holders whereby the PFWs cannot be exercised if, after giving effect thereto, the holder would beneficially own more than the designated OBP. However, upon at least 61 days’ prior notice to the Company, any holder of PFWs may elect to increase or decrease the OBP to any other percentage not to exceed

10

comply with the respective OBP terms, all of the PFWs may be exercised at any time by paying the respective exercise price or electing to exercise on a cashless basis.

As of June 30, 2025, the Company had an aggregate of

2021 | 2022 | 2024 | 2025 | ||||||

PFWs | PFWs | PFWs | PFWs | Total | |||||

Outstanding, June 30, 2025 | | (1) | | (2) | | (3) | | (4) | |

Cashless exercise of PFWs: | |||||||||

Shares surrendered for exercise price | — | ( | (5) | ( | (5) | ( | (5) | ( | |

Shares of common stock issued | — | ( | (6) | ( | (6) | ( | (6) | ( | |

Outstanding, December 31, 2025 | | | | | |

| (1) | In connection with an underwritten offering in October 2021, PFWs were issued to purchase |

| (2) | In connection with a registered direct offering in May 2022, PFWs were issued to purchase |

| (3) | In connection with an underwritten offering in June 2024, PFWs were issued to purchase |

| (4) | As discussed below under the caption 2025 Underwritten Offering, the Company issued 2025 PFWs for the purchase of |

| (5) | The holders of PFWs provided notice of cashless exercise that resulted in cancellation of shares in lieu of paying the exercise price in cash. |

| (6) | Represents the number of shares issued after giving effect to shares surrendered due to the cashless exercise notification by the holders. |

2025 Private Placement

In May 2025, the Company entered into a securities purchase agreement (the “2025 SPA”) with Handok, Inc. and two other investors relating to a private placement (the “2025 Private Placement”), pursuant to which

2025 Underwritten Offering

On April 23, 2025, the Company entered into an underwriting agreement with Guggenheim Securities, LLC (the “2025 Underwriter”) for the planned issuance and sale of equity securities in an underwritten public offering (the “2025 Underwritten Offering”). The 2025 Underwritten Offering resulted in the issuance of (i)

11

2024 Private Placement

In June 2024, the Company entered into a securities purchase agreement (the “2024 SPA”) with Handok, Inc. and one other investor relating to a private placement (the “2024 Private Placement”), pursuant to which

Jefferies Open Market Sales Agreement

On November 14, 2023, the Company and Jefferies LLC (the “Agent”) entered into an open market sales agreement (the “Sales Agreement”) that provides for an “at the market” offering for the sale of up to $

In October 2025, the Company provided the Agent with notice of termination of the Sales Agreement. Accordingly, the Company had the maximum amount remaining for sale under the Sales Agreement of $

Note 8 — Share-Based Compensation and Warrants

Inducement Grants

In connection with the appointment of the Company’s Chief Commercial Officer in August 2025 the Board of Directors approved the grant of stock options exercisable for the purchase of

Additionally, in connection with the hiring of

12

Equity Incentive Plans

Presented below is a summary of the number of shares authorized, outstanding, and available for future grants under the Company’s equity incentive plans as of December 31, 2025:

| Number of Shares | |||||

Description | | Authorized | | Outstanding | | Available |

2015 Plan |

| | |

| — | |

2016 Plan |

| |

| |

| — |

2019 Plan |

| |

| |

| — |

2021 Plan | | | | |||

Inducement Awards | | | | |||

Total |

| |

| | (1) | |

| (1) | Consists of approximately |

The Company currently has

In addition, inducement awards are allowed for grants of options pursuant to Nasdaq Listing Rule 5635(c)(4) whereby the underlying shares are not authorized under any of the Company’s stock option plans. Through December 31, 2025, the Board of Directors has authorized a total of

2022 Employee Stock Purchase Plan

On June 16, 2022, the Company’s shareholders approved the adoption of the 2022 Employee Stock Purchase Plan (the “2022 ESPP”). The 2022 ESPP provides an opportunity for employees to purchase the Company’s common stock through accumulated payroll deductions.

The 2022 ESPP has consecutive offering periods that begin approximately every 6 months commencing on the first trading day on or after July 1 and terminating on the last trading day of the offering period ending on December 31 and commencing on the first trading day on or after January 1 and terminating on the last trading day of the offering period ending on June 30. The 2022 ESPP reserves

13

Stock Options Outstanding

For the six months ended December 31, 2025, the following table summarizes the combined stock option activity under the Company’s equity incentive plans and Inducement Awards:

| Shares | | Price (1) | | Term (2) | ||

Outstanding, beginning of period |

| | $ | |

| ||

Granted | | | |||||

Exercised | ( | (3) | | ||||

Expired | ( | | |||||

Forfeited | ( | | |||||

Outstanding, end of period |

| | (4) |

| |

| |

Vested, end of period |

| | (5) |

| |

| |

| (1) | Represents the weighted average exercise price. |

| (2) | Represents the weighted average remaining contractual term for the number of years until the stock options expire. |

| (3) | The total intrinsic value (the amount by which the fair market value exceeded the exercise price) of stock options exercised during the six months ended December 31, 2025, was $ |

| (4) | As of December 31, 2025, the intrinsic value of outstanding options was approximately $ |

| (5) | As of December 31, 2025, the intrinsic value of vested stock options was approximately $ |

For the six months ended December 31, 2025, the aggregate fair value of stock options granted for approximately

For the six months ended December 31, 2025, the fair value of stock options was estimated on the respective dates of grant, with the following weighted-average assumptions:

Market price of common stock on grant date | $ | | ||

Expected volatility | | | % | |

Risk free interest rate |

| | % | |

Expected term (years) |

| |||

Dividend yield |

| | % |

Restricted Stock Units (“RSUs”)

For the six months ended December 31, 2025, the following table sets forth a summary of the combined RSU activity under the Company’s 2021 Plan:

| Shares | | Price (1) | ||

Unvested, beginning of period |

| | $ | | |

Granted | | | |||

Vested | — | — | |||

Forfeited | ( | | |||

Unvested, end of period |

| |

| | |

| (1) | Represents the weighted average grant price based on the closing market price on the date of each of the RSU grants. |

14

For the six months ended December 31, 2025, the aggregate fair value of RSUs granted for approximately

Share-Based Compensation Expense

Share-based compensation expense for the three and six months ended December 31, 2025 and 2024 is included under the following captions in the unaudited condensed consolidated statements of operations and comprehensive loss (in thousands):

Three Months Ended | Six Months Ended | |||||||||||

December 31, | December 31, | |||||||||||

| 2025 | | 2024 | 2025 | | 2024 | ||||||

Research and development | $ | | $ | | $ | | $ | | ||||

General and administrative |

| |

| |

| |

| | ||||

Total | $ | | $ | | $ | | $ | | ||||

The aggregate unrecognized share-based compensation expense related to stock options and RSUs is approximately $

Pre-Funded Warrants

PFWs are outstanding for a total of approximately

Legacy Warrants

In connection with an equity financing in October 2020, the Company issued warrants entitling the holders to purchase an aggregate of

For the six months ended December 31, 2025,

| Shares | | Price (1) | | Term (2) | ||

Outstanding, beginning of period |

| | | $ | |

| |

Expirations |

| ( | | |

| | |

Outstanding, end of period |

| | |

| |

| |

| (1) | Represents the weighted average exercise price. |

| (2) | Represents the weighted average remaining contractual term for the number of years until the warrants expire. |

15

Note 9 — Commitments and Contingencies

Licensing Commitments

Please refer to Note 5 for further discussion of commitments to make milestone payments and to pay royalties under license agreements with XOMA and ActiveSite.

Amended Employment Agreement

On October 17, 2025, the Company entered into amendments to employment agreements with Nevan Elam, Brian Roberts, Daron Evans, and Sunil Karnawat. The amendments entitle each of the executive officers to a full gross-up payment (the “Gross-Up Payment”) for any excise tax imposed by Section 4999 of the Internal Revenue Code (the “IRC”) and other local, state and federal taxes imposed if an excess parachute payment is paid in connection with a future change of control event, as determined under Section 280G of the IRC. The determination of the amount of any Gross-Up Payment will be made by the Company in its sole discretion. Except for the provisions related to Gross-Up Payments, all other terms of the respective employment agreements were unchanged.

Legal Matters

From time to time, the Company may be involved in litigation relating to claims arising out of operations in the normal course of business. At each reporting period, the Company evaluates known claims to determine whether a potential loss or a potential range of loss is probable and reasonably estimable under ASC 450, Contingencies. As of December 31, 2025, there have been several law firms that have initiated investigations into the Company and have filed press releases seeking stockholders to engage them to file litigation against the Company for alleged securities law violations related to the Company’s Phase 3 sunRIZE trial not meeting its primary and key secondary endpoints. As of the issuance date of this Quarterly Report on Form 10-Q there have been no pending or threatened lawsuits against the Company including related to the Company’s Phase 3 sunRIZE trial that could reasonably be expected to have a material effect on the Company’s results of operations. Legal fees are expensed as incurred.

Note 10 — Related Party Transactions

Related Party Licensing Agreement

On September 15, 2020, the Company and Handok entered into an exclusive license agreement (the “Handok License”) for the territory of the Republic of Korea. The Handok License relates to pharmaceutical products in final dosage form containing the pharmaceutical compounds developed or to be developed by the Company, including those related to ersodetug and the PKI Portfolio. The Handok License is in effect for a period of

Note 11 — Income Taxes

Income tax expense during interim periods is based on applying an estimated annualized effective income tax rate applied to the respective quarterly periods, adjusted for discrete tax items in the period in which they occur. The computation of the annualized estimated effective tax rate for each interim period requires certain estimates and significant judgment including, but not limited to, the expected operating results for the year, projections of the proportion of income earned and taxed in various jurisdictions, permanent and temporary differences, and the likelihood of recovering deferred income tax assets generated in the current year. The accounting estimates used to compute the provision for income taxes may change as new events occur, more experience is obtained, additional information becomes known, or as the tax environment changes.

For the three and six months ended December 31, 2025 and 2024, the Company did not recognize any income tax benefit due to a full valuation allowance on its deferred income tax assets. The Company did not have any material changes to its conclusions regarding valuation allowances for deferred income tax assets or uncertain tax positions for the three and six months ended December 31, 2025 and 2024.

16

Note 12 — Net Loss Per Share

Basic net loss per share is computed by dividing net loss by the weighted average number of outstanding shares of common stock and PFWs during periods when the PFWs are accounted for as equity instruments. Common shares associated with PFWs that are accounted for as equity instruments are included in the computation of basic and diluted net loss per share because the exercise price is negligible and all of the PFWs are fully vested and exercisable.

Three Months Ended | Six Months Ended | |||||||||||

December 31, | December 31, | |||||||||||

| 2025 | | 2024 | | 2025 | | 2024 | |||||

Common Stock | | | | | ||||||||

2021 PFWs | | | | | ||||||||

2022 PFWs | | | | | ||||||||

Exchange PFWs | — | | — | | ||||||||

2024 PFWs | | | | | ||||||||

2025 PFWs | | — | | — | ||||||||

Total | | | | | ||||||||

For the three and six months ended December 31, 2025 and 2024, basic and diluted net loss per share are the same since all other common stock equivalents were anti-dilutive.

2025 | 2024 | |||

Stock options | | | ||

RSUs | | — | ||

Legacy Warrants | | | ||

Total | | |

Note 13 — Financial Instruments and Significant Concentrations

Fair Value Measurements

Fair value is defined as the price that would be received upon sale of an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. When determining fair value, the Company considers the principal or most advantageous market in which it transacts and considers assumptions that market participants would use when pricing the asset or liability. The Company applies the following fair value hierarchy, which prioritizes the inputs used to measure fair value into three levels and bases the categorization within the hierarchy upon the lowest level of input that is available and significant to the fair value measurement:

Level 1—Quoted prices in active markets for identical assets or liabilities accessible to the reporting entity at the measurement date.

Level 2—Other than quoted prices included in Level 1 that are observable for the asset and liability, either directly or indirectly through market corroboration, for substantially the full term of the asset or liability.

Level 3—Unobservable inputs for the asset or liability used to measure fair value to the extent that observable inputs are not available, thereby allowing for situations in which there is little, if any market activity for the asset or liability at the measurement date.

17

The following tables present information about the Company’s financial assets measured at fair value on a recurring basis and indicates the fair value hierarchy classification as of December 31, 2025 and June 30, 2025 (in thousands):

Fair Value Measurement of Assets as of December 31, 2025 | ||||||||||||

Total | Level 1 | Level 2 | Level 3 | |||||||||

Cash and cash equivalents: | ||||||||||||

Money market funds | $ | | $ | | $ | — | $ | — | ||||

Marketable debt securities: | ||||||||||||

Corporate commercial paper | | — | | — | ||||||||

U.S. Government agencies | | — | | — | ||||||||

U.S. Government treasuries | | — | | — | ||||||||

Corporate notes and bonds | | — | | — | ||||||||

Total | $ | | $ | | $ | | $ | — | ||||

Fair Value Measurement of Assets as of June 30, 2025 | ||||||||||||

Total | Level 1 | Level 2 | Level 3 | |||||||||

Cash and cash equivalents: | ||||||||||||

Money market funds | $ | | $ | | $ | — | $ | — | ||||

Corporate commercial paper | | — | | — | ||||||||

U.S. Government treasuries | | — | | — | ||||||||

Marketable debt securities: | ||||||||||||

Corporate commercial paper | | — | | — | ||||||||

U.S. Government agencies | | — | | — | ||||||||

U.S. Government treasuries | | — | | — | ||||||||

Corporate notes and bonds | | — | | — | ||||||||

Total | $ | | $ | | $ | | $ | — | ||||

Marketable debt securities classified as Level 2 within the valuation hierarchy generally consist of corporate bonds, commercial paper, and U.S. government agency securities. The Company determines the fair value of marketable debt securities based upon valuations obtained from third-party pricing sources. Except for the amounts shown in the tables above, the Company did not have any other assets measured at fair value on a recurring basis as of December 31, 2025 and June 30, 2025.

The Company’s embedded derivative liability discussed in Note 6 is classified under Level 3 of the fair value hierarchy and is required to be measured and recorded at fair value on a recurring basis. Fair value is determined based on management’s assessment of the probability and timing of occurrence for the Exit Events discussed in Note 6 using a discount rate equal to the historical effective interest rate under the Loan Agreement.

The following table sets forth changes in the fair value of the Company’s embedded derivative liability for which fair value was determined on a recurring basis for the six months ended December 31, 2025 and 2024 (in thousands):

2025 | 2024 | ||||

Fair value, beginning of period | $ | | $ | | |

Changes in fair value | | | |||

Fair value, end of period | $ | | $ | | |

Except for the embedded derivative liability, the Company did not have any other liabilities measured at fair value on a recurring basis as of December 31, 2025 and June 30, 2025.

18

Due to the relatively short maturity of the respective instruments, the fair value of cash, accounts payable, and accrued liabilities approximated their carrying values as of December 31, 2025 and June 30, 2025.

The Company’s policy is to recognize asset or liability transfers among Level 1, Level 2 and Level 3 as of the actual date of the events or change in circumstances that caused the transfer. During the six months ended December 31, 2025 and 2024, the Company did not have any transfers of its assets or liabilities between levels of the fair value hierarchy.

Significant Concentrations

As of December 31, 2025, the Company had an aggregate of $

Note 14 — Segment Disclosures

The Company has determined that it operates as a reportable segment which includes all of its activities as a clinical stage biopharmaceutical company. The CODM uses consolidated net loss as reported in the unaudited condensed consolidated statements of operations and comprehensive loss to assess performance, analyze budget to actual results, forecast future operating results and cash requirements, and allocate resources for its single reportable segment. The significant segment expenses regularly reviewed by the CODM consist of clinical and manufacturing costs of ersodetug, personnel expenses, and other segment expenses. The measure of the operating segment assets is reported on the unaudited condensed consolidated balance sheets as total assets and all of the Company's tangible assets are located in the United States.

19

The following table presents consolidated net loss summarized by the significant segment expenses regularly reviewed by the CODM for the three and six months ended December 31, 2025, and 2024 (in thousands):

Three Months Ended | Six Months Ended | ||||||||||

December 31, | December 31, | ||||||||||

2025 | | 2024 | 2025 | | 2024 | ||||||

Research and development: |

|

| |||||||||

Ersodetug | $ | | $ | | $ | | $ | | |||

Compensation and benefits | | | | | |||||||

Other research and development segment expenses (1) | | | | | |||||||

Total research and development |

| | |

| | | |||||

General and administrative: |

|

| |||||||||

Compensation and benefits | | | | | |||||||

Other general and administrative segment expenses (2) | | | | | |||||||

Total general and administrative |

| | |

| | | |||||

Operating loss | ( | ( | ( | ( | |||||||

Total non-operating income, net | | | | | |||||||

Net loss | $ | ( | $ | ( | $ | ( | $ | ( | |||

| (1) | Other research and development segment expenses primarily include quality regulatory and other pipeline development costs, employee travel and expense, and other facility and information technology costs. |

| (2) | Other general and administrative segment expenses primarily include consulting expenses related to business development and market planning activities, insurance expense, public company costs, employee travel and expense, and other facility and information technology costs. |

Note 15 — Reduction in Workforce

On December 11, 2025, the Company announced that its Phase 3 sunRIZE clinical trial did not meet its primary or key secondary endpoints. Management approved a reduction in workforce of

20

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Certain figures, such as interest rates and other percentages included in this section have been rounded for ease of presentation. Percentage figures included in this section have not in all cases been calculated on the basis of such rounded figures but on the basis of such amounts prior to rounding. For this reason, percentage amounts in this section may vary slightly from those obtained by performing the same calculations using the figures in our unaudited condensed consolidated financial statements or in the associated text. Certain other amounts that appear in this section may similarly not sum due to rounding. As used in the discussion below, “we,” “our,” “us,” and the “Company” refers to Rezolute, Inc.

We are a late-stage rare disease company focused on developing biologics that significantly improve the quality of life for patients and their families.

Our priorities for 2026 are to progress our two Phase 3 programs in congenital and tumor hyperinsulinism (“HI”). Our goals include (i) achieve alignment with the U.S. Food and Drug Administration (“FDA”) on the path forward in congenital HI, (ii) complete enrollment in the registrational tumor HI study and (iii) announce topline data from the registrational tumor HI study.

Ersodetug for congenital HI

sunRIZE Phase 3 Study

On December 11, 2025, we announced that the sunRIZE study did not meet its primary (hypoglycemia events) or key secondary (time in hypoglycemia) endpoints. The study demonstrated reductions from baseline in events and time in hypoglycemia in both treatment groups, but not enough to be statistically significant compared to the pronounced study effect in the placebo arm. We believe the pronounced placebo/study effect confounded the results, particularly for hypoglycemia events by self-monitored glucometer, but that the totality of the data further supports previous clinical evidence that ersodetug is active against hypoglycemia in patients. Specifically, there was evidence of pharmacologic activity, as target therapeutic drug concentrations were achieved in both treatment groups (5 mg/kg and 10 mg/kg) with highly sensitive biomarker responses (increases in circulating insulin) in the active treatment groups that are directly indicative of reduced insulin activity at its receptor, which biologically implies fewer cell-surface glucose transporters, and a resultant increase in blood glucose.

While additional analyses are ongoing, initial observations from sunRIZE inform our belief that the pharmacologic response demonstrates therapeutic activity, which may be obscured by the nature of patient-monitored hypoglycemia endpoint, and hypoglycemia-avoidant confounding behaviors. The magnitude of the placebo response observed for hypoglycemia events was a surprise to us and reveals a significant challenge in studying glucose in an ambulatory setting, where intensive visits and monitoring is inevitable and can independently influence outcomes, particularly when the patient-monitored glucose is simultaneously the safety lifeline for patient and families.

In light of these limitations, assessing the potential benefit in the ongoing open-label extension (“OLE”) portion of the study will be important, including blood glucose levels in the placebo group following roll-over to ersodetug. All 59 participants who completed the study elected to continue to receive ersodetug in the OLE. To date, 57 participants remain in the OLE, with an exposure duration ranging from ~3 months for the most recently entered patients, to ~21 months. We believe that a potential indicator of ersodetug’s underlying efficacy is an observed reduction in overall background standard of care (“SOC”) therapies in the OLE, including several children who have discontinued SOC and tube feeds and are now receiving ersodetug as monotherapy.

We will be meeting with the FDA prior to the end of calendar Q1 2026 under our Breakthrough Therapy Designation to further characterize these and other clinical outcomes to discuss the full sunRIZE dataset and next steps for this indication. FDA may require additional clinical studies in order to advance the program, which would have an impact on our operating plans and cash resources.

The Phase 3 sunRIZE study (RZ358-301) was a multi-center, randomized, double-blind, placebo-controlled, parallel arm study designed to evaluate the efficacy and safety of ersodetug in patients with congenital hyperinsulinism (“HI”), ages 3 months to 45 years old, who were experiencing continued hypoglycemia on currently available SOC. Eligible participants were randomized to one of three treatment arms to receive either ersodetug (5 or 10 mg/kg) or matched placebo-control as add on to existing SOC. The initial 8 infant participants

21

(ages 3 months – 1 year old) were enrolled open-label but subsequent participants in this age range could be enrolled into the double-blind randomized, controlled trial (“RCT”). Study drug was administered every other week during an initial loading phase, and then every 4 weeks during the 24-Week controlled pivotal treatment period. Following the pivotal treatment phase of the study, participants could roll-over into an optional open-label extension phase to continue to receive ersodetug.

The study enrolled 63 participants (55 RCT) in more than a dozen countries around the world, inclusive of U.S. patients. The primary and key secondary efficacy endpoints in the study were the change from baseline in the average number of hypoglycemia events per week and the average percent time in hypoglycemia, respectively, over 24 weeks of treatment.

Congenital HI is the most common cause of recurrent and persistent hypoglycemia in children. Individuals with congenital HI typically present with signs or symptoms of hypoglycemia shortly after birth. Hypoglycemia can result in significant brain injury and death if not recognized and managed appropriately. Additionally, recurrent, or cumulative, hypoglycemia can lead to progressive and irreversible damage over time, including serious and devastating brain injury, seizures, neuro-developmental problems, feeding difficulties, and significant impact on patient and family quality of life. In cases where individuals have diffuse disease, a near-total pancreatectomy may be undertaken, although ongoing medical treatment of hypoglycemia is generally required for several years after surgery, before eventual insulin-dependent diabetes ensues. There are no FDA approved therapies for all forms of congenital HI, and the current standard of care treatments are suboptimal. The treatments used by physicians today include glucagon, diazoxide, somatostatin analogues and pancreatectomy. We estimate that in the U.S. alone, the initial addressable pediatric market for congenital HI is more than 1,500 individuals. We believe this addressable population will increase with the elimination of near-total pancreatectomy (“NTP”) and use of ersodetug in patients on diazoxide who experience side effects or are partially responsive.

Ersodetug has received Orphan Drug Designation in the U.S. and European Union for the treatment of congenital HI, as well as Rare Pediatric Disease Designation in the U.S., a prerequisite for a request for a Rare Pediatric Disease Priority Review Voucher upon Biologics License Application (“BLA”) submission. Based on the multinational Phase 2b clinical trial outcomes and the evidence of benefit in this serious condition with substantial unmet medical need, ersodetug was subsequently granted a priority medicines (“PRIME”) designation by the European Medicines Agency (“EMA”), an Innovation Passport designation by the UK Innovative Licensing and Access Pathway (“ILAP”) Steering Group for the treatment of congenital HI, and Breakthrough Therapy Designation by the FDA in the U.S.

Ersodetug for tumor HI

upLIFT Phase 3 Study

In mid-2025 we initiated the Phase 3 registrational study (“upLIFT”) of ersodetug for the treatment of hypoglycemia due to tumor HI. Topline results from the study are anticipated to be available in the second half of calendar 2026, but the specific date of the availability of such results may vary.

At a meeting held with FDA on August 19, 2025, the agency agreed to modifications to the design of the upLIFT study including removing the need to conduct a randomized, double-blind, placebo-controlled trial with hypoglycemia events as the endpoint. The truncated upLIFT study is a Phase 3 registrational, single-arm, open-label, pivotal trial in as few as 16 participants with insulinoma or paraneoplastic non-islet cell tumors, who are requiring continuous parenteral dextrose because of refractory hypoglycemia. Eligible participants requiring continuous parenteral dextrose will receive ersodetug 9 mg/kg per week for 8 weeks, as an add-on to standard of care. Following this 8-week pivotal treatment period, all participants may receive ersodetug in long-term extension, with the discretion to decrease the dosing frequency to every 2 to 4 weeks. The primary endpoint is the number of participants able to achieve at least a 50 percent reduction from baseline in the rate of continuous parenteral dextrose (glucose infusion rate; “GIR”), where 60% of participants would need to reach the endpoint to be considered statistically significant. Additional endpoints include the time to discontinuation of glucose infusion, time to discharge from the hospital, extent of hypoglycemia events and hypoglycemia time in the outpatient setting by SMBG and CMG, respectively, and patient reported quality of life.

Based on historical precedent, supportive data from the sunRIZE study (i.e., safety and drug activity), the recent liberalization of the tumor HI study and differentiation between study endpoints, and the experience that we have reported in the historical Expanded Access Program, we remain cautiously optimistic regarding the probability of success in this indication; however, there can be no assurance that FDA will not consider the sunRIZE study’s failure to meet its endpoints in assessing the approvability of tumor HI. We will continue to engage with FDA on this topic.

22

Expanded Access Program (“EAP”)

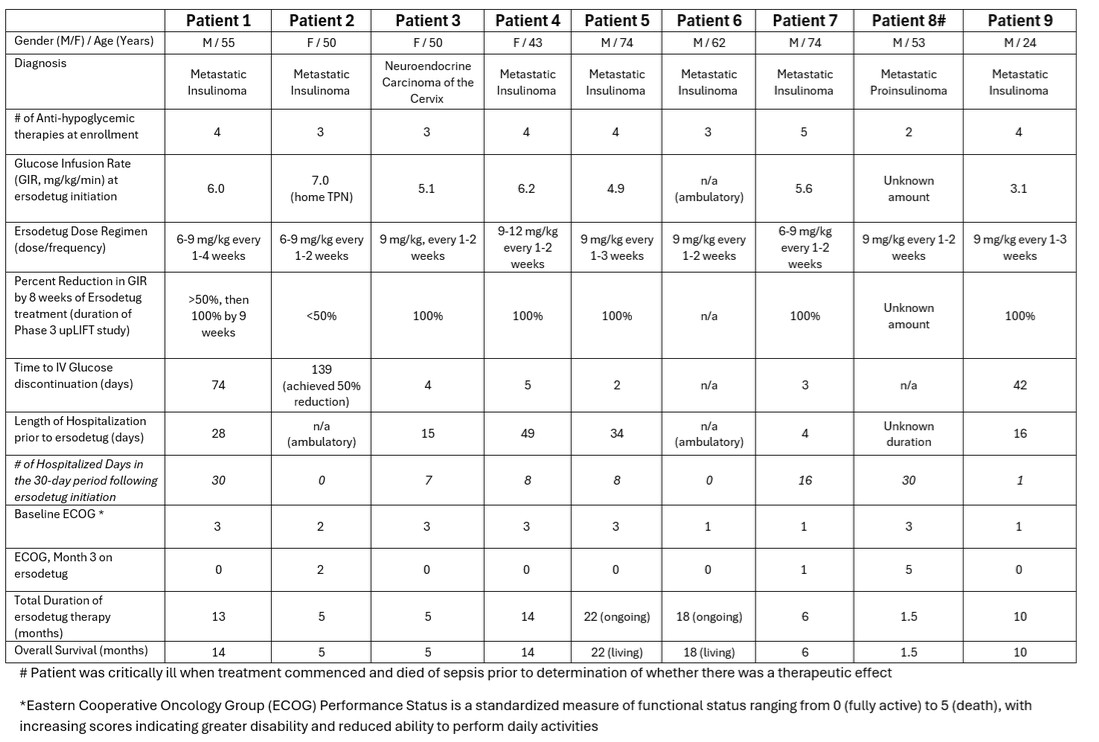

We maintain an EAP for a variety of HI indications for the purpose of making ersodetug available on a compassionate use basis when available therapeutic options have failed, and an individual’s hypoglycemia is unmanageable. In clinical and real-world experience, ersodetug has been shown to counteract excessive insulin action downstream, at the insulin-receptor on target organs. The unique mechanism of action of ersodetug makes the therapy a potential universal treatment for any form of HI. To date, we have received over 30 unsolicited inbound physician inquiries regarding the use of ersodetug in patients with tumor HI caused by metastatic insulinomas or non-islet cell tumors, which has thus far resulted in the request, approval, and initiation of ersodetug in 15 ICT and NICT patients. In the U.S., these requests have all been individually approved by the FDA's Office of Cardiology, Hematology, Endocrinology and Nephrology - Division of Diabetes, Lipid Disorders, and Obesity (“Division”). The tumor HI patients that have received ersodetug have been refractory to SOC therapies for chronic management of hypoglycemia. These patients have generally required continuous intravenous dextrose or nutritional infusion in order to prevent severe hypoglycemia and were typically hospitalized and in life-threatening or hospice-bound condition at the time of request. Further treatment with tumor-directed therapies (e.g., embolization, radiotherapy, chemotherapy) was often deferred as a result of debilitating hypoglycemia.

Generally, dosing for tumor HI patients has been either 6 mg/kg or 9 mg/kg every 1-4 weeks. Nearly universally, ersodetug has led to substantial reductions in GIR (equating to an improvement in hypoglycemia) and has been well tolerated. Within a relatively short period of time after administration of ersodetug, GIR was discontinued or substantially reduced, and hospitalized patients were able to be discharged and receive maintenance ersodetug doses on an outpatient basis, with durable benefit. In several cases, other background medical therapies to prevent hypoglycemia were able to be weaned or stopped, and patients were able to resume tumor-directed therapies for treatment of their underlying cancer. No participants have discontinued the therapy due to lack of response or safety, and the duration of treatment has ranged from several months to almost 2 years in some instances, in this subset of tumor HI patients with significantly advanced and metastatic tumor burden.

Presented in a table filed on January 7, 2026, on Form 8-K with the U.S. Securities and Exchange Commission are cumulative data from the initial 9 participants in the EAP, including patient characteristics, ersodetug dosing, and observed outcomes. This same data cohort was provided to FDA last year in support of our request for Breakthrough Therapy Designation and subsequently informed the discussion with FDA that led to revision of the Phase 3 upLIFT study in tumor HI to a single arm, open-label study. In summary, 75% of the patients receiving IV dextrose/total parenteral nutrition (“TPN”) in the EAP achieved a complete discontinuation of IV dextrose/TPN.

23

This outcome is highly relevant to the ongoing upLIFT study and provides additional evidence of the activity and potential efficacy of ersodetug across various forms of HI. Notably, the GIR assessment in the EAP is the primary endpoint in upLIFT, which measures the number of participants (out of ~16) who achieve at least a 50% reduction in GIR, an objective endpoint in a highly controlled hospital setting. For statistical significance, 60% of open-label participants need to achieve this threshold. Topline results are anticipated in the second half of 2026.

Six patients with congenital HI are currently receiving ersodetug as part of our EAP, which has served to support patients on a compassionate use basis prior to availability of the Phase 3 sunRIZE clinical trial. These participants were refractory to usual therapies and include one infant where off-label or surgical (pancreatectomy) therapies were being considered. The duration of treatment in these participants ranges from more than a year to more than 3 years, with ongoing benefit.

Tumor HI may be caused by two distinct types of solid tumors: neuroendocrine islet cell tumors (“ICTs”) and non-islet cell tumors (“NICTs”), both of which lead to hypoglycemia due to excessive activation of the insulin receptor. Insulinomas are the most common type of functional ICT and mediate hypoglycemia through excessive insulin production. NICTs are generally associated with relatively large, solid tumors such as hepatocellular carcinoma, fibrosarcoma and mesothelioma, and can cause hypoglycemia by producing and secreting insulin-like paraneoplastic substances such as IGF-2 or related variants that bind to and activate the insulin receptor. This form of hypoglycemia can occur in more than 15 different types of tumors.

Current therapies for insulinomas and NICTs can be grouped into two main categories: (a) tumor-directed de-bulking therapies (e.g., surgery, chemotherapy, radiotherapy), which may indirectly and/or eventually lead to decreased levels of circulating insulin and/or insulin-like substances, and therefore control HI and related hypoglycemia; and/or (b) medical therapies such as Diazoxide and

24

glucocorticoids that are used to attempt to treat the hypoglycemia. Tumor-directed therapies do not directly treat hypoglycemia caused by insulinomas or NICTs. In many cases, tumor-directed therapies are administered concurrently with medical therapies for hypoglycemia and in other cases successful treatment of hypoglycemia often enables the initiation and/or continuation of tumor-directed therapies, as indicated. During the period from diagnosis to surgical treatment, or if surgery is contraindicated or refused, medical treatments are often necessary to directly manage the HI and hypoglycemia induced by the tumor. Additionally, chronic medical management of refractory hypoglycemia is often necessary for patients who cannot be cured by surgery, such as those with extensive disease of the pancreas, multi-focal insulinomas, inoperable or unresectable benign or malignant insulinomas, metastatic insulinomas, non-pancreatic insulinomas, or NICT hypoglycemia resulting from a variety of other tumors.

A significant unmet need exists for treatment options with improved efficacy and tolerability, as normalization of glucose levels is crucial to prevent serious signs and symptoms of hypoglycemia, improve patient quality of life and overall function, and even to ensure patients are fit to receive cancer treatment and to reduce mortality. Unfortunately, some patients are unresponsive to the current standard of care medical therapies for tumor HI and experience debilitating hypoglycemia that is otherwise untreatable. Currently available medical therapies are directed at reducing or eliminating insulin production and/or secretion from tumors, which may be challenging when the tumor is differentiated or dysregulated, and therefore not responding to usual control mechanisms for suppressing insulin production. In some cases, commonly utilized somatostatin analog therapies may even worsen hypoglycemia due to suppression of glucagon. Therefore, currently available medical therapies directed at suppressing insulin production may have limited effectiveness in tumor HI.

While we believe the total addressable market may be larger, the immediately addressable incidence market for the combined indications causing tumor HI is estimated to be approximately 3,000 patients in the U.S. alone per year. We believe 60% of these patients are managed at the National Cancer Institutes, which will be our primary focus at launch.

Recent Developments

Reduction in Workforce

Concurrent with the announcement on December 11, 2025 that our Phase 3 sunRIZE clinical trial did not meet its primary endpoint, management approved a reduction in workforce to conserve cash by reducing overall operating expenses based on our changing needs. We reduced our workforce by 29 employees on December 15, 2025. We incurred approximately $1.5 million of one-time severance expenses consisting of $0.9 million of research and development expense and $0.6 million in general and administrative expense in the three and six months ended December 31, 2025. All of the $1.5 million of one-time severance benefits is included as an accrued liability on the condensed consolidated balance sheet as of December 31, 2025 and included in operating expenses on the condensed consolidated statement of operations for the three and six months ended December 31, 2025. The accrued liability of $1.5 million was paid in full to the affected employees in January 2026 and no remaining liability related to the one-time severance benefits remain at the issuance date of the unaudited condensed consolidated financial statements.

Factors Impacting our Results of Operations

We have not generated any meaningful revenues since our inception in March 2010. Over the last several years, we have conducted private placements and public offerings to raise additional capital, adopted a licensing model to pursue development of product candidates, conducted pre-clinical and clinical trials, and conducted other research and development activities on our pipeline of product candidates.

We do not expect to generate revenue from any of our product candidates until we obtain regulatory approval and commercialize our approved product candidates. We expect to incur operating losses for the foreseeable future; therefore, we expect to continue efforts to raise additional capital to maintain our current operating plans over the next several years. We cannot assure you that we will secure such financing or that it will be adequate for the long-term execution of our business strategy. Even if we obtain additional financing, it may be costly and may require us to agree to covenants or other provisions that will favor new investors over our existing shareholders.

Key Components of Consolidated Statements of Operations and Comprehensive Loss

Research and development expenses. Research and development (“R&D”) expenses consist primarily of compensation and benefits for our personnel engaged in R&D activities, clinical trial costs, licensing costs, and consulting and outside services. Our R&D

25

compensation costs include an allocable portion of our cash and share-based compensation, employee benefits, and consulting costs related to personnel engaged in the design and development of product candidates and other scientific research projects. We also allocate a portion of our facilities and overhead costs based on the personnel and other resources devoted to R&D activities.

General and administrative expenses. General and administrative (“G&A”) expenses consist primarily of (i) an allocable portion of our cash and share-based compensation and employee benefits related to personnel engaged in our administrative, finance, accounting, and executive functions, and (ii) an allocable portion of our facilities and overhead costs related to such personnel. G&A expenses also include professional fees for business development, legal, auditing, consulting, investor relations and other costs primarily related to our status as a public company.

Interest and other income. Interest and other income consist primarily of interest income earned on marketable debt securities and temporary cash investments, amortization of investment premiums and accretion of investment discounts, and realized gains on investments in marketable debt securities.

Loss from change in fair value of derivative liabilities. We recognize liabilities for financial instruments that are required to be accounted for as derivatives, as well as embedded derivatives in our debt agreements. Derivative liabilities are adjusted to fair value at the end of each reporting period until the contracts are settled, expire, or otherwise meet the conditions for equity classification. Changes in fair value are reflected as a gain or loss in our unaudited condensed consolidated statements of operations and comprehensive loss.

Critical Accounting Policies and Significant Judgments and Estimates

Overview

The discussion herein is based on our unaudited condensed consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these unaudited condensed consolidated financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the unaudited condensed consolidated financial statements, as well as the reported revenue and expenses during the reporting periods. These items are monitored and analyzed for changes in facts and circumstances, and material changes in these estimates could occur in the future. We base our estimates on historical experience and on various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Changes in estimates are reflected in reported results for the period in which they become known. Actual results may differ from these estimates under different assumptions or conditions.

With respect to our significant accounting policies that are described in Note 1 to our consolidated financial statements included in Item 8 of our 2025 Form 10-K, we believe that the following accounting policies involve a greater degree of judgment and complexity. Accordingly, these are the policies we believe are the most critical to aid in fully understanding and evaluating our consolidated financial condition and results of operations.

Investments in Marketable Debt Securities

We account for investments in marketable debt securities as available-for-sale securities whereby they are recorded in our consolidated balance sheets at fair value. Interest income consists of accrued interest earned based on the coupon rate of the security, plus the impact of accreting discounts and amortizing premiums to maturity using the straight-line method which approximates the interest method. Unrealized gains and losses due to subsequent changes in fair value of the investments are reported in shareholders’ equity as a component of accumulated other comprehensive income (loss). The individual debt securities in our portfolio are subject to credit risk in the event of default by the issuers. We review the components of our portfolio of available-for-sale debt securities, using both quantitative and qualitative factors, to determine if declines in fair value below amortized cost have resulted from a credit-related loss or other factors. To the extent that declines in fair value are due to a deterioration of credit quality of the issuer, we will recognize an allowance for credit losses related to such investments with a corresponding loss in the consolidated statements of operations. Allowances for credit losses may be reversed in subsequent periods if conditions improve and credit-related losses are no longer expected. For a decline in fair value that is solely due to changes in interest rates, impairment is not recognized if we have the ability and intent to hold the investment until maturity. The cost basis of any securities sold prior to maturity will be determined using the specific identification method.

26

Research and Development

R&D costs are expensed as incurred. Intangible assets related to in-licensing costs under license agreements with third parties are charged to expense unless we are able to determine that the licensing rights have an alternative future use.

Clinical Trial Accruals

Clinical trial costs are a component of R&D expenses. We accrue and recognize expenses for clinical trial activities performed by third parties based upon estimates of the percentage of work completed over the life of the individual study in accordance with agreements established with clinical research organizations and clinical trial sites. We determine the estimates through discussions with internal clinical personnel and external service providers as to the progress or stage of completion of trials or services and the agreed-upon fee to be paid for such services. Nonrefundable advance payments for goods and services that will be used or rendered in future R&D activities are deferred and recognized as expense in the period that the related goods are delivered, or services are performed.

Share-Based Compensation Expense

We measure the fair value of services received in exchange for grants of share-based awards based on the fair value of the award as of the grant date. We compute the fair value of the stock option awards with time-based vesting using the Black-Scholes-Merton option-pricing model and recognize the cost of the equity awards over the period that services are provided to earn the award. For stock option awards that contain a graded vesting schedule, and the only condition for vesting is a service condition, compensation cost is recognized on a straight-line basis over the requisite service period as if the award was, in substance, a single award. We recognize the impact of forfeitures in the period that the forfeiture occurs, rather than estimating the number of awards that are not expected to vest in accounting for share-based compensation. For stock options that are voluntarily surrendered, all unrecognized compensation is immediately recognized in the period the options are cancelled. Fair value of RSUs is based on the closing market price on the date of grant whereby compensation cost is recognized ratably over the vesting period of the RSUs.

Results of Operations

Revenue. As a late-stage rare disease company, we did not generate any revenue for the three and six months ended December 31, 2025 and 2024. We are at a late stage of clinical development and do not currently have any commercial products. Our existing product candidates will require extensive additional clinical evaluation, regulatory review, significant marketing efforts and substantial investment before they generate any revenues. We do not expect to be able to generate revenue from any of our product candidates until we obtain regulatory approval and commercialize our approved product candidates.

Three months ended December 31, 2025 and 2024

Research and development expenses. R&D expenses for the three months ended December 31, 2025 and 2024 were as follows (in thousands, except percentages):

December 31, | Increase |

| ||||||||||

| 2025 | | 2024 | | Amount | | Percent |

| ||||

Total R&D expenses | $ | 14,348 | $ | 12,627 | $ | 1,721 |

| 14 | % | |||

The increase in total R&D expenses of $1.7 million for the three months ended December 31, 2025 was attributable to increases of $1.6 million in R&D compensation and benefits, one-time severance benefits of $0.9 million, and an increase of $0.8 million in other R&D costs related to quality and patient affairs costs related to the phase 3 clinical studies. These increases amount to $3.3 million and were partially offset by a decrease of $1.6 million related to ersodetug program costs.