DEF 14A: Definitive proxy statements

Published on April 5, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| SCHEDULE 14A |

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Section 240.14a-12

Rezolute, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

REZOLUTE, INC.

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

April 24, 2019

4:00 p.m. Mountain Time

To the Stockholders of Rezolute, Inc.:

The Annual Meeting of the stockholders (the “Annual Meeting”) of Rezolute, Inc. (the “Company”), a Delaware corporation, will be held via a virtual meeting on Wednesday, April 24, 2019 at 4:00 p.m. Mountain Time. You may attend the Annual Meeting, vote and submit a question during the Annual Meeting by visiting www.virtualshareholdermeeting.com/RZLT 2019. The Annual Meeting will be held for the following purposes:

| (1) | To elect Nevan Elam, Young-Jin Kim and Young Chul Sung to the Company’s Board of Directors (the “Board” or the “Board of Directors”). |

| (2) | To ratify the appointment of Plante Moran, PLLC (formerly EKS&H LLLP) as the Company’s independent registered public accountants for the fiscal year ending on June 30, 2019 (the “Accountant Proposal”). |

| (3) | To approve an amendment to the Company’s Amended Certificate of Incorporation, as amended (the “Certificate of Incorporation”), to increase the authorized shares of common stock from 200,000,000 to 500,000,000 shares of common stock (the “Share Increase Proposal”). |

| (4) | To approve an amendment to the Certificate of Incorporation to undesignate all of the 15,000,000 shares of the Company’s Series A preferred stock, none of which is currently outstanding, so that it returns to the status of authorized but undesignated and unissued (the “Series A Proposal”). |

| (5) | To authorize an adjournment of the Annual Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of the Share Increase Proposal and/or the Series A Proposal (the “Adjournment Proposal”). |

| (6) | To approve an amendment to the Company’s 2016 Non-Qualified Stock Option Plan, as amended (the “Plan”), to increase the number of shares of the Company’s common stock available for issuance thereunder by 13,000,000 shares of common stock resulting (if such increase is authorized by the stockholders) in the aggregate 28,000,000 shares authorized for issuance under the Plan (the “Plan Amendment Proposal”). |

| (7) | To transact such other business as may properly come before the meeting, or any postponements or adjournments thereof. |

All stockholders of record at the close of business on March 1, 2019 are entitled to notice of and to vote at such meeting. The date on which we anticipate this Proxy Statement and the accompanying proxy will be first sent or given to stockholders will be on or about April 9, 2019.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on Wednesday, April 24, 2019.

Pursuant to the rules of the Securities and Exchange Commission (the “SEC”), the Company has elected to provide access to its proxy materials by sending you a full set of proxy materials, including this Notice, the accompanying Proxy Statement and Proxy Card.

All stockholders are cordially invited to attend the Annual Meeting. If you attend the meeting live, you may withdraw your proxy and vote your shares at the meeting. Stockholders attending the meeting whose shares are held in the name of a broker or other nominee who desire to vote their shares at the meeting should bring with them a letter or account statement from that firm confirming their ownership of shares.

Your vote is extremely important. Whether or not you expect to attend the Annual Meeting, please vote by mail, Internet or telephone as described in the enclosed proxy materials.

| By order of the Board of Directors | |

| /s/ Nevan Elam | |

| Nevan Elam | |

| Chief Executive Officer | |

| Redwood City, California |

| 2 |

TABLE OF CONTENTS

Exhibit A - Form of Certificate of Amendment to Certificate of Incorporation of Rezolute, Inc.

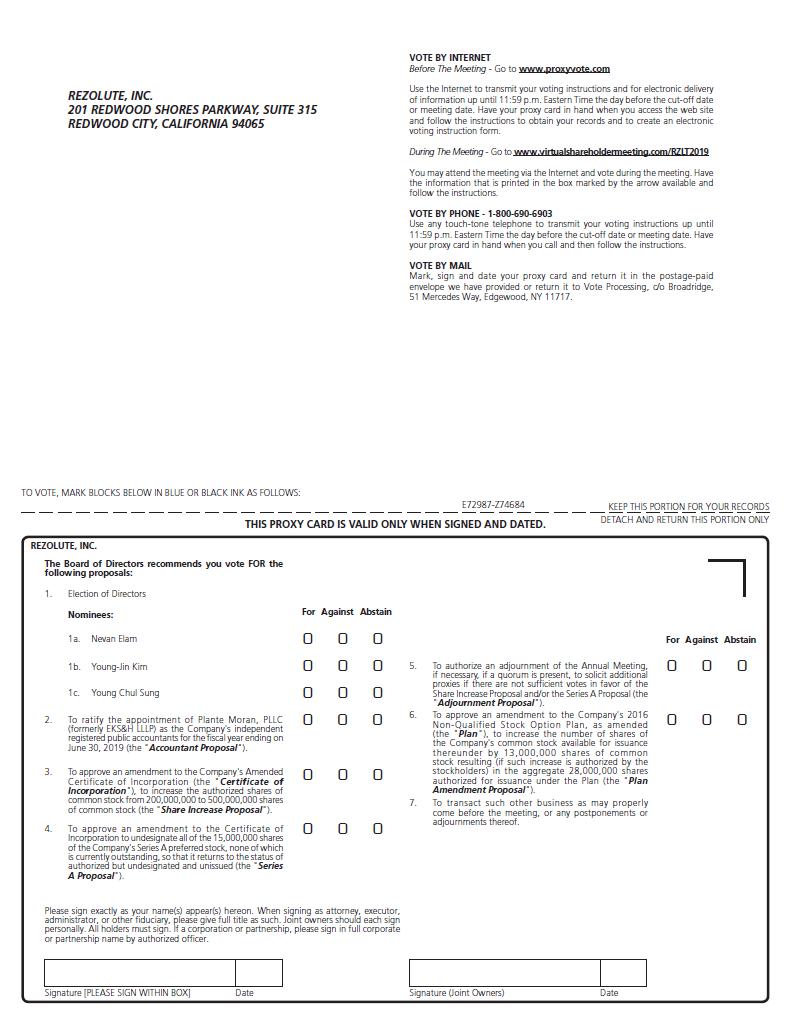

Exhibit B - Form of Proxy Card

Exhibit C - Form of Amendment to 2016 Non-Qualified Stock Option Plan

| 3 |

2018 ANNUAL MEETING OF STOCKHOLDERS

to be held April 24, 2019

PROXY STATEMENT

GENERAL INFORMATION

The enclosed proxy is solicited by the Board of Directors of Rezolute, Inc., a Delaware corporation, which we refer to as “the Company,” “Rezolute,” “we,” “us,” or “our,” for use at the 2018 Annual Meeting of Stockholders of the Company (the “Annual Meeting”), to be held on, April 24, 2019 at 4:00 p.m. Mountain Time, via a virtual meeting, and at any postponement or adjournment thereof. You may attend the Annual Meeting, vote and submit a question during the Annual Meeting by visiting www.virtualshareholdermeeting.com/RZLT 2019. If you plan to attend the Annual Meeting, please follow the voting and registration instructions as outlined in this Proxy Statement.

All stockholders of record at the close of business on March 1, 2019 are entitled to notice of and to vote at such meeting. The date on which we anticipate that this Proxy Statement and the accompanying proxy will be first sent or given to stockholders will be on or about April 9, 2019.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

The following questions and answers are intended to briefly address potential questions that our stockholders may have regarding this Proxy Statement and the Annual Meeting. They are also intended to provide our stockholders with certain information that is required to be provided under the rules and regulations of the SEC. These questions and answers may not address all of the questions that are important to you as a stockholder. If you have additional questions about the Proxy Statement or the Annual Meeting, please see “Whom should I contact with other questions?” below.

What is the purpose of the Annual Meeting?

At the Annual Meeting, our stockholders will be asked to consider and vote upon the matters described in this Proxy Statement and in the accompanying Notice, and any other matters that properly come before the Annual Meeting.

What is a proxy statement and what is a proxy?

A proxy statement is a document that we are required by law to give you when we ask you to sign a proxy designating individuals to vote on your behalf. A proxy is your legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card.

Why did I receive these proxy materials?

We are providing these proxy materials in connection with the solicitation by the Board of Directors of the Company of proxies to be voted at the Annual Meeting, and at any postponement or adjournment thereof. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. You are invited to attend the Annual Meeting virtually to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting virtually to vote your shares. Instead, you may vote your shares using one of the other voting methods described in this Proxy Statement. Whether or not you expect to attend the Annual Meeting, please submit your completed proxy card as soon as possible in order to ensure your representation at the Annual Meeting and to minimize the cost to the Company of proxy solicitation.

How may I attend the meeting?

The Annual Meeting will be conducted completely as a virtual meeting via the Internet. Stockholders may attend the meeting virtually, vote their shares electronically during the meeting via the live audiocast, and may submit questions in advance of the meeting, by visiting www.proxyvote.com. We believe that holding our meeting completely online will enable greater participation and improved communication. Stockholders will need the digit control number included on their proxy card to enter the meeting and vote their shares at the meeting.

| 4 |

Can I vote my shares at the meeting?

If you are a stockholder of record of our common stock or our Series AA Preferred Stock, you may vote your shares at the meeting by going to www.proxyvote.com and using your digit control number included on your proxy card. Even if you currently plan to attend the meeting, we recommend that you also submit your proxy as described above so that your vote will be counted if you later decide not to attend the meeting. If you are a street name holder, you must vote your shares in the manner prescribed by your broker, bank, trust or other nominee.

How can I submit questions for the Annual Meeting?

You may submit questions prior to the meeting at www.proxyvote.com. Questions pertinent to matters to be acted upon at the Annual Meeting as well as appropriate questions regarding the business and operations of the company will be answered during the Annual Meeting, subject to time constraints. In the interests of time and efficiency, we reserve the right to group questions of a similar nature together to facilitate the question and answer portion of the meeting. We may not be able to answer all questions submitted in the allotted time.

How do I give a proxy to vote my shares?

If you are a stockholder of record of our common stock or our Series AA Preferred Stock as of the Record Date, you can give a proxy to be voted at the Annual Meeting in any of the following ways:

| · | over the telephone by calling a toll-free number; |

| · | electronically, via the Internet; or |

| · | by completing, signing and mailing the enclosed proxy card. |

The telephone and Internet procedures have been set up for your convenience. We encourage you to save corporate expense by submitting your vote by telephone or Internet. The procedures have been designed to authenticate your identity, to allow you to give voting instructions, and to confirm that those instructions have been recorded properly. If you are a stockholder of record and you would like to submit your proxy by telephone or Internet, please refer to the specific instructions provided on the enclosed proxy card. If you wish to submit your proxy by mail, please return your signed proxy card to our transfer agent before the Annual Meeting.

What am I being asked to vote upon at the Annual Meeting?

At the Annual Meeting, you will be asked to:

| · | Vote on the election of Nevan Elam, Young-Jin Kim and Young Chul Sung to the Company’s Board of Directors (the “Director Proposal”); |

| · | Ratify the appointment of Plante Moran, PLLC (formerly EKS&H LLLP) as the Company’s independent registered public accountants for the fiscal year ending June 30, 2019 (the “Accountant Proposal”); |

| · | Approve an amendment to the Company’s Amended Certificate of Incorporation (“Certificate of Incorporation”), as amended, to increase the authorized shares of common stock from 200,000,000 to 500,000,000 shares of common stock (the “Share Increase Proposal”); |

| · | Approve an amendment to the Certificate of Incorporation to undesignate all of the 15,000,000 shares of the Company’s Series A preferred stock, none of which is currently outstanding, so that it returns to the status of authorized but undesignated and unissued (the “Series A Proposal”); |

| 5 |

| · | Approve an adjournment of the Annual Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of the Share Increase Proposal and/or the Series A Proposal (the “Adjournment Proposal”); |

| · | Approve an amendment to the Company’s 2016 Non-Qualified Stock Option Plan (the “Plan”) to increase the number of shares of the Company’s common stock available for issuance thereunder by 13,000,000 shares of common stock resulting (if such increase is authorized by the stockholders) in the aggregate 28,000,000 shares authorized for issuance under the Plan (the “Plan Amendment Proposal”); and |

| · | Act upon such other matters as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

Does the Board of Directors recommend voting in favor of the proposals?

Yes. The Board of Directors unanimously recommends that you vote your shares

| · | “FOR” the Director Proposal; |

| · | “FOR” the Accountant Proposal; |

| · | “FOR” the Share Increase Proposal; |

| · | “FOR” the Series A Proposal; |

| · | “FOR” the Plan Amendment Proposal; |

| · | “FOR” the Adjournment Proposal. |

Who can vote at the Annual Meeting?

Only our “stockholders of record” at the close of business on March 1, 2019 (the “Record Date”) will be entitled to vote at the Annual Meeting. On the Record Date, there were 61,866,319 shares of our common stock outstanding and entitled to vote. There were also 3,267,519 shares of our Series AA Preferred Stock outstanding on the Record Date and entitled to vote at the Annual Meeting on an as-converted basis. The common stock and Series AA Preferred Stock vote together as a single class.

Beneficial Owners

If, on the Record Date, your shares were held in an account at a bank, broker, dealer, or other nominee, then you are the “beneficial owner” of shares held in “street name” and this Proxy Statement is being forwarded to you by that nominee. The nominee holding your account is considered the “stockholder of record” for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your nominee on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the “stockholder of record,” you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your nominee. Please contact your nominee directly for additional information.

Brokers, banks or other nominees holding shares of record for their respective customers generally are not entitled to vote on the election of directors unless they receive voting instructions from their customers. As used herein, “uninstructed shares” means shares held by a nominee who has not received instructions from its customers on a particular matter. As used herein, “broker non-vote” means the votes that could have been cast on the matter by nominees with respect to uninstructed shares if the nominees had received instructions. The effect of proxies marked “withheld” as to any director nominee or “abstain” as to any other proposal, and the effect of broker non-votes on each of the proposals, is discussed in each proposal below.

How many votes do I get?

Each share of common stock entitles the holder thereof to one vote on each matter to be voted upon. Each share of Series AA Preferred Stock entitles the holder thereof to 45.5454 votes per share of Series AA Preferred Stock, which represents the number of shares of common stock issuable upon the conversion of each share of Series AA Preferred Stock. Dissenters’ rights are not applicable to any of the matters being voted upon.

| 6 |

What are the voting requirements to approve the proposals?

Each proxy that is properly completed, signed and returned to the Company prior to the Annual Meeting, and not revoked, will be voted in accordance with the instructions given in such proxy. Please see each proposal below for voting requirements applicable to each proposal.

What happens if I do not vote?

Please see each proposal below for the effect of not voting as well as the effect of withholdings, abstentions and broker non-votes.

What is the quorum requirement for the Annual Meeting?

The presence in person via the Internet or by proxy of the holders of shares of stock having a majority of the votes which could be cast by the holders of all outstanding shares of stock entitled to vote at the meeting shall be necessary and sufficient to constitute a quorum.

For purposes of establishing quorum, stockholders of record who are present at the Annual Meeting in person via the Internet or by proxy and who abstain or withhold their vote, including brokers, dealers or other nominees holding shares of their respective customers of record who cause abstentions to be recorded at the Annual Meeting, are considered stockholders who are present and entitled to vote and count toward the quorum. If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained.

Could other matters be decided at the Annual Meeting?

As of the date this Proxy Statement went to press, the Board of Directors did not know of any matters which will be brought before the Annual Meeting other than those specifically set forth in the Notice hereof. However, if any other matter properly comes before the Annual Meeting, it is intended that the proxies, or their substitutes, will vote on such matters in accordance with the instructions given in such proxy.

How can stockholders nominate a candidate for election as a director?

Any stockholders desiring to submit a recommendation for consideration by the Board of a candidate that the stockholder believes is qualified to be a Board nominee at any upcoming stockholders meeting may do so by submitting that recommendation in writing to the Board not later than 120 days prior to the first anniversary of the date on which the proxy materials for the prior year’s Annual Meeting were first sent to stockholders. However, if the date of the upcoming Annual Meeting has been changed by more than 30 days from the date of the prior year’s meeting, the recommendation must be received within a reasonable time before the Company begins to print and mail its proxy materials for the upcoming Annual Meeting. In addition, the recommendation should be accompanied by the following information:

| · | the name and address of the nominating stockholder and of the person or persons being recommended for consideration as a candidate for Board membership; |

| · | the number of shares of voting stock of the Company that are owned by the nominating stockholder, his or her recommended candidate and any other stockholders known by the nominating stockholder to be supporting the candidate’s nomination; |

| · | a description of any arrangements or understandings, that relate to the election of directors of the Company, between the nominating stockholder, or any person that (directly or indirectly through one or more intermediaries) controls, or is controlled by, or is under common control with, such stockholder and any other person or persons (naming such other person or persons); |

| · | such other information regarding each such recommended candidate as would be required to be included in a Proxy Statement filed pursuant to the proxy rules of the SEC; and |

| · | the written consent of each such recommended candidate to be named as a nominee and, if nominated and elected, to serve as a director. |

| 7 |

Can I change my vote after submitting my proxy?

Yes. You may revoke your proxy and change your vote at any time before your proxy is voted at the Annual Meeting. If you are a stockholder of record, you may revoke your proxy and change your vote by submitting a later-dated proxy by telephone, internet or mail, or by voting at the meeting.

To request an additional proxy card, or if you have any questions about the Annual Meeting or how to vote or revoke your proxy, you should contact:

Broadridge Financial Solutions, Inc.

51 Mercedes Way, Edgewood, New York 11717

Call toll free: (855) 325-6676

Where can I find voting results of the Annual Meeting?

We will announce preliminary voting results with respect to each proposal at the Annual Meeting. In accordance with SEC rules, final voting results will be published in a Current Report on Form 8-K within four business days following the Annual Meeting, unless final results are not known at that time in which case preliminary voting results will be published within four business days of the Annual Meeting and final voting results will be published once they are known by the Company.

What is the deadline to submit stockholder proposals for the 2019 Annual Meeting?

Proposals of stockholders intended to be presented at the 2019 Annual Meeting of Stockholders must be received at the Company’s principal office no later than 120 days prior to the first anniversary of the date on which the proxy materials for the prior year’s Annual Meeting were first sent to stockholders for inclusion in the Proxy Statement and form of proxy relating to that meeting. However, if the date of the 2019 Annual Meeting of Stockholders has been changed by more than 30 days from the date of the prior year’s meeting, then the deadline is a reasonable time before the Company begins to print and send its proxy materials. Matters pertaining to such proposals, including the number and length thereof, eligibility of persons entitled to have such proposals included and other aspects are regulated by the Securities Exchange Act of 1934 and the rules and regulations of the SEC.

If date of the 2018 Annual Meeting of Stockholders is changed by more than 30 days from the one-year anniversary of this year’s Annual Meeting of Stockholders as expected, pursuant to the rules and regulations of the SEC, the Company will publicly announce such revised Annual Meeting date and applicable deadlines for stockholder proposals for action or nomination once finally determined.

Where can I find information about the Annual Report of the Company?

The Company will furnish without charge to each person whose proxy is being solicited, upon request of any such person, a copy of the Annual Report of the Company on Form 10-K, as amended for the fiscal year ended June 30, 2018, as such was filed with the SEC, including financial statements and associated schedules. Such report was filed with the SEC on October 15, 2018, as amended on December 31, 2018 and is available on the SEC’s website at www.sec.gov, as well as the Company’s website at www.rezolutebio.com.

PROPOSAL 1

ELECTION OF DIRECTORS

On January 7, 2019, we entered into a Purchase Agreement for Shares of Series AA Preferred Stock (the “Purchase Agreement”) with Handok, Inc. and Genexine, Inc. (each a “Purchaser” and collectively, the “Purchasers”) whereby subject to certain closing conditions, the Purchasers agreed to purchase shares of Series AA Preferred Stock aggregate gross proceeds to the Company of $25,000,000 (the “Series AA Financing”). As a condition to closing the Series AA Financing, our directors prior to the closing of the Series AA Financing (Nevan Elam, Hoyoung Huh, Gil Labrucherie, Dave Welch, Tae Hoon Kim and Samir Patel) other than Mr. Elam, resigned and our board prior to the closing of the Series AA Financing appointed Mr. Kim and Dr. Sung to the Board.

| 8 |

We currently have three directors serving on the Board of Directors. Each of our current directors has been nominated by the Board for re-election at the Annual Meeting. If elected, each nominee has consented to serve as a director and to hold office until the next annual stockholders’ meeting, until his successor is elected and shall have qualified, or until his earlier death, resignation, removal or disqualification.

The following paragraphs provide information about each nominee as of the date of this Proxy Statement. The information presented includes information that each nominee has given us about his age, all positions he holds with the Company, his principal occupation and business experience for the past five years, and the names of other publicly held companies of which he currently serves as a director or has served as a director during the past five years.

When considering whether directors and nominees have the experience, qualifications, attributes and skills to enable the Board of Directors to satisfy its oversight responsibilities effectively in light of the our business and structure, the Board of Directors focuses primarily on the industry and transactional experience, and other background, in addition to any unique skills or attributes associated with a director.

None of the directors presently serving on the Board of Directors and the nominees are “independent” as that term is defined in Section 5205(a) of Nasdaq listing rules. The Company is not, however, subject to the Nasdaq listing rules because its common stock is not listed for trading on any Nasdaq market.

|

Name and Age of Director and/or Nominee |

Principal Occupation, Business Experience For the Past Five Years and Directorships of Public Companies |

Director Since |

||

| Nevan Elam, 52 | Mr. Elam serves as our Chief Executive Officer. Mr. Elam was as a Managing Director of Konus Advisory Group, Inc. from January 2012 to September 2014. Prior to his service with Rezolute and Konus Advisory Group, Inc., Mr. Elam served as Chief Executive Officer and President of AeroSurgical Ltd., a medical device company operating out of Ireland. Prior to his service with AeroSurgical Ltd., Mr. Elam was a Senior Vice President of Nektar Therapeutics for four years. Earlier in his career, Mr. Elam was a senior executive and co-founder of E2open, Inc. and was a corporate partner in the law firm of Wilson Sonsini Goodrich & Rosati. He serves as Director of Savara, Inc. and AeroSurgical Ltd. Mr. Elam received his Juris Doctorate from Harvard Law School and a Bachelors of Arts from Howard University. We believe that Mr. Elam’s experience advising pharmaceutical companies of their unique legal and regulatory obligations qualifies him to serve on the Board. | 2013 | ||

| Young Chul Sung, Ph.D., 62 | Dr. Sung serves as a member of our Board. Dr. Sung is the founder and former CEO of Genexine Inc, a KOSDAQ listed biotech company developing innovative drugs in cancer and orphan diseases. Dr. Sung currently serves as a professor at POSTECH Department of Life Sciences and founder of POSTECH- Catholic Bio Medical Institute. Dr. Sung is an expert immunologist and has published over one hundred scientific articles. He has served on editorial boards of many biological organizations and has earned numerous awards including the most recently the 49th Science Day Presidential Commendation for Science and Technology Promotion Division from KIST as remarks of Antibody fusion (hyFc) technology and gene therapy vaccine technology. Dr. Sung currently serves on the Board of the Korean Society for Molecular and Cellular Biology and The Korean Society of Medical Biochemistry and Molecular Biology both since 2003. He is also a member of the Korean Society of Virology. Dr. Sung was a former president of the Korean Association of Immunobiologists (KAI) from 2005 to 2007. We believe Dr. Sung’s scientific background qualifies him to serve on the Board. | 2019 |

| 9 |

| Young-Jin Kim, 62 | Mr. Kim serves as the Chairman of our Board. Mr. Kim is Chairman & CEO of Handok Inc. (“Handok”), one of the leading pharmaceutical companies in the Republic of Korea. Mr. Kim joined Handok in 1984 and spent two years between 1984 and 1986 working at Hoechst AG in Frankfurt, Germany. Between 1991 and 2005, he served as CEO of Roussel Korea, Hoechst Marion Roussel Korea and Aventis Pharma Korea and also appointed as the Country Manager of Hoechst AG and Aventis in Korea between 1996 and 2005. In 1996, he was appointed as CEO of Handok. Mr. Kim has been serving as President of Handok Jeseok Foundation since 2014. He also has been serving as President of KDG (Korean-German Society) since 2010 and Vice President of Medium Industries Committee of KCCI (The Korea Chamber of Commerce & Industry) since 2009. Mr. Kim received an MBA at the Kelley School of Business at Indiana University in 1984 and received the award of Distinguished Alumni Fellows from Indiana University. Mr. Kim completed Advanced Management Program at the Harvard Business School in 1996. We believe Mr. Kim’s experience working with pharmaceutical companies qualifies him to serve on the Board. We believe Mr. Kim’s experience working with pharmaceutical companies qualifies him to serve on the Board. | 2019 |

Vote Required

Directors are elected by a plurality of the voting power of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. The nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the three nominees named above. If you do not vote for a particular nominee, or if you withhold authority for one or all nominees, your vote will not count either “for” or “against” the nominee, although it will be counted for purposes of determining whether there is a quorum. Broker non-votes will have the same effect as votes “AGAINST” this proposal. If any director-nominee should withdraw or otherwise become unavailable for reasons not presently known, the proxies which would have otherwise been voted for that director nominee may be voted for a substitute director nominee selected by our Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF EACH OF THE ABOVE-IDENTIFIED DIRECTOR-NOMINEES.

| 10 |

PROPOSAL 2

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

Our Board of Directors has appointed the firm Plante & Moran, PLLC (“Plante Moran”), Denver, Colorado, to serve as our independent registered public accounting firm for the fiscal year ending June 30, 2019. While our Board is solely responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm, our Board is requesting that the stockholders ratify this appointment. If the stockholders ratify this appointment, our Board, in its discretion, may appoint a different independent registered public accounting firm at any time during the year if it believes that doing so would be in the best interests of our stockholders. If the stockholders do not ratify this appointment, our Board may reconsider, but might not change, its appointment.

Effective October 1, 2018, EKS&H LLLP (“EKS&H”), the independent registered public accounting firm for the Company, combined with Plante Moran. As a result of this transaction, on October 16, 2018, the Company engaged Plante Moran as the new independent registered public accounting firm for the Company.

During the two most recent fiscal years ended June 30, 2018 and 2017, and through the subsequent interim period preceding the appointment of Plante Moran, there were no disagreements between the Company and EKS&H on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of EKS&H, would have caused them to make reference thereto in their reports on the Company’s financial statements for such years.

During the two most recent fiscal years ended June 30, 2018 and 2017 and through the subsequent interim period preceding the appointment of Plante Moran, there were no reportable events within the meaning set forth in Item 304(a)(1)(v) of Regulation S-K.

The audit reports of EKS&H on the Company’s financial statements for the years ended June 30, 2018 and 2017 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles, except the audit report of EKS&H on the Company’s financial statements for the year ended June 30, 2018 contained an explanatory paragraph indicating that there was substantial doubt about the ability of the Company to continue as a going concern.

During the two most recent fiscal years ended June 30, 2018 and 2017 and through the subsequent interim period preceding Plante Moran’s engagement, the Company did not consult with Plante Moran on either, (1) the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that may be rendered on the Company’s financial statements, and Plante Moran did not provide either a written report or oral advice to the Company that Plante Moran concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (2) any matter that was either the subject of a disagreement, as defined in Item 304(a)(1)(iv) of Regulation S-K, or a reportable event, as defined in Item 304(a)(1)(v) of Regulation S-K.

The Company has provided EKS&H a copy of the disclosures in this proxy statement, which were filed on October 16, 2018, in the Company’s Current Report on Form 8-K and requested that EKS&H furnish it with a letter addressed to the Securities and Exchange Commission stating whether or not it agrees with the Company’s statements. A copy of the original letter was filed as an exhibit to our Current Report on Form 8-K on October 16, 2018.

Representatives of Plante Moran are expected to be present virtually at the Annual Meeting of stockholders.

The aggregate fees for professional services rendered by our previous independent registered public accounting firm, EKS&H, prior to its merger into Plante Moran, for the respective periods, all of which were approved by our full Board of Directors for fiscal 2017 and by the Audit Committee for fiscal 2018. The full Board of Directors will oversee the auditors for fiscal 2019 until the sufficient independent board members are appointed to the Board.

Principal Accountant Fees and Services

Audit Fees

Fees charged by EKS&H LLLP for the audit of the Company’s annual financial statements and the review of the financial statements included in the Company’s quarterly reports on Form 10-Q for fiscal years ending June 30, 2018 and 2017 were $143,086 and $122,271, respectively.

Audit-Related Fees

Fees charged by EKS&H LLLP for audit related services for the fiscal years ending June 30, 2018 and 2017 were $12,500 and $12,846, respectively.

Tax Fees

The aggregate fees billed by BKD for professional services rendered to us in connection with the completion of the tax returns for the years ended June 30, 2018 and 2017 were $9,932 and $9,275, respectively.

| 11 |

All Other Fees

None

Pre-Approval Policy

Our Audit Committee or the entire Board of Directors endeavors to approve in advance all services provided by our independent registered public accounting firm. All engagements of our independent registered public accounting firm in years ended 2018 and 2017 were approved by the Board of Directors.

Vote Required

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the appointment of Plante Moran as the Company’s independent registered public accounting firm for fiscal 2019. If the stockholders do not ratify the appointment of Plante Moran, the Audit Committee may reconsider its selection, but is not required to do so. Notwithstanding the proposed ratification of the appointment of Plante Moran by the stockholders, the Audit Committee, in its discretion, may direct the appointment of new independent auditors at any time during the year without notice to, or the consent of, the stockholders, if the Audit Committee determines that such a change would be in the best interests of the Company and its stockholders. Brokers have discretion to vote uninstructed shares with respect to this proposal. Accordingly, broker non-votes will not occur with respect to this proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE RATIFICATION OF PLANTE MORAN AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2019.

PROPOSAL 3

SHARE INCREASE PROPOSAL

Introduction

In connection with the Series AA Financing, we agreed to amend the Certificate of Incorporation to increase our authorized shares of common stock to permit the conversion of the Series AA Preferred Stock no less than sixty (60) calendar days from the closing of the Series AA Financing. As a result, our Board has unanimously determined that it is in the best interests of the Company and our stockholders to amend Article 5 of the Certificate of Incorporation (such amendment as shown in Exhibit A) to increase the number of authorized shares of common stock from 200,000,000, par value $0.001, to 500,000,000 par value $0.001.

Why did the Board approve the Share Increase Proposal?

We believe that the Share Increase Proposal, if approved, will provide us with the flexibility to settle our contractual obligations under our outstanding Series AA Preferred Stock through the issuance of shares of our common stock. As of March 1, 2019 we had 200,000,000 shares of common stock authorized for issuance under our Certificate of Incorporation of which 61,866,319 shares of common stock were issued and outstanding, 41,616,604 shares of common stock issuable upon the exercise of warrants and 13,830,417 shares of common stock issuable upon the exercise options. At the current conversion rate of 45.5454 shares of common stock per share of Series AA Preferred Stock, we may be required to issue up to 148,523,394 million shares of common stock upon conversion of our Series AA Preferred Stock.

If the Share Increase Proposal is approved it will increase the number of shares of common stock available for issuance including principally the Series AA Preferred Stock. Absent the availability of shares of common stock, the Company will be unable to convert all of the shares of Series AA Preferred Stock. Failure to convert the Series AA Preferred Stock may subject us to certain remedies that the holders of the Series AA Preferred Stock may have in law or equity.

| 12 |

For this reason, the Board determined that the Share Increase Proposal would give the Company greater flexibility in settling these securities by increasing the number of shares of common stock available for issuance to settle the conversion of these securities.

What are the Material Terms of the Series AA Financing?

As disclosed in our Current Report on Form 8-K filed with the United States Securities and Exchange Commission (the “SEC”), on January 7, 2019, we entered into the Purchase Agreement with Handok, Inc. and Genexine, Inc. whereby subject to certain closing conditions, the Purchasers agreed to purchase Series AA Preferred Stock for aggregate gross proceeds to the Company of $25,000,000 (each Purchaser paid $12,500,000 to the Company). We plan to use the proceeds for general working capital purposes. The Series AA Preferred Stock automatically converts into common stock if this Share Increase Proposal is approved. The Series AA Preferred Stock has an effective conversion price of $0.22 per share of common stock. On January 30, 2019, we closed the Series AA Financing and issued 1,250,000 Series AA Preferred to each Purchaser pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) at a purchase price of $10.00 per share of Series AA Preferred Stock. In addition, because the Series AA Financing qualified as a qualified financing under certain of our outstanding senior secured notes, the outstanding principal and interest due thereunder was automatically converted into the Series AA Preferred Stock at a 20% discount. As a result of the closing of the Series AA Financing, the notes plus accrued interest of $800,117 were automatically converted into 767,515 shares of Series AA Preferred Stock. The Series AA Preferred Stock was issued to the note holders pursuant to Section 4(a)(2) of the Securities Act.

As a result of the issuance of the Series AA Preferred Stock to the Purchasers, a change in control of the Company has occurred since the Purchasers collectively own 54% (each owning approximately 27% of our common stock on an as-converted basis) of our common stock on an as-converted basis. Each Purchaser used their working capital as a source of funds to purchase their respective portion of the Series AA Preferred Stock offered in the Series AA Financing.

Optional Conversion

The Series AA Preferred Stock may be converted at any time, at the option of the holder, into shares of our common stock at an initial ratio of 45.45454 shares of common stock for one share of Series AA Preferred Stock (the “Conversion Rate”), subject to adjustments for stock dividends, splits and the anti-dilution adjustment described in Certificate of Designation of Series AA Convertible Preferred Stock of the Company.

Mandatory Conversion

The Series AA Preferred Stock automatically converts into shares of common stock at the Conversion Rate upon the occurrence of any of the following:

| (i) | At any time upon the vote or consent of the holders of two thirds of the voting power of the then outstanding Series AA Preferred Stock; or |

| (ii) | The amendment to our Certificate of Incorporation to increase the number of shares of common stock authorized to be issued to at least 500,000,000 shares of common stock. |

Registration Rights

We agreed to use our commercially reasonable efforts to, (i) prepare and file with the SEC within sixty (60) calendar days after the closing of the Series AA Financing a registration statement under the U.S. Securities Act of 1933, as amended (the “Registration Statement”), to permit the resale of shares of common stock issuable upon the conversion of the shares of Series AA Preferred Stock purchased in the Series AA Financing. We also agreed to use our commercially reasonable efforts to cause the Registration Statement to be declared effective within ninety (90) calendar days following the closing of the Series AA Financing.

Call Option

We granted each Purchaser a call option whereby the earlier of, (i) December 31, 2020 and (ii) the date when the we ask the Purchasers for further financing, each Purchaser may elect to purchase up to $10,000,000 worth of shares of our common stock at a purchase price equal to the greater of, (i) $0.29 per share or (ii) 75% of the volume weighted average closing price of the our common stock during the thirty (30) consecutive trading days prior to the date of the notice.

Board Nomination Right

We granted the Purchasers a board nomination right whereby so long as the Purchasers and their affiliates collectively hold at least 40% of the aggregate shares of Series AA Preferred Stock, they shall have the right to nominate three (3) members of the board of directors of the Company.

| 13 |

What is the purpose of the Share Increase Proposal?

The Board recommends the Share Increase Proposal for the following reasons:

| · | To provide flexibility for the Company to settle its obligations under Series AA Preferred Stock and the Purchase Agreement through the issuance of shares of common stock; |

| · | To permit the Company to make future issuances or exchanges of common stock for capital raising purposes or to restructure outstanding securities of the Company; and |

| · | To permit the Company to make future issuances of options, warrants and other convertible securities. |

What could happen if the stockholders do not approve the Share Increase Proposal?

| · | In the event the Share Increase Proposal is not approved, there will not be sufficient shares of common stock to settle conversions of all of the outstanding shares of Series AA Preferred Stock. If we are unable to issue shares of common stock upon conversion of the Series AA Preferred Stock, the Company will be subject to certain remedies the holders of the Series AA Preferred Stock may have in law or equity. |

| · | If we do not increase our authorized shares of common stock, we may be unable to conduct further offerings of our equity securities to raise additional capital to implement our business plan or to further our corporate objectives. |

If the Share Increase Proposal is approved, will the additional authorized shares of common stock have preemptive rights?

No, if the Share Increase Proposal is approved, the additional authorized shares of common stock will not have preemptive rights.

What dilutive effect will the Share Increase Proposal have?

If the stockholders approve the Share Increase Proposal, the Board may cause the issuance of additional shares of common stock without further vote of the stockholders of the Company, except as provided under Delaware corporate law or under the rules of any national securities exchange or automated quotation system on which shares of common stock of the Company are then quoted, listed or traded. The relative voting and other rights of holders of the common stock will not be altered by the authorization of additional shares of common stock. Each share of common stock will continue to entitle its owner to one vote. Each share of stock when issued, the additional shares of common stock authorized by the amendment will have the same rights and privileges as the shares of common stock currently authorized and outstanding. Issuance of significant numbers of additional shares of the Company’s common stock in the future (i) will dilute current stockholders’ percentage ownership, (ii) if such shares are issued at prices below what current stockholders’ paid for their shares, will dilute the value of current stockholders’ shares and (iii) by reducing the percentage of equity of the Company owned by present stockholders, would reduce such present stockholders’ ability to influence the election of directors or any other action taken by the holders of common stock and (iv) issuance of a material number of shares of common stock could create downward pressure on the per share price of the common stock, thereby further diminishing the value of stockholders’ shares of common stock.

If the Share Increase Proposal is approved, our stockholders will experience significant dilution as a result of shares of common stock issued upon the conversion of our outstanding Series AA Preferred Stock. The Share Increase Proposal will increase the total number of authorized shares of common stock. As a result, we would have a larger number of authorized but unissued shares from which to issue additional shares of common stock, or securities convertible or exercisable into shares of common stock, in equity or convertible debt financing transactions.

What are the anti-takeover effects of the Share Increase Proposal?

Although the Share Increase Proposal is not motivated by anti-takeover concerns and is not considered by our Board to be an anti-takeover measure, the availability of additional authorized shares of common stock could enable the Board to issue shares defensively in response to a takeover attempt or to make an attempt to gain control of our company more difficult or time-consuming. For example, shares of common stock could be issued to purchasers who might side with management in opposing a takeover bid that the Board determines is not in the best interests of our stockholders, thus diluting the ownership and voting rights of the person seeking to obtain control of our company. In certain circumstances, the issuance of common stock without further action by the stockholders may have the effect of delaying or preventing a change in control of the company, may discourage bids for our common stock at a premium over the prevailing market price and may adversely affect the market price of our common stock. As a result, increasing the authorized number of shares of our common stock could render more difficult and less likely a hostile takeover of our company by a third-party, or a tender offer or proxy contest, assumption of control by a holder of a large block of our stock, and the possible removal of our incumbent management. We are not aware of any proposed attempt to take over the company or of any present attempt to acquire a large block of our common stock.

If the stockholders approve the Share Increase Proposal, does the Company have plans for future issuances of shares of common stock?

Other than the issuance of shares of common stock upon conversion of the Series AA Preferred Stock of the Company as discussed above, as of the date of this Proxy Statement, we do not have any plans for future issuances of shares of common stock.

| 14 |

What are the Material Effects of the Series AA Financing to our Existing Stockholders?

Voting and Ownership Effects

The primary effect of the Series AA Financing to our existing stockholders was that their relative voting power and ownership interests would be reduced as set forth in the following table.

| Prior to Closing of Series AA Financing(1): | After Closing of Series AA Financing (2): | |||||||||||||||

| Number of Shares of Common Stock Held | Ownership Interest and Voting Power | Number of Shares of Common Stock Held | Ownership Interest and Voting Power | |||||||||||||

| Current holders of common stock (Excluding affiliates and holders of 5% or more of the Company's common stock) | 39,417,942 | 64% (1) | 39,417,942 | 19% (2) | ||||||||||||

| 1) | Based on 61,866,319 shares of common stock outstanding as of March 27, 2019 |

| 2) | Based on 210,389,713 shares of common stock outstanding as of March 27, 2019 assuming the conversion of the Series AA Preferred Stock into common stock at the Conversion Ratio |

Other Effects

In addition to the effects set forth above, the Series AA Financing also had the following effects on our existing stockholders.

The

Series AA Financing strengthened our Company from perspectives of cash position, program advancement, and strategic support.

Per our recent Quarterly Report on Form 10-Q, cash balance was approximately $0.3 million as of December 31, 2018. Given adjustments for the Series AA Financing, conversion of certain secured notes, and the amendment to the Xoma License Agreement, the pro forma cash balance at this time point increased to $17.8 million.

This increase in cash is allowing us to advance towards achieving it’s stated program goals, including: (i) initiate the Phase 2 clinical program for RZ358 in the US and/or Europe, (ii) complete the necessary toxicology studies for RZ402 to enable the filing of an IND and initiation of clinical studies, and (iii) complete the ongoing Phase 1 study for AB101. We believe all of which are positives

Additionally, the Series AA Financing brought with it the backing and support of two mature pharmaceutical companies with a collective market capitalization of over $1.7 billion, that are very active in pursuing therapies to treat metabolic diseases.

| 15 |

What vote is required to approve the Share Increase Proposal?

The affirmative vote of the holders of a majority of the shares of common stock issued and outstanding will be required to approve an amendment to our Certificate of Incorporation to effect the Share Increase Proposal. If approved, the amendment will be effective upon filing of such amendment with the Delaware Secretary of State. Broker non-votes and abstentions will have the same effect as votes “AGAINST” this proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE SHARE INCREASE PROPOSAL.

Introduction

The Company has “blank check” preferred stock authorized under its Certificate of Incorporation, which may be issued by the Board of Directors in one or more designated series. Currently, the designated series are the Series A Convertible Preferred Stock (the “Series A Preferred Stock”) and the Series AA Preferred Stock, of which there are currently 20,000,000 shares designated. There are no shares of Series A Preferred Stock currently outstanding. The amendment, if adopted by the stockholders, would undesignate the Series A Preferred Stock as a series of preferred stock authorized for issuance by the Company, such that all 15,000,000 authorized shares of the Company’s Series A Preferred Stock would be undesignated and available for subsequent designation and issuance by the Board of Directors in accordance with its certificate of incorporation, bylaws and applicable law.

What vote is required to approve the Series A Proposal?

The affirmative vote of the holders of a majority of the shares of common stock issued and outstanding will be required to approve an amendment to our Certificate of Incorporation to effect the Series A Proposal. If approved, the amendment will be effective upon filing of such amendment with the Delaware Certificate of State. Broker non-votes and abstentions will have the same effect as votes “AGAINST” this proposal.

Why am I being asked to vote on the Series A Proposal?

The Board believes that the flexibility to designate and issue all authorized shares of preferred stock could enhance the ability of our Board of Directors to negotiate on behalf of the stockholders in a takeover situation. The authorized, but undesignated and unissued shares of preferred stock could be used by the Board of Directors to discourage, delay or make more difficult a change in the control of the Company. For example, such shares could be privately placed with purchasers who might align themselves with the board of directors in opposing a hostile takeover bid. In addition, the Board of Directors believes that the ability to designate future classes of preferred stock will allow the Company to complete equity financings on an expedited basis.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE SERIES A PROPOSAL.

PROPOSAL 5

ADJOURNMENT PROPOSAL

Introduction

If at the Annual Meeting the number of shares of common stock and Series AA Preferred Stock present or represented and voting in favor of the Share Increase Proposal is insufficient to approve the Share Increase Proposal, management may move to adjourn, postpone or continue the Annual Meeting in order to enable the Board to continue to solicit additional proxies in favor of the Share Increase Proposal.

| 16 |

In this Adjournment Proposal, we are asking you to authorize the holder of any proxy solicited by the Board to vote in favor of adjourning, postponing or continuing the Annual Meeting and any later adjournments. If the stockholders approve the Adjournment Proposal, we could adjourn, postpone or continue the Annual Meeting, and any adjourned session of the Annual Meeting, to use the additional time to solicit additional proxies in favor of the Share Increase Proposal. Among other things, approval of the Adjournment Proposal could mean that, even if proxies representing a sufficient number of votes against the Share Increase Proposal has been received, we could adjourn, postpone or continue the Annual Meeting without a vote on the Share Increase Proposal and seek to convince the holders of those shares to change their votes to votes in favor of the Share Increase Proposal.

What vote is required to approve the Adjournment Proposal?

The Adjournment Proposal will be approved if a majority of the voting shares (shares of common stock and Series AA Preferred Stock on an as-converted basis voting together as a single class) present in person or by proxy at the Annual Meeting votes FOR the proposal. Accordingly, abstentions and broker non-votes, if any, will be counted as votes AGAINST the Adjournment Proposal. No proxy that is specifically marked AGAINST the Share Increase Proposal will be voted in favor of the Adjournment Proposal, unless it is specifically marked FOR the discretionary authority to adjourn, postpone or continue the Annual Meeting to a later date.

Why am I being asked to vote on the Adjournment Proposal?

The Board believes that if the number of shares of common stock and Series AA Preferred Stock present or represented at the Annual Meeting and voting in favor of the Share Increase Proposal are insufficient to approve such proposals, it is in the best interests of the stockholders to enable the Board, for a limited period of time, to continue to seek to obtain a sufficient number of additional votes to approve the amendment.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE ADJOURNMENT PROPOSAL.

PROPOSAL 6

PLAN AMENDMENT PROPOSAL

Introduction

Our Board ratified the adoption of the Plan, and submitted it to our stockholders for their ratification at the 2018 annual meeting. An aggregate of 15,000,000 shares of our common stock was reserved for issuance under the Plan. Since the adoption of the Plan, 9,155,000 shares have been issued upon a grant under the Plan. The Board believes that an increase in the number of authorized shares is necessary for the continued optimal use of the Plan.

Our Board has unanimously adopted and is submitting for stockholder approval an amendment to increase the number of shares covered by, and reserved for issuance under, the Plan by 13,000,000 shares of common stock resulting (if such increase is authorized by the shareholders) in the aggregate 28,000,000 shares authorized for issuance under the Plan. Such amendment will enable the Company to make grants under the Plan to directors, employees (including officers), independent contractors, and other persons who provide services to us. A copy of the proposed Amendment to the Plan is attached as Exhibit “C” hereto.

The principal provisions of the Plan, as amended, are summarized below. This summary is not a complete description of all of the Plan’s provisions and is qualified in its entirety by reference to the Plan, which is attached as Exhibit “D” to our proxy statement filed with the SEC on October 20, 2017. Capitalized terms in this summary not defined in this proxy statement have the meanings set forth in the Plan.

| 17 |

Administration

The Compensation Committee administers the Plan and has full power and authority to designate participants, determine the number of shares covered by each award and determine the terms and conditions of each award (including any terms relating to forfeiture and exercisability). In addition, the Compensation Committee may accelerate the exercisability of any award. The Compensation Committee may also specify the manner in which the awards are paid out under the Plan. Subject to the provisions of the Plan, the Compensation Committee may amend or waive the terms and conditions, or accelerate the exercisability, of an outstanding award. The Compensation Committee has authority to interpret the Plan and establish rules and regulations for the administration of the Plan.

The Compensation Committee may delegate to one or more officers or directors of the Company the authority to grant awards under the Plan, except that the Compensation Committee may not delegate such authority with regard to grants to officers or directors of the Company or in a manner that would contravene applicable corporate law.

Shares Available for Awards

The aggregate number of shares of our common stock that may be issued as awards under the 2016 Plan as of the date of its adoption was 15,000,000. As of March 6, 2019, 5,845,000 shares of our common stock remain available for future grants under the Plan and 9,155,000 shares of our common stock are subject to currently outstanding awards. Shares of our common stock that are issued under awards granted in substitution for awards previously granted by an entity that is acquired by or merged with us or one of our affiliates will not be counted against the aggregate number of shares of our common stock available for awards under the Plan. No non-employee director may be granted awards under the Plan that are denominated in shares of our common stock with a value of more than $200,000 in the aggregate in any calendar year.

The Compensation Committee will adjust the number of shares and share limits described above, the number of shares subject to outstanding option awards and the exercise price of any such option award in the case of a dividend or other distribution, stock split, reverse stock split, merger or other similar corporate transaction or event that affects shares of our common stock, in order to prevent dilution or enlargement of the benefits or potential benefits intended to be provided under the Plan.

Counting Shares

Under the terms of the Plan, if an option entitles the holder to receive or purchase shares of our common stock, the shares covered by such award or to which the award relates will be counted against the aggregate number of shares available for awards. Awards that do not entitle the holder to receive or purchase shares will not be counted against the aggregate number of shares available for awards under the Plan.

| 18 |

If shares covered by an award are not purchased or are forfeited or are reacquired by us (including any shares withheld by us or tendered to satisfy any tax withholding obligation or if an award otherwise terminates or is cancelled without delivery of any shares), then the number of shares counted against the aggregate number of shares available under the Plan with respect to such award, to the extent of any such forfeiture, reacquisition by us, termination or cancellation, will again be available for future awards under the Plan. Notwithstanding the above, any shares that would have been issued but for the fact the exercise price was paid by a “net exercise”, shares withheld as payment of the exercise price of an award or in satisfaction of tax obligations relating to an option, and shares repurchased by us using option exercise proceeds, will not be available again for granting awards under the 2016 Incentive Plan.

Eligible Participants

Any employee, officer, non-employee director or consultant or independent contractor providing services to us or any of our affiliates, any such person to whom an offer of employment or engagement with the Company or an affiliate is extended, is eligible to receive an award under the Plan. Subject to the terms of the Plan, the Compensation Committee will have full authority to designate which eligible persons will be granted an award. As of March 1, 2019, the record date for our 2019 annual meeting of stockholders, approximately 13 officers and other employees and 4 non-employee directors would have been eligible to be selected by the Compensation Committee to receive awards under the Plan. In fiscal 2018, we granted awards to approximately 6 officers and other employees.

Types of Awards and Terms and Conditions

The Plan permits the granting of exclusively non-qualified stock options. Awards may be granted alone, in addition to, in combination with or in substitution for, any other award granted under the Plan or any other compensation plan. Awards can be granted for no cash consideration or for any cash or other consideration as may be determined by the Compensation Committee or as required by applicable law. Awards may provide that upon the grant or exercise thereof, the holder will receive cash, shares of our common stock, other securities (but excluding promissory notes), other awards or other property, or any combination of these in a single payment, installments or on a deferred basis.

The exercise price per share under any stock option may not be less than the fair market value of our common stock on the date of grant of such option, except if such option is granted in substitution for an option previously granted by an entity that is acquired by or merged with us or one of our affiliates. The grant price of any stock appreciation right may not be less than the fair market value of our common stock on the date of grant of such stock appreciation right, except if such stock appreciation right is granted in substitution for a stock appreciation right previously granted by an entity that is acquired by or merged with us or one of our affiliates. Determinations of fair market value under the Plan will be made in accordance with methods and procedures established by the Compensation Committee. The fair market value of a share of our common stock as of a given date will be the closing price per share of the common stock on any established stock exchange on which the shares are listed, or if no shares were traded on such date, on the next preceding date on which there was a sale of shares of our common stock. Awards will be adjusted by the Compensation Committee in the case of a dividend (other than a regular cash dividend) or other distribution, recapitalization, stock split, reverse stock split, merger or other similar corporate transaction or event that affects shares of our common stock, in order to prevent dilution or enlargement of the benefits or potential benefits intended to be provided under the Plan.

The Compensation Committee may provide for the acceleration of the exercisability of any award or the lapse of any restrictions relating to any award, except that no award agreement may contain a definition of change in control that has the effect of accelerating the exercisability of any award or the lapse of any restrictions relating to any award upon the announcement or stockholder approval (rather than consummation) of any reorganization, merger or consolidation of the Company, or sale or other disposition of all or substantially all of our assets.

| 19 |

Stock Options. The holder of an option will be entitled to purchase a number of shares of our common stock at a specified exercise price during a specified time period, all as determined by the Compensation Committee. The option exercise price may be payable, at the discretion of the Compensation Committee, in cash, shares of our common stock, other securities, other awards or other property having a fair market value on the exercise date equal to the exercise price, but never a promissory note. The Compensation Committee may also permit an option to be exercised by delivering to the participant a number of shares of our common stock having an aggregate fair market value equal to the excess, if positive, of the fair market value of the shares underlying the option being exercised, on the date of exercise, over the exercise price of the option for such shares (being referred to as a “net exercise”). Stock options vest and become exercisable in accordance with a vesting schedule established by the Compensation Committee. All stock options granted under the Plan are non-qualified stock options for federal income tax purposes.

Amendment and Termination

The Plan will terminate on October 31, 2021, unless earlier terminated by the Board. No awards may be made after the termination dates. Unless otherwise expressly provided in an applicable option agreement, any award granted under the Plan prior to expiration may extend beyond the expiration of the relevant Plan through the award’s normal expiration date.

The Board may amend, alter, suspend, discontinue or terminate the Plan at any time, although stockholder approval must be obtained for any amendment to the Plan that would (1) require stockholder approval under the rules of the SEC or any securities exchange applicable to the Company, (2) increase the number of shares of our common stock available under the Plan, (3) increase the number of shares or value of the Plan, (4) permit repricing of options, (5) permit awards of options at a price less than fair market value on the date of grant, or (6) increase the maximum term permitted for options under the Plan.

Certain Corporate Events

In the event of certain corporate transactions or events involving us, including any reorganization, merger, consolidation, split-up, spin-off, combination, repurchase or exchange of shares of our common stock or other securities, or if we enter into a written agreement to undergo such a transaction or event, the Compensation Committee or our Board will have the authority, with respect to any awards under the Plan and subject to the terms of the Plan, to either (i) terminate such awards, whether or not vested, in exchange for an amount of cash and/or other property, if any, equal to the amount that would have been attained upon the exercise of the award or realization of the participant’s rights (or if no amount would be realized upon exercise, terminate the award without any payment), or replace such awards with other rights or property selected by the Compensation Committee or the Board, (ii) provide that such awards will be assumed by the successor or survivor corporation, or a parent or subsidiary of the successor or surviving corporation, or substituted for by similar options, rights or awards covering the stock of the successor or survivor corporation, or a parent or subsidiary thereof, with appropriate adjustments as to the number and kind of shares and prices, (iii) accelerate such awards, or (iv) provide that such awards cannot vest, be exercised or become payable after a date certain in the future, which may be the effective date of such event.

Transferability of Awards

Except as otherwise provided by the Compensation Committee in its discretion and subject to additional terms and conditions as it determines, no awards and no right under any under the Plan, and no rights under any such award, may be transferred (other than by will or by the laws of descent and distribution) or pledged, alienated, attached or otherwise encumbered. The Compensation Committee may establish procedures to designate a beneficiary to exercise the rights of the participant and receive any property distributable with respect to any award in the event of a participant’s death.

| 20 |

Federal Income Tax Consequences

Grant of Options. The grant of a stock option is not expected to result in any taxable income for the recipient.

Exercise of Non-Qualified Stock. Upon exercising a non-qualified stock option, the optionee must recognize ordinary income equal to the excess of the fair market value of the shares of our common stock acquired on the date of exercise over the exercise price, and we generally will be entitled at that time to an income tax deduction for the same amount. Upon exercising a stock appreciation right, the amount of any cash received and the fair market value on the exercise date of any shares of our common stock received are taxable to the recipient as ordinary income and generally are deductible by us.

The tax consequence upon a disposition of shares acquired through the exercise of a non-qualified stock option will depend on how long the shares have been held. Generally, there will be no tax consequence to us in connection with the disposition of shares acquired under a non-qualified stock option.

Income Tax Deduction. Subject to the usual rules concerning reasonable compensation, including our obligation to withhold or otherwise collect certain income and payroll taxes, we generally will be entitled to a corresponding income tax deduction at the time a participant recognizes ordinary income from awards made under the Plan. However, the Company does not expect stock options granted under the Plan will be treated as “qualified performance-based compensation” within the meaning of Section 162(m) of the Code, meaning that the Company may not be able to deduct the value of proceeds paid to certain key employees to the extent that such proceeds along with all other compensation to any such employee that is likewise not treated as “qualified performance-based compensation” exceeds $1,000,000 within the calendar year.

Special Rules for Executive Officers Subject to Section 16 of the Exchange Act. Special rules may apply to individuals subject to Section 16 of the Exchange Act. In particular, unless a special election is made pursuant to the Code, shares received through the exercise of a stock option may be treated as restricted as to transferability and subject to a substantial risk of forfeiture for a period of up to six months after the date of exercise. Accordingly, the amount of any ordinary income recognized and the amount of our income tax deduction will be determined as of the end of that period.

New Plan Benefits

No benefits or amounts have been granted, awarded or received under the Plan contingent upon stockholder approval. In addition, the Compensation Committee, in its sole discretion, will determine the number and types of awards that will be granted under the Plan prospectively. Accordingly, it is not possible to determine the benefits that will be received by eligible participants if the Plan are approved by our stockholders. The closing price of a share of our common stock as reported on March 1, 2019 the record date for our 2018 annual meeting of stockholders, was $0.20.

What are the terms of the Proposed Amendment to the Plan?

The Board has reviewed the number of shares covered by, and reserved for issuance under, the Plan, and has determined that it is appropriate to increase the number of shares of common stock authorized for issuance under the Plan. Since the adoption of the Plan, 9,155,000 shares have been issued upon a grant under the Plan. The Board believes that an increase in the number of authorized shares is necessary for the continued optimal use of the Plan.

Therefore, the Board has approved the proposed amendment to the Plan that would increase the number of shares authorized for issuance under the Plan from 15,000,000 shares by 13,000,000 shares of common stock resulting (if such increase is authorized by the shareholders) in the aggregate 28,000,000 shares authorized for issuance under the Plan. Such amendment will enable the Company to make grants under the Plan to directors, employees (including officers), independent contractors, and other persons who provide services to us.

| 21 |

The following table displays equity compensation plan information as of June 30, 2018:

| Number of securities | ||||||||||||

| remaining available for future | ||||||||||||

| Number of Securities to be | issuance under equity | |||||||||||

| issued upon exercise of | Weighted-average exercise | compensation plans (excluding | ||||||||||

| outstanding options, warrants | price of outstanding options, | securities reflected in column | ||||||||||

| and rights | warrants, and rights | (a)) | ||||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by security holders | 26,500,000 | 1.64 | 7,084,754 | |||||||||

| Equity compensation plans not approved by security holders (1) | - | - | - | |||||||||

| Total | 26,500,000 | 1.64 | 7,084,754 | |||||||||

What vote is required to approve the Plan Amendment Proposal?

Abstentions and broker non-votes will have the same effect as votes “AGAINST” this proposal.

Proxies received in response to this solicitation will be voted “FOR” the approval of the amendment to the Plan unless otherwise specified in the proxy.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to approve amendment to the Plan

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE PLAN AMENDMENT PROPOSAL.

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The following table sets forth certain information with respect to our current directors, executive officers and key employees. See the Director Proposal related to the appointment of Directors. The ages of the directors, executive officer and key employees are shown as of March 7, 2019.

| Name | Position | Age | ||

| Nevan C. Elam | Chief Executive Officer and Director | 52 | ||

| Yuong-Jin Kim | Director and Chairman of the Board | 62 | ||

| Young Chul Sung, Ph.D. | Director | 62 | ||

| Keith Vendola | Chief Financial Officer | 47 | ||

| Sankaram Mantripragada, Ph.D. | Chief Scientific Officer | 59 |

The biographical information for the Directors are set forth above in the Director Proposal. Set forth below is biographical information with respect to each of the executives not listed in the Director Proposal.