S-3/A: Registration statement for specified transactions by certain issuers

Published on June 28, 2022

As filed with the Securities and Exchange Commission on June 28, 2022

Registration No. 333-265703

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-Effective Amendment No. 1

to

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

REZOLUTE, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Nevada | 27-3440894 | |

| (State or Other Jurisdiction of | (I.R.S. Employer | |

| Incorporation or Organization) | Identification No.) |

201 Redwood Shores Parkway, Suite 315

Redwood City, CA 94065

(650) 206-4507

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Nevan Elam

Chief Executive Officer

201 Redwood Shores Parkway, Suite 315

Redwood City, CA 94065

Telephone: (650) 206-4507

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Anthony W. Epps

Joshua B. Erekson

Dorsey & Whitney LLP

1400 Wewatta St #400

Denver, CO 80202

(303) 629-3400

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, please check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ¨ | Smaller reporting company x |

| Accelerated Filer ¨ | Emerging growth company ¨ |

| Non-accelerated filer x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

Explanatory Note

This Amendment No. 1 on Form S-3/A (this “Amendment”) to the registration statement on Form S-3, of Rezolute, Inc. (the “Company”) initially filed with the Securities and Exchange Commission (the “SEC”) on June 17, 2022 (the “Original Filing”), is being filed to correct an administrative error in the Original Filing. This Amendment is being filed solely to correct Exhibit 23.2 to the Original Filing to reference the correct date of the Report of Independent Registered Public Accounting Firm of Plante & Moran, PLLC as reflected in the Company’s Amendment No. 1 on Form 10-K/A filed on September 27, 2021. No other changes have been made to the Original Filing, including the prospectus that forms a part of the registration statement, other than to reflect such corrected Exhibit 23.2.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 28, 2022

PROSPECTUS

Up to 10,947,371 Shares of Common Stock Issuable upon Conversion of Warrants

This prospectus relates to the resale of 10,947,371 shares of Common Stock, par value $0.001 per share (“Common Stock”) of Rezolute, Inc. (the “Company”) by Federated Hermes Kaufmann Small Cap Fund, Federated Hermes Kaufmann Fund, Federated Hermes Kaufmann Fund II, CDK Associates, L.L.C., Third Street Holdings LLC, Blackstone Annex Master Fund L.P., Vivo Opportunity Fund Holdings, L.P., and Adage Capital Partners LP (the “Selling Stockholders”). The Common Stock is issuable upon the exercise of 10,947,371 Class B Warrants (the “Class B Warrants”) of the Company issued to the Selling Stockholders pursuant to the underwriting agreement dated May 1, 2022 between the Company and Jefferies LLC, as representative of the underwrites listed therein. The Class B Warrants have an exercise price of $0.001 per share. We will receive the proceeds from the exercise of the Class B Warrants. We will not receive any proceeds from the sale of any shares of Common Stock by the Selling Stockholders pursuant to this prospectus.

Our registration of the securities covered by this prospectus does not mean that the Selling Stockholders will offer or sell any of the shares of Common Stock. The Selling Stockholders may sell the shares of Common Stock offered by this prospectus from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or through any other means described in this prospectus under the caption “Plan of Distribution.” The shares of Common Stock may be sold at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices.

Our Common Stock is listed on The Nasdaq Capital Market under the symbol “RZLT”. On June 14, 2022, the last reported sale price for our Common Stock was $3.02 per share. Each prospectus supplement to this prospectus will indicate if the securities offered thereby will be listed on any securities exchange.

Investing in our securities involves risks. You should carefully review the risks and uncertainties described under the heading “Risk Factors” beginning on page 10 of this prospectus, any applicable prospectus supplement or any related free writing prospectus, and in any documents incorporated by reference herein or therein before investing in our securities.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is __, 2022

You should rely only on the information contained in this prospectus or in any related free writing prospectus filed by us with the Securities and Exchange Commission (“SEC”). We and the Selling Stockholders have not authorized anyone to provide you with any information or to make any representation not contained in this prospectus. We and the Selling Stockholders do not take any responsibility for, and can provide no assurance as to the reliability of, any information that others may provide to you. This prospectus is not an offer to sell or an offer to buy securities in any jurisdiction where offers and sales are not permitted. The information in this prospectus is accurate only as of its date, regardless of the time of delivery of this prospectus or any sale of securities. You should also read and consider the information in the documents to which we have referred you under the caption “Where You Can Find More Information” in the prospectus.

Neither we nor the Selling Stockholders have done anything that would permit a public offering of the securities or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside of the United States.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section titled “Where You Can Find Additional Information.”

We urge you to read carefully this prospectus, as supplemented and amended, before deciding whether to invest in any of the Common Stock being offered.

Unless the context indicates otherwise, as used in this prospectus, the terms “Rezolute,” “we,” “us,” “our,” and “our business” refer to Rezolute, Inc. and its subsidiaries.

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, and the documents incorporated by reference herein, contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act and the Private Securities Litigation Reform Act of 1995, and are based on management’s current expectations. These forward-looking statements can be identified by the use of forward-looking terminology, including, but not limited to, “believes,” “may,” “will,” “would,” “should,” “expect,” “anticipate,” “seek,” “see,” “confidence,” “trends,” “intend,” “estimate,” “on track,” “are positioned to,” “on course,” “opportunity,” “continue,” “project,” “guidance,” “target,” “forecast,” “anticipated,” “plan,” “potential” and the negative of these terms or comparable terms.

Various factors could adversely affect our operations, business or financial results in the future and cause our actual results to differ materially from those contained in the forward-looking statements, including those factors discussed under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” or otherwise discussed in our Annual Report on Form 10-K for the fiscal year ended June 30, 2021, our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2022, and in our other filings made from time to time with the SEC after the date of this prospectus.

For additional information about factors that could cause actual results to differ materially from those described in the forward-looking statements, please see the documents that we have filed with the SEC, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other documents and reports filed from time to time with the SEC.

All subsequent forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We are not under any obligation to, and expressly disclaim any obligation to, update or alter any forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise.

3

We are a clinical-stage biopharmaceutical company developing transformative therapies for metabolic diseases related to chronic glucose imbalance.

Our Pipeline

Our lead clinical asset, RZ358, is an antibody therapy in Phase 2b development as a potential treatment for congenital hyperinsulinism (“HI”), an ultra-rare pediatric genetic disorder. In February 2020, we announced the initiation of the RZ358-606 Phase 2b study (“RIZE”) globally at multiple study centers. Prior to COVID-19, we had planned to complete the RIZE study by the middle of calendar year 2021. In March 2020, we paused the RIZE study as a result of the COVID-19 pandemic. As the COVID-19 pandemic began to abate in different regions, we resumed clinical activities including trial site initiations and patient enrollment in July 2021 . We reported positive topline results from the RIZE study in March 2022. These results were presented at the Pediatric Endocrine Society Meeting on May 1st, 2022.

The RIZE study was conducted primarily in a young pediatric population, average ~6.5 years of age and enrolled 23 patients across diverse genetic types. RZ358 resulted in a > 50% improvement in hypoglycemic events across all doses and approximately 75% improvement at the mid (6 mg/kg) and top (9 mg/kg) doses. Time-in-range by continuous glucose monitoring (“CGM”) improved by 8% across all doses and 16% at the top dose. Expected RZ358 concentrations were achieved and clear dose-exposure responses were observed. There were no adverse drug reactions, dose-limiting toxicities, or drug-related serious adverse events. We believe that these positive results from the RIZE study will be Phase-3 enabling and we plan to interact with the regulatory authorities in the second half of calendar year 2022. If we obtain clearance, we will initiate our Phase 3 study in the first half of calendar year 2023.

In addition, during the first half of calendar year 2020 we had positive interactions with the United States Food and Drug Administration (“FDA”) whereby we were granted Rare Pediatric Disease (“RPD”) designation for RZ358, which qualified us to receive a priority review voucher (“PRV”) upon marketing approval of the drug in congenital HI. Such a voucher could be redeemed to receive a priority review of a subsequent marketing application for any drug candidate in any disease indication.

Our second clinical asset, RZ402, is a selective and potent plasma kallikrein inhibitor (“PKI”) being developed as a potential oral therapy for the chronic treatment of diabetic macular edema (“DME”). RZ402 recently completed the Phase 1 development program. In January 2021, we dosed the first subject in the Phase 1a study, and in May 2021 we announced positive topline results whereby single dose oral administration of RZ402 resulted in plasma concentrations that substantially exceeded target pharmacologically active drug levels, demonstrating the potential for once daily dosing. RZ402 was generally safe and well-tolerated at all doses tested, without dose-limiting toxicities. In August 2021, we announced the initiation in the Phase 1b multiple-ascending dose (“MAD”) study and reported positive results in March 2022. The results further validated and supported the potential for once daily oral dosing and showed dose-dependent increases in systemic exposures, with repeat-dosing to steady-state resulting in the highest concentrations of RZ402 explored to date, exceeding 200 ng/mL and 50 ng/mL at peak and 24-hour trough, respectively. The MAD study results showed that RZ402 was generally safe and well-tolerated, including at higher doses than previously tested in the SAD study. There were no serious adverse events, adverse drug reactions or identified risks. We are advancing developmental activities toward a Phase 2a proof-of-concept study, which we plan to initiate during the second half of calendar year 2022.

RZ358

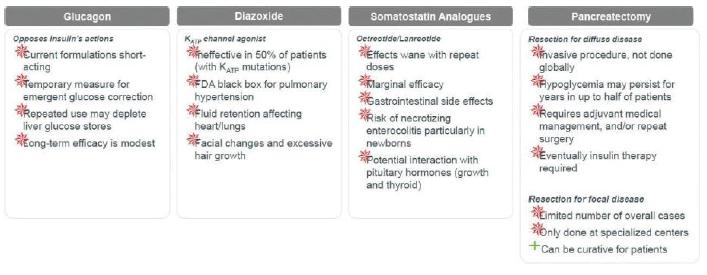

Congenital HI is an ultra-rare pediatric genetic disorder characterized by excessive production of insulin by the pancreas. If untreated, the elevated insulin levels in these patients can induce extreme hypoglycemia (low blood sugar) events, increasing the risk of neurological and developmental complications, including persistent feeding problems, learning disabilities, recurrent seizures, brain damage or even death. There are no FDA approved therapies for congenital HI, and the current standard of care treatments are suboptimal. The current treatments used by physicians includes Glucagon, Diazoxide, Somatostatin Analogues and Pancreatectomy. Each of these treatments has the following drawbacks as set forth in the graphic set below.

4

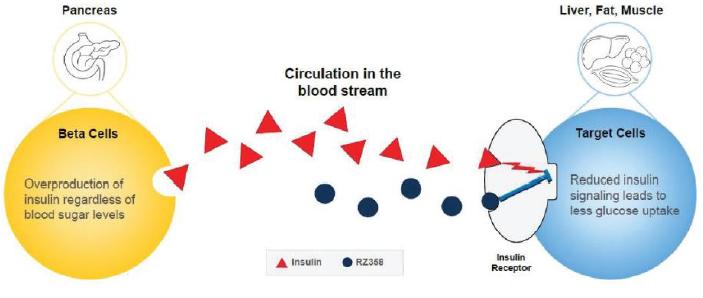

Our lead candidate, RZ358, is an intravenously administered human monoclonal antibody that binds to a unique site (allosteric) on the insulin receptor throughout the body, such as in the liver, fat, and muscle. The antibody modifies insulin’s binding and signaling to maintain glucose levels in a normal range, which counteracts the effects of elevated insulin in the body. Therefore, we believe that RZ358 is ideally suited as a potential therapy for conditions characterized by excessive insulin levels, and it is being developed to treat the hyperinsulinism and low blood sugar characteristic of diseases such as congenital HI. As RZ358 acts downstream from the beta cells, it has the potential to be universally effective at treating congenital HI caused by any of the underlying genetic defects.

A summary of the completed clinical studies is as follows:

Phase 1 pharmaco-kinetic studies of single intravenous doses of RZ358 at 0.1 to 9 mg/kg in healthy volunteers revealed dose-dependent pharmacokinetics with a half-life of 15 days, supporting the biweekly dosing approach. In healthy volunteers, RZ358 prevented hypoglycemia induced by insulin administration, without producing hyperglycemia. This effect showed a pharmacokinetic-pharmacodynamic (dose - response) correlation, with the hypoglycemia-blunting effects of RZ358 lasting for two weeks.

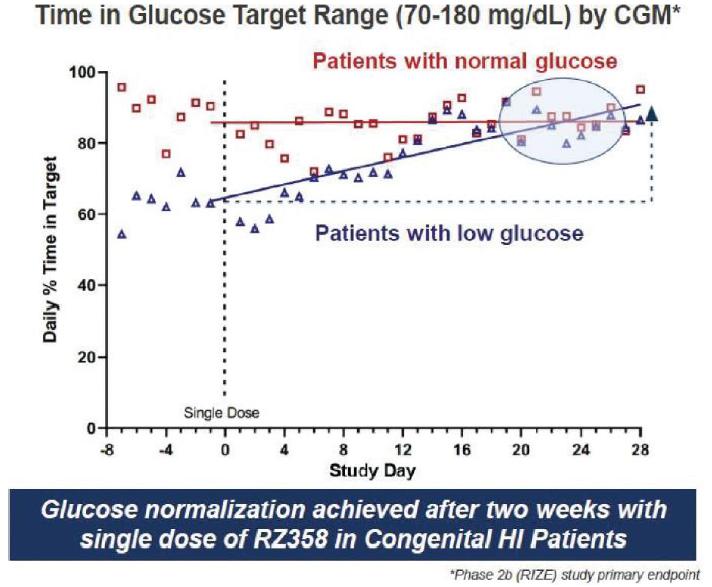

The clinical proof-of-concept of RZ358 in congenital HI was evaluated in Phase 2a studies in a total of 14 patients with congenital HI (12 years or older). The studies investigated the pharmacokinetics (PK), pharmacodynamics (PD), safety and preliminary efficacy of RZ358. RZ358 was well-tolerated in adult and pediatric patients with congenital HI who received single intravenous doses in the phase 2a studies and the PK results from the phase 2a studies were consistent with those in healthy volunteers. There was a durable dose- and disease-dependent normalization of blood sugar in patients with congenital HI who had elevated insulin levels/low blood glucose levels at baseline, with an approximate 50% improvement in hypoglycemia and near normalization of glucose control, which was sustained for more than two weeks after dosing. RZ358 did not increase blood sugar levels in patients with normal blood sugar levels at baseline. The increases in blood sugar, depended on and correlated with disease severity and RZ358 concentrations, making RZ358 uniquely suited as a potential therapy for congenital HI, a disease with known heterogeneity and variability.

5

The Phase 2b (RZ358-606) trial, “RIZE” study, was conducted in a repeat-dose fashion to evaluate the safety, pharmacokinetics, dose-exposure response relationship and to assess the glycemic efficacy across a range of CGM and BGM-based principle glycemic endpoints to inform Phase 3. In the study, eligible patients received RZ358 in open-label fashion in one of 4, sequentially conducted dosing cohorts of up to 8 participants per cohort. RZ358 was administered as a 30 min IV infusion every other week for an 8-week treatment exposure period. The first 3 cohorts were fixed dosing levels of RZ358, the anticipated dosing regimen. The 4th cohort was an optional cohort which was designed to explore whether there were any advantages of a fixed titration approach, should the first 3 cohorts indicate a need to do so.

The RIZE study enrolled 23 patients and was primarily in a young pediatric population, average ~6.5 years of age and in a diverse group of patients across gender and genetics. A key entry criterion was for patients to have substantial hypoglycemia to be eligible for enrollment. We observed that patients enrolled on stable background therapies had clinically-significant, and in many cases, substantial residual hypoglycemia and also, some hyperglycemia (> 180 mg/dL) at baseline.

6

Results from the RIZE study showed that target and expected RZ358 concentrations were achieved and dose-exposure dependent responses were also observed. RZ358 was generally safe and well-tolerated and there were no adverse drug reactions, adverse events leading to study discontinuations, or dose-limiting toxicities. Importantly, RZ358 demonstrated a ~50% improvement in hypoglycemia across all doses and cohorts and a ~75% improvement in hypoglycemia at the 6 mg/kg and 9 mg/kg cohorts. Time in range by CGM improved 8% across all doses, 16% at the top dose, and more significantly (>25%) in patients without baseline hyperglycemia on SOC.

RZ402

DME is a vascular complication of diabetes and a leading cause of blindness in the U.S. and elsewhere. Chronic exposure to high blood sugar levels can lead to inflammation, cell damage, and the breakdown of blood vessel walls. Specifically, in DME, blood vessels behind the back of the eye become porous and permeable leading to the unwanted infiltration of fluid into the macula. This fluid leakage creates distorted vision and if left untreated, could result in blindness.

Currently available treatments for DME involve frequent burdensome anti-vascular growth factor (anti- VEGF) injections into the eye or invasive laser surgery. RZ402 is designed to be a once daily oral therapy for the treatment of DME. Unlike the anti-VEGF therapies, RZ402 targets the Kallikrein - Kinin System in order to address inflammation and vascular leakage. We believe that systemic exposure through oral delivery is critical to target the microvasculature behind the back of the eye. Further, as an oral therapy, RZ402 has the potential to substantially change the therapeutic paradigm for patients suffering with DME by providing a convenient, self-administered treatment option to encourage patients to initiate therapy sooner, adhere to prescribed treatment guidelines, and improve overall outcomes.

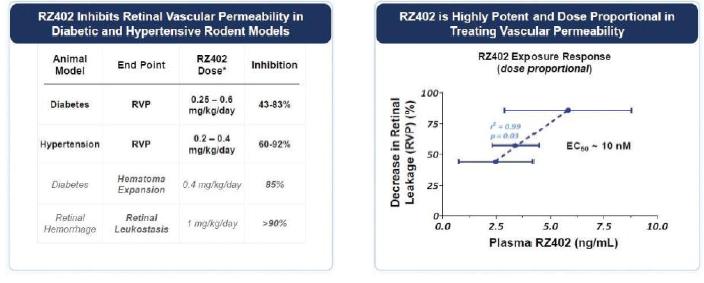

In our modeling of RZ402 low nanomolar potency was exhibited in rodent DME models.

Results from the Phase 1a Single-Ascending Dose (SAD) Study (RZ402-101) were reported in May 2021. RZ402-101 was a first-in-human single-center, randomized, double-blind, placebo-controlled SAD study in healthy adult volunteers. The study objectives were to characterize the safety profile and pharmacokinetics of RZ402 administered as single oral doses. The study enrolled 30 subjects in three planned sequential dose- level cohorts of 25 mg, 100 mg, and 250 mg. Within each ten-subject dose cohort, subjects were randomized 8:2 to receive either RZ402 oral solution or matched placebo. After receiving single doses, participants remained in the clinic for seven days for serial pharmacokinetic and safety assessments, before completing two outpatient follow-up visits at study days 14 and 30. Dose advancement proceeded following blinded reviews of safety and pharmacokinetic data from the preceding cohort(s).

7

Single doses of RZ402 resulted in dose-dependent increases in systemic exposure. Plasma concentrations of RZ402 significantly exceeded the 3.5 ng/mL target concentration that was pharmacologically active in animal models of DME for a 24-hour period after receipt of RZ402. Across the dose and exposure range, there were no serious adverse events, adverse drug reactions, or discontinuations due to adverse events, and no imbalance of adverse events between the treatment and placebo control groups. Similarly, regular laboratory, hemodynamic, cardiac, and ophthalmologic safety examinations were unremarkable.

Results from the Phase 1b Multiple-Ascending Dose (MAD) Study (RZ402-102) were reported in February 2022. RZ402-102 was a single- center, randomized, double-blind, placebo-controlled, in healthy adult volunteers. The objectives of the study were to characterize the repeat-dose safety profile (including maximum tolerated dose) and pharmacokinetics of RZ402 administered as daily oral doses for two weeks. The study was conducted in 40 subjects in sequential ascending dose-level cohorts comprising ten subjects per cohort. Within each dose cohort, subjects were randomized in an 8:2 ratio to receive either RZ402 oral solution or matched placebo. Participants remained in-clinic throughout the two-week dosing period for serial pharmacokinetic and safety assessments, before completing an outpatient follow-up visit at study day 28. Blood biomarkers of target engagement (kallikrein activity) were explored as a systemic surrogate for DME, using a precedent from studies of kallikrein inhibitors in a systemic vascular leakage syndrome (hereditary angioedema). Dose advancement proceeded in staggered fashion every three weeks as appropriate, following blinded reviews of data from the preceding cohort(s).

MAD study showed dose-dependent increases in systemic exposures, with repeat-dosing to steady-state resulting in the highest concentrations of RZ402 explored to date, exceeding 200 ng/mL and 50 ng/mL at peak and 24-hour trough, respectively. Following the precedent established in systemic deliveries of PKIs in vascular diseases such as hereditary angioedema, steady-state plasma kallikrein activity in human plasma was measured on Day 14 as a biomarker of RZ402 target engagement. Daily dosing with RZ402 inhibited plasma kallikrein in a dose and concentration-dependent manner (r=0.74; p < 0.001). Given that the in-vivo EC90 for RZ402 in animal models of DME is ~6 ng/mL, the results at both peak and 24-hour trough substantially exceeded target concentrations based on a combination of in-vitro and in-vivo profiling. RZ402 was generally safe and well-tolerated, including at higher doses than previously tested in the SAD study. There were no serious adverse events, adverse drug reactions or identified risks.

Competition

We face competition from pharmaceutical and biotechnology companies, academic institutions, governmental agencies, and private research organizations in recruiting and retaining highly qualified scientific personnel and consultants and in the development and acquisition of technologies.

There are a handful of companies developing therapies for congenital HI that are potential competitors to RZ358. Crinetics Pharmaceuticals Inc. is one such company.

There are a handful of companies developing oral therapies for DME that are potential competitors to the PKI therapy, KalVista Pharmaceuticals being one such company.

Government Regulation

Regulation by governmental authorities in the U.S. and other countries is a significant factor in the development, manufacture and marketing of pharmaceutical products. All of our potential products will require regulatory approval by governmental agencies prior to commercialization. In particular, pharmaceutical therapies are subject to rigorous preclinical testing and clinical trials and other pre-market approval requirements by the FDA and regulatory authorities in foreign countries. Various federal, state and foreign statutes and regulations also govern or influence the manufacturing, safety, labeling, storage, record keeping and marketing of such products.

We are also subject to various federal, state, and local laws, regulations and recommendations relating to safe working conditions; laboratory and manufacturing practices; the experimental use of animals; and the use and disposal of hazardous or potentially hazardous substances, including radioactive compounds and infectious disease agents, used in connection with our research, development and manufacturing.

8

Employees

As of March 31, 2022, we had 39 full-time employees, of which 28 employees were engaged in research and development, manufacturing, clinical operations and quality activities and 11 employees in general administrative functions. Of the 39 employees, all were located in the United States. We have a number of employees who hold advanced degrees, such as a Ph.D. degrees. None of our employees are covered by a collective bargaining agreement, and we have experienced no work stoppages nor are we aware of any employment circumstances that are likely to disrupt work at any of our facilities. As part of our measures to attract and retain personnel, we provide a number of benefits to our full-time employees, including health insurance, life insurance, retirement plans, paid holiday and vacation time. We believe that we maintain good relations with our employees.

Corporate Information

We were incorporated in Delaware in 2010 and we re-incorporated in Nevada in June 2021. We maintain an executive office located at 201 Redwood Shores Parkway, Suite 315, Redwood City, CA 94065 and our phone number is (650) 206-4507. Our website address is www.rezolutebio.com. The information contained in, or that can be accessed through, our website is not part of, and is not incorporated into this document.

9

Investing in our securities involves a risk of loss. Before investing in our securities, you should carefully consider the risk factors described under “Risk Factors” in our Annual Report on Form 10-K filed with the SEC for the most recent year, in any applicable prospectus supplement and in our filings with the SEC, including our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, together with all of the other information included in this prospectus and any prospectus supplement and the other information incorporated by reference herein and therein. These risks are not the only ones facing us. Additional risks not currently known to us or that we currently deem immaterial also may impair or harm our business and financial results. Statements in or portions of a future document incorporated by reference in this prospectus, including, without limitation, those relating to risk factors, may update and supersede statements in and portions of this prospectus or such incorporated documents. Please also refer to the section entitled “Special Note Regarding Forward-Looking Statements.”

10

All of the shares of Common Stock offered by the Selling Stockholders pursuant to this prospectus will be sold by the Selling Stockholders for its own account. We will not receive any of the proceeds from these sales.

We will receive up to an aggregate of approximately $10,000 from the exercise of the Class B Warrants, assuming the exercise in full of all of the Class B Warrants for cash. We expect to use the net proceeds from the exercise of the Class B Warrants for general corporate purposes.

11

DESCRIPTION OF TRANSACTION WITH THE SELLING STOCKHOLDERS AND WARRANTS

On May 1, 2022, we entered into an underwriting agreement with Jefferies LLC, as representative of the underwriters listed therein, relating to the issuance and sale in an underwritten registered direct offering (the “Registered Direct Offering”) by the Company of an aggregate of (i) 18,026,315 shares (the “Registered Direct Shares”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”), at a public offering price of $3.80 per share, (ii) Class A pre-funded warrants (the “Class A Warrants”) to purchase up to 1,973,684 shares of Common Stock at a public offering price of $3.799 per Class A Warrant, which represents the per share public offering price for the Registered Direct Shares less the $0.001 per share exercise price for each Class A Warrant, and (iii) the Class B Warrants (together with the Class A Warrants, the “Pre-Funded Warrants”) to purchase up to 10,947,371 shares of Common Stock at a public offering price of $3.799 per Class B Warrant, which represents the per share public offering price for the Registered Direct Shares less the $0.001 per share exercise price for each Class B Warrant. The Registered Direct Shares and Pre-Funded Warrants in the Registered Direct Offering were offered pursuant to a registration statement on Form S-3 (File No. 333-251498), which was declared effective by the SEC on June 23, 2021, as supplemented by a prospectus supplement filed with the SEC on May 2, 2022 pursuant to Rule 424(b) under the Securities Act of 1933, as amended (the “Securities Act”).

The Registered Direct Offering closed on May 4, 2022. The net proceeds of the Registered Direct Offering to the Company, after deducting the underwriting discounts and commissions and offering expenses payable by the Company were approximately $110.5 million.

The Class B Warrants issued in the Registered Direct Offering have an exercise price of $0.001 per share, which is subject to adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting the Common Stock and also upon any distributions for no consideration of assets to the Company's stockholders. In the event of certain corporate transactions, the holders of the Class B Warrants will be entitled to receive, upon exercise of the Class B Warrants, the kind and amount of securities, cash or other property that the holders would have received had they exercised the Class B Warrants immediately prior to such transaction. The Class B Warrants do not entitle the holders thereof to any voting rights or any of the other rights or privileges to which holders of Common Stock are entitled.

In connection with the offer of the Class B Warrants, the Company entered into a registration rights agreement (the “Class B Registration Rights Agreement”) with the purchasers of the Class B Warrants. Pursuant to the Class B Registration Rights Agreement, the Company is required to file this resale registration statement (the “Class B Registration Statement”) with the SEC to register for resale the shares issuable upon exercise of the Class B Warrants, within two days of receipt of Stockholder Approval, and to have such Class B Registration Statement declared effective within 60 days after the signing date of the underwriting agreement in the event the Class B Registration Statement is not reviewed by the SEC, or 90 days of the signing date in the event the Class B Registration Statement is reviewed by the SEC. The Company will be obligated to pay certain liquidated damages to the purchaser if the Company fails to file the Class B Registration Statement when required, fails to cause the Class B Registration Statement to be declared effective by the SEC when required, of if the Company fails to maintain the effectiveness of the Class B Registration Statement.

12

General

This prospectus describes the general terms of our capital stock. For a more detailed description of our capital stock, you should read the applicable provisions of the Nevada Revised Statutes, or NRS, and our charter and bylaws.

Common Stock

Our articles of incorporation, as amended, (the “Articles of Incorporation”) provide authority for us to issue up to 100,000,000 shares of Common Stock, par value $0.001 per share. As of June 14, 2022, there were 33,582,831 shares of our Common Stock outstanding. Under Nevada law, stockholders generally are not personally liable for our debts or obligations solely as a result of their status as stockholders. Our outstanding shares of Common Stock are, and any shares offered by this prospectus will be, when issued and paid for, fully paid and nonassessable.

Holders of our Common Stock are entitled to one vote per share on all matters submitted to our stockholders for a vote. There are no cumulative voting rights in the election of directors. Our shares of Common Stock are entitled to receive such dividends as may be declared and paid by our Board of Directors out of funds legally available therefor and to share ratably in the net assets, if any, of Rezolute upon liquidation. Our stockholders have no preemptive rights to purchase any shares of our capital stock. Our Articles of Incorporation provides that the Eighth Judicial District Court of Clark County, Nevada shall be the sole and exclusive forum for (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting a claim for breach of a fiduciary duty owed by any of our directors, officers, employees or agents to us or our stockholders, (iii) any action asserting a claim arising pursuant to any provision of the NRS Chapters 78 or 92A, our Articles of incorporation or our bylaws or (iv) any action asserting a claim governed by the internal affairs doctrine. Notwithstanding this exclusive forum provision, the exclusive forum provision shall not preclude or contract the scope of exclusive federal or concurrent jurisdiction for actions brought under the Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended, or the respective rules and regulations promulgated thereunder.

Preferred Stock

Our Articles of incorporation provides authority for us to issue up to 400,000 shares of preferred stock, par value $0.001 per share. Our Board of Directors is authorized, without further stockholder action, to establish various series of preferred stock from time to time and to determine the rights, preferences and privileges of any unissued series including, among other matters, any dividend rights, dividend rates, conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms, the number of shares constituting any such series, and the description thereof and to issue any such shares. As of June 14, 2022, there are no issued and outstanding shares of preferred stock and our Board of Directors has not designated any series of preferred stock for future issuance.

The rights of the holders of our Common Stock will be subject to, and may be adversely affected by, the rights of holders of any preferred stock that may be issued in the future. Such rights may include voting and conversion rights which could adversely affect the holders of the Common Stock. Satisfaction of any dividend or liquidation preferences of outstanding preferred stock would reduce the amount of funds available, if any, for the payment of dividends or liquidation amounts on Common Stock.

A prospectus supplement, relating to any offered class or series of preferred stock, will specify the following terms of such class or series, as applicable:

| · | the designation of such class or series of our $0.001 par value preferred stock; |

| · | the number of shares of such class or series of preferred stock offered, the liquidation preference per share and the offering price of such class or series of preferred stock; |

| · | the dividend rate(s), period(s), and/or payment date(s) or method(s) of calculation thereof applicable to such class or series of preferred stock; |

13

| · | whether dividends on such class or series of preferred stock are cumulative or not and, if cumulative, the date from which dividends on such class or series of preferred stock shall accumulate; |

| · | the provision for a sinking fund, if any, for such class or series of preferred stock; |

| · | the provision for redemption, if applicable, of such class or series of preferred stock; |

| · | any listing of such class or series of preferred stock on any securities exchange; |

| · | the preemptive rights, if any, of such class or series of preferred stock; |

| · | the terms and conditions, if applicable, upon which shares such class or series of preferred stock will be convertible into shares of our Common Stock or shares of any other class or series of our stock or other securities, including the conversion price (or manner of calculation thereof); |

| · | a discussion of any additional material federal income tax consequences applicable to an investment in such class or series of preferred stock; |

| · | the relative ranking and preferences of such class or series of preferred stock as to dividend rights and rights upon liquidation, dissolution or winding up of the affairs of our Company; |

| · | any limitations on issuance of any class or series of stock ranking senior to or on parity with such class or series of preferred stock as to dividend rights and rights upon liquidation, dissolution or winding up of the affairs of our Company; |

| · | any voting rights of such class or series of preferred stock; and |

| · | any other specific terms, preferences, rights, limitations or restrictions of such class or series of preferred stock. |

Transfer Agent and Registrar

The transfer agent of our Common Stock is Issuer Direct Corporation. Their address is One Glenwood Avenue, Suite 1001, Raleigh, NC 27306.

14

The common stock being offered by the Selling Stockholders are those issuable to the Selling Stockholders upon exercise of the Class B Warrants. For additional information regarding the issuances of those warrants, see “Description of Transaction and Selling Stockholders and Warrants” above. We are registering the shares of common stock in order to permit the Selling Stockholders to offer the shares of common stock underlying the Class B Warrants for resale from time to time. Except for the ownership of the shares of common stock and the warrants, the Selling Stockholders have not had any material relationship with us within the past three years.

The table below lists the Selling Stockholders and other information regarding the beneficial ownership of the shares of common stock by each of the Selling Stockholders. The second column lists the number of shares of common stock beneficially owned by each Selling Stockholder, based on its ownership of the shares of common stock and warrants, as of June 14, 2022, assuming exercise of the warrants held by the Selling Stockholders on that date, without regard to any limitations on exercises.

The third column lists the shares of common stock being offered by this prospectus by Selling Stockholders.

In accordance with the terms of a registration rights agreement with the Selling Stockholders, this prospectus generally covers the resale of the maximum number of shares of common stock issuable upon exercise of the Class B Warrants, determined as if the outstanding warrants were exercised in full as of the trading day immediately preceding the date this registration statement was initially filed with the SEC, each as of the trading day immediately preceding the applicable date of determination and all subject to adjustment as provided in the registration right agreement, without regard to any limitations on the exercise of the warrants. The fourth column assumes the sale of all of the shares offered by the Selling Stockholders pursuant to this prospectus.

Under the terms of the Class B Warrants, a Selling Stockholder may not exercise the warrants to the extent such exercise would cause such Selling Stockholder, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which would exceed 19.99% (or, at the election of the Selling Stockholder, 4.99% or 9.99%) of our then outstanding common stock following such exercise, excluding for purposes of such determination shares of common stock issuable upon exercise of the warrants which have not been exercised. The number of shares in the second and third columns, and the percentage ownership in the fourth column, do not reflect this limitation. The Selling Stockholders may sell all, some or none of their shares in this offering. See "Plan of Distribution."

15

| Name of Selling Stockholder |

Number of Shares of Common Stock Owned Prior to Offering |

Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus |

Number of Shares of Common Stock Owned After Offering |

Percentage of Shares |

||||||||||||

| Federated Hermes Kaufmann Funds (3) | 10,554,327 | 3,421,053 | 7,133,274 | 21.2 | % | |||||||||||

| CDK Associates, L.L.C. (4) | 2,490,306 | 1,039,739 | 1,450,567 | 4.3 | % | |||||||||||

| Third Street Holdings LLC (5) | 158,956 | 66,366 | 92,590 | * | ||||||||||||

| Blackstone Annex Master Fund L.P. (6) | 2,631,579 | 1,093,895 | 1,537,684 | 4.6 | % | |||||||||||

| Vivo Opportunity Fund Holdings, L.P. (7) | 3,289,473 | 2,800,000 | 489,473 | 1.5 | % | |||||||||||

| Adage Capital Partners LP (8) | 3,158,008 | 2,526,318 | 631,690 | 1.9 | % | |||||||||||

| Total | 22,282,649 | 10,947,371 | 11,335,278 | 33.8 | % | |||||||||||

* Represents ownership of less than 1%.

| 1. | Applicable percentage ownership is based on 33,582,831 shares of our common stock outstanding as of June 14, 2022. |

| 2. | Assumes the sale of all shares of common stock offered in this prospectus. |

| 3. | Beneficial ownership consists of (i) 3,215,300 shares of common stock, 1,690,301 shares currently issuable upon exercise of Class B pre-funded warrants, 200,970 shares currently issuable upon exercise of warrants at $19.50 per share, and 56,800 shares currently issuable upon exercise of pre-funded warrants at $0.01 per share held by Federated Hermes Kaufmann Fund, a portfolio of Federated Hermes Equity Funds, (ii) 84,174 shares of common stock, 44,952 shares currently issuable upon exercise of Class B pre-funded warrants, 5,696 shares currently issuable upon exercise of warrants at $19.50 per share, and 1,400 shares currently issuable upon exercise of pre-funded warrants at $0.01 per share held by Federated Hermes Kaufmann Fund II, a portfolio of Federated Hermes Insurance Series, and (iii) 3,310,800 shares of common stock, 1,685,800 shares currently issuable upon exercise of Class B pre-funded warrants, 193,334 shares currently issuable upon exercise of warrants at $19.50 per share, and 64,800 shares currently issuable upon exercise of pre-funded warrants at $0.01 per share held by Federated Hermes Kaufmann Small Cap Fund, a portfolio of Federated Hermes Equity Funds (collectively, the “Federated Hermes Kaufmann Funds”). The Class B pre-funded warrants are subject to a 19.99% ownership cap. The warrants at $19.50 per share are subject to a 14.99% ownership cap. The pre-funded warrants at $0.01 per share are subject to a 19.99% ownership cap. The Federated Hermes Kaufmann Funds are managed by Federated Equity Management Company of Pennsylvania and subadvised by Federated Global Investment Management Corp., which are wholly owned subsidiaries of FII Holdings, Inc., which is a wholly owned subsidiary of Federated Hermes, Inc. (the “Federated Hermes Parent”). All of the Federated Hermes Parent’s outstanding voting stock is held in the Voting Shares Irrevocable Trust (the “Federated Trust”) for which Thomas R. Donahue, Rhodora J. Donahue and J. Christopher Donahue, who are collectively referred to as Trustees, act as trustees. The Federated Hermes Parent’s subsidiaries have the power to direct the vote and disposition of the securities held by the Federated Hermes Kaufmann Funds. Each of the Federated Hermes Parent, its subsidiaries, the Federated Trust, and each of the Trustees expressly disclaim beneficial ownership of such securities. The address of the Federated Hermes Kaufmann Funds is 4000 Ericsson Drive, Warrendale, Pennsylvania 15086-7561. |

16

| 4. | The number of shares includes 2,490,306 shares of common stock beneficially owned by CDK Associates, L.L.C. (“CDK”), including 131,600 shares issuable upon exercise of warrants at $19.50 per share, and 1,039,739 shares of common stock issuable upon exercise of Class B Warrants, without giving effect to any beneficial ownership limitations. CDK is managed by Caxton Corporation which is wholly-owned by Bruce Kovner. Accordingly, Bruce Kovner has voting and dispositive control over the securities held by CDK. In connection with a financing completed on October 9, 2020, CDK and Third Street Holdings, LLC were provided with a single board observer seat. The address of CDK is 731 Alexander Road, Building 2, Suite 500, Princeton, NJ 08540. |

| 5. | The number of shares includes 158,956 shares of common stock beneficially owned by Third Street Holdings, LLC (“Third Street”), including 8,400 shares of common stock issuable upon exercise of warrants at $19.50 per share, and 66,366 shares of common stock issuable upon exercise of Class B Warrants, without giving effect to any beneficial ownership limitation. Third Street is managed by Caxton Alternative Management LP, whereby Peter P. D’Angelo has voting and dispositive control over the securities held by the named selling stockholder. In connection with a financing completed on October 9, 2020, CDK and Third Street were provided with a single board observer seat. The address of Third Street is 731 Alexander Road, Building 2, Suite 500, Princeton, NJ 08540. |

| 6. | The number of shares includes 2,631,579 shares of common stock beneficially owned by Blackstone Annex Master Fund L.P. (the “Annex Fund”), including 1,093,895 shares of common stock issuable upon exercise of Class B Warrants, without giving effect to any beneficial ownership limitation. Blackstone Alternative Asset Management Associates LLC is the general partner of the Annex Fund. Blackstone Holdings II L.P. is the sole member of Blackstone Alternative Asset Management Associates LLC. Blackstone Holdings I/II GP L.L.C. is the general partner of Blackstone Holdings II L.P. Blackstone Inc. is the sole member of Blackstone Holdings I/II GP L.L.C. Blackstone Group Management L.L.C. is the sole holder of the Series II preferred stock of Blackstone Inc. Blackstone Group Management L.L.C. is wholly owned by its senior managing directors and controlled by its founder, Stephen A. Schwarzman. Each of such Blackstone entities and Mr. Schwarzman may be deemed to beneficially own the securities beneficially owned by the Annex Fund directly or indirectly controlled by it or him, but each (other than the Annex Fund to the extent of its direct holdings) disclaims beneficial ownership of such securities. The address of each of the entities listed is c/o Blackstone Inc., 345 Park Avenue, New York, New York 10154. |

| 7. | The number of shares includes 3,289,473 shares of common stock beneficially owned by Vivo Opportunity Fund Holdings, L.P., including 2,800,000 shares of common stock issuable upon exercise of Class B Warrants, without giving effect to any beneficial ownership limitation. Dr. Gaurav Aggarwal is a managing member of Vivo Opportunity, LLC, which is the general partner of Vivo Opportunity Fund Holdings, L.P. Dr. Aggarwal may be deemed to share voting and dispositive power over the securities held by Vivo Opportunity Fund Holdings, L.P. with four other managing members of Vivo Opportunity, LLC. |

| 8. | The number of shares includes 631,690 shares of common stock beneficially owned by Adage Capital Partners, LP (“Adage”), including 2,526,318 shares of common stock issuable upon exercise of Class B Warrants. Adage Capital Partners GP, LLC is the general partner of Adage, and Adage Capital Advisors, LLC is the managing member of Adage Capital Partners GP, LLC; therefore, Adage Capital Partners GP, LLC and Adage Capital Advisors, LLC may be deemed to beneficially own securities owned by Adage. Adage’s address is 200 Clarendon Street, 52nd Floor, Boston, Massachusetts 02116. |

17

Each Selling Stockholder of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby on the principal Trading Market or any other stock exchange, market or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of the following methods when selling securities:

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; | |

| · | block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; | |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; | |

| · | an exchange distribution in accordance with the rules of the applicable exchange; | |

| · | privately negotiated transactions; | |

| · | settlement of short sales; | |

| · | in transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated price per security; | |

| · | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; | |

| · | a combination of any such methods of sale; or | |

| · | any other method permitted pursuant to applicable law. |

The Selling Stockholders may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of our common stock, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with Financial Industry Regulatory Authority, or FINRA, Rule 5110; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the securities or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling Stockholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each Selling Stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities.

18

The Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus effective until the date that all shares of Common Stock covered by this propsectus (i) have been sold, thereunder or pursuant to Rule 144, or (ii) may be sold without volume or manner-of-sale restrictions pursuant to Rule 144 and without the requirement for the Company to be in compliance with the current public information requirement under Rule 144, as determined by the counsel to the Company pursuant to a written opinion letter to such effect, addressed and acceptable to the Transfer Agent and the affected holders The Company shall telephonically request effectiveness of a Registration Statement as of 5:00 p.m. (New York City time) on a Trading Day. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

At the time a particular offer of securities is made, if required, a prospectus supplement will be distributed that will set forth the number of securities being offered and the terms of the offering, including the name of any underwriter, dealer or agent, the purchase price paid by any underwriter, any discount, commission and other item constituting compensation, any discount, commission or concession allowed or reallowed or paid to any dealer, and the proposed selling price to the public.

19

Certain legal matters in connection with the offered securities will be passed upon for us by Dorsey & Whitney LLP, Denver, Colorado. Any underwriters or agents will be represented by their own legal counsel, who will be identified in the applicable prospectus supplement.

Plante & Moran, PLLC has audited our consolidated financial statements included in our Annual Report on Form 10-K for the years ended June 30, 2021 and 2020, which are incorporated by reference in this prospectus and elsewhere in the registration statement. Our financial statements are incorporated by reference in reliance on Plante & Moran, PLLC’s report, given their authority as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet website at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Our reports on Forms 10-K, 10-Q and 8-K, and amendments to those reports, are also available for download, free of charge, as soon as reasonably practicable after these reports are filed with, or furnished to, the SEC, at our website at www.rezolutebio.com. Information contained on or accessible through our website is not a part of this prospectus supplement, and the inclusion of our website address in this prospectus supplement is an inactive textual reference only.

As permitted by SEC rules, this prospectus does not contain all of the information we have included in the registration statement and the accompanying exhibits and schedules we file with the SEC. You may refer to the registration statement, exhibits and schedules for more information about us and the securities. The registration statement, exhibits and schedules are available through the SEC’s website or at its public reference room.

20

In this prospectus, we “incorporate by reference” certain information that we file with the SEC, which means that we can disclose important information to you by referring you to that information. The information we incorporate by reference is an important part of this prospectus, and later information that we file with the SEC will automatically update and supersede this information. The following documents or information have been filed by us with the SEC and are incorporated by reference into this prospectus (other than, in each case, documents or information that are or are deemed to have been furnished rather than filed in accordance with SEC rules, including disclosure furnished under Items 2.02 or 7.01 of Form 8-K):

| ¨ | the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2021, filed on September 15, 2021, as amended by the Company’s Annual Report on Form 10-K/A filed on September 27, 2021; |

| ¨ | the Company’s Quarterly Reports on Form 10-Q for the quarter ended September 30, 2021, filed on November 12, 2021, for the quarter ended December 31, 2021 filed on February 9, 2022, and for the quarter ended March 31, 2022 filed on May 12, 2022; |

| ¨ | the Company’s Current Reports on Form 8-K filed with the SEC on August 4, 2021, October 13, 2021, May 2, 2022, May 4, 2022, and May 16, 2022; and June 17, 2022; |

| ¨ | the description of the Company’s common stock, par value $0.001 per share, as contained in Item 1 of Amendment No. 1 to the Registration Statement on Form 8-A/A filed on June 21, 2021, under the Exchange Act, including any amendment or report filed under the Exchange Act for the purpose of updating such description. |

All documents and reports that we file with the SEC (other than, in each case, documents or information that are or are deemed to have been furnished rather than filed in accordance with SEC rules) under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to in this prospectus as the “Exchange Act,” from the date of this prospectus until the completion of the offering under this prospectus shall be deemed to be incorporated by reference into this prospectus. Unless specifically stated to the contrary, none of the information we disclose under Items 2.02 or 7.01 of any Current Report on Form 8-K that we may from time to time furnish to the SEC will be incorporated by reference into, or otherwise included in, this prospectus. The information contained on or accessible through any websites, including our website, is not and shall not be deemed to be incorporated by reference into this prospectus.

You may request a copy of these filings, other than an exhibit to these filings unless we have specifically included or incorporated that exhibit by reference into the filing, at no cost, by writing or telephoning us at the following address:

Rezolute, Inc.

201 Redwood Shores Parkway, Suite 315

Redwood City, CA 94065

(650) 206-4507

Any statement contained in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus, any prospectus supplement, or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

21

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

ITEM 14. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

The following table sets forth expenses payable by us in connection with the issuance and distribution of the securities being registered pursuant to this registration statement.

| SEC registration fee | $ | 3,044.47 | ||

| Legal fees and expenses | 10,000.00 | |||

| Accounting fees and expenses | 7,000.00 | |||

| Miscellaneous | 3,000.00 | |||

| Total | $ | 23,044.47 |

ITEM 15. INDEMNIFICATION OF DIRECTORS AND OFFICERS

Our officers and directors are indemnified under Nevada law, our amended and restated articles of incorporation, as amended, and our amended and restated bylaws, as amended, against certain liabilities. Our amended and restated articles of incorporation, as amended, require us to indemnify our directors and officers to the fullest extent permitted by the laws of the State of Nevada in effect from time to time.

Pursuant to our amended and restated articles of incorporation, as amended, and our amended and restated bylaws, as amended, each person who was or is made a party or is threatened to be made a party to or is otherwise involved in any action, suit or proceeding, by reason of the fact that he is or was a director or an officer of the Company or is or was serving at the request of the Company as a director, officer, or trustee of another enterprise, (hereinafter an “lndemnitee”), whether the basis of such proceeding is alleged action in an official capacity as a director, officer or trustee or in any other capacity while serving as a director, officer or trustee, shall be indemnified and held harmless by the Company to the fullest extent permitted by the Nevada Revised Statutes, as the same exists or may hereafter be amended, against all expense, liability and loss (including attorneys’ fees, judgments, fines, ERISA excise taxes or penalties and amounts paid in settlement) reasonably incurred or suffered by such Indemnitee in connection therewith; provided, however, that, except as otherwise provided in our amended and restated articles of incorporation, we shall not be required to indemnify or advance expenses to any such Indemnitee in connection with a proceeding initiated by such Indemnitee unless such proceeding was authorized by the Board of Directors of the Company. However, Nevada Revised Statutes 78.138 currently provides that, except as otherwise provided in the Nevada Revised Statutes, a director or officer shall not be individually liable to us or our stockholders or creditors for any damages as a result of any act or failure to act in his or her capacity as a director or officer unless it is proven that (i) the presumption established by Nevada Revised Statutes 78.138(3) has been rebutted, (ii) the director’s or officer’s acts or omissions constituted a breach of his or her fiduciary duties as a director or officer, and (iii) such breach involved intentional misconduct, fraud or a knowing violation of the law.

In addition, an lndemnitee shall also have the right to be paid by the Company the expenses (including attorney’s fees) incurred in defending any such proceeding in advance of its final disposition; provided, however, that, if Nevada Revised Statutes requires, an advancement of expenses incurred by an Indemnitee in his capacity as a director or officer shall be made only upon delivery to the Company of an undertaking, by or on behalf of such Indemnitee, to repay all amounts so advanced if it shall ultimately be determined by final judicial decision from which there is no further right to appeal that such lndemnitee is not entitled to be indemnified for such expenses.

No director shall be personally liable to us or our stockholders for any monetary damages for breaches of fiduciary duty as a director; provided that this provision shall not eliminate or limit the liability of a director, to the extent that such liability is imposed by applicable law, (i) for any breach of the director’s duty of loyalty to the Company or our stockholders; (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; (iii) under Section 174 or successor provisions of the Nevada Revised Statutes; or (iv) for any transaction from which the director derived a personal benefit. No amendment to or repeal of this provision shall apply to or have any effect on the liability or alleged liability of any director for or with respect to any acts or omissions of such director occurring prior to such amendment or repeal. If the Nevada Revised Statutes is amended to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the Company shall be eliminated or limited to the fullest extent permitted by Nevada Revised Statues, as so amended.

II-1

Section 78.7502 of the Nevada Revised Statutes permits a corporation to indemnify, pursuant to that statutory provision, a present or former director, officer, employee or agent of the corporation, or of another entity or enterprise for which such person is or was serving in such capacity at the request of the corporation, who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, except an action by or in the right of the corporation, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred in connection therewith, arising by reason of such person’s service in such capacity if such person (i) is not liable pursuant to Section 78.138 of the Nevada Revised Statutes, or (ii) acted in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to a criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. In the case of actions brought by or in the right of the corporation, however, no indemnification pursuant to Section 78.7502 of the Nevada Revised Statutes may be made for any claim, issue or matter as to which such person has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals therefrom, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court in which the action or suit was brought or other court of competent jurisdiction determines upon application that in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

Any discretionary indemnification pursuant to Section 78.7502 of the Nevada Revised Statutes, unless ordered by a court or advanced to a director or officer by the corporation in accordance with the Nevada Revised Statutes, may be made by a corporation only as authorized in each specific case upon a determination that indemnification of the director, officer, employee or agent is proper in the circumstances. Such determination must be made (1) by the stockholders, (2) by the board of directors by majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding, (3) if a majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding so orders, by independent legal counsel in a written opinion, or (4) if a quorum consisting of directors who were not parties to the action, suit or proceeding cannot be obtained, by independent legal counsel in a written opinion.

Section 78.751 of the Nevada Revised Statutes further provides that indemnification pursuant to Section 78.7502 of the Nevada Revised Statutes does not exclude any other rights to which a person seeking indemnification or advancement of expenses may be entitled under our amended and restated articles of incorporation, as amended, or any bylaw, agreement, vote of stockholders or disinterested directors or otherwise, for either an action in the person’s official capacity or an action in another capacity while holding office, except that indemnification, unless ordered by a court pursuant to Section 78.7502 of the Nevada Revised Statutes or for the advancement of expenses, may not be made to or on behalf of any director or officer finally adjudged by a court of competent jurisdiction, after exhaustion of any appeals, to be liable for intentional misconduct, fraud or a knowing violation of law, and such misconduct, fraud or violation was material to the cause of action.

As permitted by the Nevada Revised Statutes, we have entered into indemnity agreements with each of our directors and executive officers. These agreements, among other things, require us to indemnify each director and officer to the fullest extent permitted by law and advance expenses to each indemnitee in connection with any proceeding in which indemnification is available.

We have an insurance policy covering our officers and directors with respect to certain liabilities, including liabilities arising under the Securities Act of 1933, as amended, or the Securities Act, or otherwise.

II-2

See also the undertakings set out in response to Item 17 herein.

ITEM 16. EXHIBITS

EXHIBITS

| Exhibit No. | Description | Registrant’s Form |

Date Filed |

Exhibit Number |

Filed Herewith |

|||||

| 2.1 | Agreement and Plan of Merger dated as of June 18, 2021, by and between Rezolute, Inc. and Rezolute Nevada Merger Corporation | 8-K | 6/21/21 | 2.1 | ||||||

| 4.1 | Amended and Restated Articles of Incorporation | 8-K | 6/21/21 | 3.3 | ||||||

| 4.2 | Amended and Restated Bylaws | 10-K | 9/15/21 | 3.4 | ||||||

| 4.3 | Form of Financing Warrant | 8-K | 4/3/18 | 4.1 | ||||||

| 4.4 | Form of Common Stock Purchase Warrant | 8-K | 10/13/20 | 4.1 | ||||||

| 4.4 | Form of Class A Warrant | 8-K | 5/1/22 | 4.1 | ||||||

| 4.5 | Form of Class B Warrant | 8-K | 5/1/22 | 4.2 | ||||||

| 4.6 | Form of Class C Warrant | 8-K | 5/1/22 | 4.3 | ||||||

| 5.1 | Opinion of Dorsey & Whitney LLP | S-3 | 6/17/22 | 5.1 | ||||||

| 23.1 | Consent of Dorsey & Whitney LLP (to be included in Exhibit 5.1). | S-3 | 6/17/22 | 5.1 | ||||||

| 23.2 | Consent of Plante & Moran, PLLC | X | ||||||||

| 24 | Power of Attorney (included in the signature page) | X | ||||||||

| 107 | Filing Fee Table filed herewith as EX-FILING FEES | S-3 | 6/17/22 | 107 |

ITEM 17. UNDERTAKINGS

| (a) | The undersigned registrant hereby undertakes: |

| (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; |

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

II-3

| (2) | That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (3) | remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

| (4) | That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

| (i) | Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and |