UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

SCHEDULE 14C

|

SCHEDULE 14C INFORMATION

(Amendment No. 1)

Information Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934 (Amendment No. 1)

Check the appropriate box:

|

x

|

Preliminary Information Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

o

|

Definitive Information Statement

|

AntriaBio, Inc.

(Exact Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required

|

|

o

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

(5)

|

Total fee paid:

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

(3)

|

Filing Party:

|

|

(4)

|

Date Filed:

|

890 Santa Cruz Avenue

Menlo Park, CA 94025

Notice of Action by Written Consent

To all stockholders of AntriaBio, Inc.:

The purpose of this letter is to inform you that on December 13, 2013, the board of directors (the “Board”) of AntriaBio, Inc., a Delaware corporation (the “Company”), and the holders of a majority of the Company’s voting capital stock, by written consent in lieu of a meeting, approved a reverse split of the Company’s common stock, par value $0.001 per share, so that every six (6) outstanding shares of the Company’s common stock before the reverse split shall represent one (1) share of the Company’s common stock after the reverse split (the “Reverse Split”). In addition, on March 26, 2014, the Board, by special meeting of the Board, and the holders of a majority of the Company’s voting capital stock, by written consent in lieu of a meeting, approved the adoption of the Company’s 2014 Stock Option and Incentive Plan (the “Plan”)

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

THIS IS NOT A NOTICE OF AN ANNUAL MEETING OR SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER WHICH WILL BE DESCRIBED HEREIN.

The accompanying Information Statement, which we urge you to read carefully, describes the Reverse Split and the Plan in more detail, and is being furnished to our stockholders for informational purposes only, pursuant to Section 14(c) of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations prescribed thereunder. Pursuant to Rule 14c-2 under the Exchange Act, the Reverse Split and the Plan may not be effective until at least twenty (20) calendar days after the mailing of the accompanying Information Statement to the Company’s stockholders. Notwithstanding the foregoing, we must notify the Financial Industry Regulatory Authority of the Reverse Split by filing the Issuer Company Related Action Notification Form no later than ten (10) days prior to the anticipated record date for stockholder approval of such actions.

BY ORDER OF THE BOARD OF DIRECTORS

April 7, 2014

/s/ Nevan Elam__________________

Nevan Elam, Chief Executive Officer

1

890 Santa Cruz Avenue

Menlo Park, CA 94025

Information Statement

April 7, 2014

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Introduction

This Information Statement is being mailed to the stockholders of AntriaBio, Inc., a Delaware corporation (hereinafter referred to as the “Company”, “we”, “our”, “us” or “AntriaBio”), on or about April [●], 2014 in connection with the corporate action described below. On December 13, 2013, the Company’s board of directors (the “Board”) and stockholders (collectively, the “Consenting Stockholders”) holding a majority of the issued and outstanding shares of common stock (the “Common Stock”) of the Company, acting by written consent in lieu of a meeting, approved an amendment to the Company’s certificate of incorporation (the “Certificate of Incorporation”) to effect a one (1) for six (6) reverse stock split (the “Reverse Split”) so that every six (6) outstanding shares of the Common Stock before the Reverse Split shall represent one (1) share of Common Stock after the Reverse Split.

In addition, on or about March 26, 2014, the Board, acting at a special meeting of the Board and the Consenting Stockholders, acting by written consent in lieu of a meeting, approved the adoption of the Company’s 2014 Stock Option and Incentive Plan (the “Plan”).

Accordingly, this Information Statement is furnished solely for the purpose of informing stockholders, in the manner required under Regulation 14C of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), of the corporate actions set forth herein. No other stockholder approval is required. The record date for determining stockholders entitled to receive this Information Statement has been established as the close of business on March 26, 2014 (the “Record Date”).

The Delaware General Corporation Law permits any action that can be taken at an annual or special meeting of stockholders to be taken without a meeting, without prior notice and without a vote, if the holders of outstanding stock having not less than the minimum number of votes that will be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted to consent to such action in writing. The approval of the Reverse Split and the adoption of the Plan require the affirmative vote or written consent of the majority of the issued and outstanding shares of the Common Stock.

Common Stock

On March 31, 2014, there were 40,000,000 shares of the Common Stock issued and outstanding, of which the Consenting Stockholders hold approximately 75%, or 30,000,000 shares of Common Stock. Each share of the Common Stock entitles the holder to one vote per share of the Common Stock.

2

The following table sets forth the names of the Consenting Stockholders, the number of shares of the Common Stock held by each Consenting Stockholder, the total number of votes in favor of the Reverse Split and the adoption of the Plan and the percentage of the issued and outstanding voting equity of the Company that voted in favor thereof.

|

Name of

Consenting Stockholder |

Number of Shares of Common Stock Held

|

Number of Votes held by such Consenting Stockholder

|

Number of Votes that Voted in Favor of the Reverse Split

|

Number of Votes that Voted in Favor of Adopting the Plan

|

Percentage of voting equity that voted in Favor of the Reverse Split

|

Percentage of voting equity that voted in Favor of Adopting the Plan

|

|

EU One Group, LLC

L’Estoril, 31 Avenue Princesse Grace

MC 98000, Monaco (1)

|

20,000,000

|

20,000,000

|

20,000,000

|

20,000,000

|

50%

|

50%

|

|

Sankaram Mantripragada

999 18th Street, Suite 3000

Denver, CO 80202

|

6,000,000

|

6,000,000

|

6,000,000

|

6,000,000

|

15%

|

15%

|

|

Konus Advisory Group, Inc.

890 Santa Cruz Avenue

Menlo Park, CA 94025 (2)

|

4,000,000

|

4,000,000

|

4,000,000

|

4,000,000

|

10%

|

10%

|

|

Total

|

30,000,000

|

30,000,000

|

30,000,000

|

30,000,000

|

75%

|

75%

|

|

|

(1)

|

EU One Group, LLC is a Nevis limited liability company. Phillip Feller has sole investment power with respect to these securities. Pursuant to a voting agreement (the “Voting Agreement”) between Mr. Howe and EU One Group, LLC (“EU One”), EU One granted Mr. Howe a voting proxy (the “Voting Proxy”) to vote the shares of the Company held by EU One in Mr. Howe’s sole discretion. The Voting Proxy is only revocable upon the sale of the shares subject to the Voting Proxy. Other than his rights granted pursuant to the Voting Agreement, Mr. Howe disclaims beneficial ownership in the shares beneficially owned by EU One.

|

|

|

(2)

|

Konus Advisory Group, Inc. is a Delaware corporation in which Hoyoung Huh and Nevan Elam, members of our Board, have shared voting and investment power with respect to these securities.

|

3

FINRA APPROVAL

Under Exchange Act Rule 10b-17, we must notify the Financial Industry Regulatory Authority (“FINRA”) no later than ten (10) days prior to the anticipated effective date of the Reverse Split by submitting an Issuer Company-Related Notification Form to FINRA.

PROPOSAL 1

AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO EFFECT A 1 FOR 6 REVERSE SPLIT OF THE COMPANY’S ISSUED AND OUTSTANDING COMMON STOCK

Overview

On December 13, 2013, our Board and the Consenting Stockholders approved an amendment to our Certificate of Incorporation to effect the Reverse Split at an exchange ratio of one (1) post-split share for every six (6) pre-split shares. The effective date of the Reverse Split will be the later of: (i) twenty days following the date of the mailing of this Information Statement; or (ii) FINRA’s approval of the Reverse Split (the “Effective Date”).

The proposed form of amendment to our Certificate of Incorporation to implement the Reverse Split is attached to this Information Statement as Appendix A.

In its sole discretion, our Board may elect not to implement the Reverse Split. Our Board has the maximum flexibility to react to current market conditions and to therefore achieve the purposes of the Reverse Split, if implemented, and to act in the best interests of the Company and our stockholders.

Reasons for Reverse Stock Split

The Board believes that the number of shares of our Common Stock needs to be reduced with the goals of: (i) better enabling the Company to raise funds to finance our operations; (ii) facilitating higher levels of institutional stock ownership where investment policies generally prohibit investments in lower-priced securities; (iii) encouraging investor interest and improving the marketability of our Common Stock to a broader range of investors as a result of the potential increase in stock price resulting from the Reverse Split; and (iv) increasing our share price to potentially give the Company the added flexibility to list our shares of Common Stock on a stock exchange such as The Nasdaq Capital Market or the NYSE MKT.

Material Effects of the Reverse Split

The Reverse Split will not affect the registration of our Common Stock under the Exchange Act, nor will it change our periodic reporting and other obligations thereunder. The number of stockholders of record will not be affected by the Reverse Split. The number of shares of our Common Stock authorized for issuance pursuant to our Certificate of Incorporation will remain the same following the Effective Date. The number of shares of our Common Stock issued and outstanding on the Effective Date will be decreased following the Effective Date of the Reverse Split in accordance with the following formula: every six (6) shares of our Common Stock owned by a stockholder will automatically be changed into and become one (1) new share of our Common Stock. Any shares of Common Stock issued and outstanding after the Effective Date would be unaffected. In addition, there shall be no change in each stockholder’s percentage of ownership in the Company as a result of the Reverse Split. The Company does not have any current plans with respect to these additional authorized but unissued shares of our Common Stock.

4

Potential Negative Consequences of the Reverse Split

While we expect that the Reverse Split, if implemented, will result in an increase in the market price of our Common Stock, there can be no assurance that the Reverse Split will increase the market price of our Common Stock by a multiple equal to the exchange number or result in the permanent increase in any potential market price (which is dependent upon many factors, including our performance and prospects). Also, should the market price of our Common Stock decline, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would pertain in the absence of the Reverse Split. Furthermore, the possibility exists that potential liquidity of the trading market of our Common Stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Split. In addition, the Reverse Split will increase the number of stockholders of the Company who own odd lots (less than 100 shares). Stockholders who hold odd lots typically will experience an increase in the cost of selling their shares, as well as possible greater difficulty in effecting such sales. Consequently, there can be no assurance that the Reverse Split will achieve the desired results.

Procedure for Effecting Exchange of Stock Certificates

Commencing on the Effective Date, each certificate evidencing shares of the Common Stock will be deemed for all corporate purposes to evidence ownership of the decreased number of shares of Common Stock resulting from the Reverse Split. As soon as practicable after the Effective Date, stockholders should contact our transfer agent, VStock Transfer, Yoel Goldfeder, Phone: 212-363-0825, to arrange to surrender their certificates representing shares of pre-Reverse Split Common Stock in exchange for certificates representing shares of post-Reverse Split Common Stock. No new certificates will be issued to a stockholder until that stockholder has surrendered the stockholder's outstanding certificate(s) to our transfer agent.

Anti-Takeover Effects of the Reverse Split

By increasing the number of shares of Common Stock available for issuance, the Reverse Split could, under certain circumstances, have an anti-takeover effect, although this is not the intent of the Board. For example, it may be possible for the Board to delay or impede a takeover to transfer control of the Company by causing such additional authorized but unissued shares of Common Stock to be issued to holders who might side with the Board in opposing a takeover bid that the Board determines is not in the best interests of the Company or its stockholders. The Reverse Split therefore may have the effect of discouraging unsolicited takeover attempts. By potentially discouraging initiation of any such unsolicited takeover attempts the Reverse Split may limit the opportunity for our stockholders to dispose of their shares of Common Stock at a higher price generally available in takeover attempts or that may be available under a merger proposal. The Reverse Split may have the effect of permitting our current management, including the current Board, to retain its position, and place it in a better position to resist changes that stockholders may wish to make if they are dissatisfied with the conduct of our business. However, the Board is not aware of any attempt to take control of the Company and the Board has not approved the Reverse Split with the intent that it be utilized as a type of anti-takeover device.

STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE.

Fractional Shares

No fractional shares of post-Reverse Split Common Stock will be issued to any stockholder in connection with the Reverse Split. In order to avoid the expense and inconvenience of issuing and transferring fractional shares of Common Stock to stockholders who would otherwise be entitled to receive fractional

5

shares of Common Stock following the Reverse Split, any fractional shares which result from the Reverse Split will be rounded up to the closest whole share of Common Stock.

Federal Income Tax Consequences of the Reverse Split

The following is a summary of certain material federal income tax consequences of the Reverse Split. It does not purport to be a complete discussion of all of the possible federal income tax consequences of the Reverse Split and is included for general information only. Further, it does not address any state, local or foreign income or other tax consequences. Also, it does not address the tax consequences to holders that are subject to special tax rules, such as banks, insurance companies, regulated investment companies, personal holding companies, foreign entities, non-resident alien individuals, broker-dealers and tax-exempt entities. The discussion is based on the provisions of the United States federal income tax law as of the date hereof, which is subject to change retroactively as well as prospectively. This summary also assumes that the shares of Common Stock were, prior to the Reverse Split, and will be, after the Reverse Split, held as a “capital asset,” as defined in the Internal Revenue Code of 1986, as amended (the “Code”) (i.e., generally, property held for investment). The tax treatment of a stockholder may vary depending upon the particular facts and circumstances of such stockholder. Each stockholder is urged to consult with such stockholder’s own tax advisor with respect to the tax consequences of the Reverse Split.

No gain or loss should be recognized by a stockholder upon such stockholder’s exchange of pre-Reverse Split shares of Common Stock for post-Reverse Split shares of Common Stock pursuant to the Reverse Split. The aggregate tax basis of the new shares of Common Stock received in the Reverse Split will be the same as the stockholder’s aggregate tax basis in the pre-Reverse Split shares of Common Stock exchanged therefor. The stockholder’s holding period for the post-Reverse Split shares will include the period during which the stockholder held the pre-Reverse Split shares of Common Stock surrendered in the Reverse Split.

TO ENSURE COMPLIANCE WITH TREASURY DEPARTMENT CIRCULAR 230, STOCKHOLDERS ARE HEREBY NOTIFIED THAT: (A) ANY DISCUSSION OF FEDERAL TAX ISSUES IN THIS INFORMATION STATEMENT IS NOT INTENDED OR WRITTEN TO BE RELIED UPON, AND CANNOT BE RELIED UPON BY STOCKHOLDERS FOR THE PURPOSE OF AVOIDING PENALTIES THAT MAY BE IMPOSED ON STOCKHOLDERS UNDER THE INTERNAL REVENUE CODE; (B) SUCH DISCUSSION IS INCLUDED HEREIN BY US IN CONNECTION WITH OUR PROMOTION OR MARKETING (WITHIN THE MEANING OF CIRCULAR 230) OF THE TRANSACTIONS OR MATTERS ADDRESSED HEREIN; AND (C) STOCKHOLDERS SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

Our view regarding the tax consequences of the Reverse Split is not binding on the Internal Revenue Service or the courts. Accordingly, each stockholder should consult with his or her own tax advisor with respect to all of the potential tax consequences to him or her of the Reverse Split.

PROPOSAL 2

ADOPTION OF ANTRIABIO, INC. 2014 STOCK AND INCENTIVE PLAN

Background Information

The Board and the Consenting Stockholders adopted the Plan on March 26, 2014. The purpose of the Plan is to promote the interests of the Company and its stockholders by aiding the Company in attracting and

6

retaining employees, officers, consultants, advisors and non-employee directors capable of assuring the future success of the Company, to offer such persons incentives to put forth maximum efforts for the success of the Company’s business and to compensate such persons through various stock based arrangements and provide them with opportunities for stock ownership in the Company, thereby aligning the interests of such persons with the Company’s stockholders. The Plan is attached to this Information Statement as Appendix B.

The following is a summary of the Plan.

General Administration of the Plan

The Plan will be administered by a committee or subcommittee of the Board appointed from time to time by the Board (the “Committee”), or in the event no Committee has been formed, then it shall mean the entire Board. The Committee will be authorized to grant to any employee, officer, non-employee director, consultant, independent contractor or advisor awards in the form of stock options and shares of Common Stock.

The Committee has the full power and authority to administer the Plan including, but not limited to, the power to: (i) designate Plan participants; (ii) determine the type or types of awards to be granted to each participant under the Plan; (iii) determine the number of shares of Common Stock to be covered by (or the method by which payments or other rights are to be calculated in connection with) each Plan award; and (iv) determine the terms and conditions of any Plan award or Plan award agreement, including any terms relating to the forfeiture of any Plan award and the forfeiture, recapture or disgorgement of any cash, shares of Common Stock or other amounts payable with respect to any Plan award.

Shares of Common Stock Reserved under the Plan

The aggregate number of shares of Common Stock that may be issued under all awards under the Plan is 3,750,000 shares of Common Stock, which represents the post Reverse Split shares of Common Stock.

Eligibility

Any employee, officer, non-employee director, consultant, independent contractor or advisor to the Company or any affiliate of the Company shall be eligible to be designated as a participant. In determining which eligible persons shall receive a Plan award and the terms of any Plan award, the Committee may take into account the nature of the services rendered by the respective eligible persons, their present and potential contributions to the success of the Company or such other factors as the Committee, in its discretion, shall deem relevant. As of the March 21, 2014, we had 4 employees, 2 officers, 2 non-employee directors, 3 consultants and no independent contractors.

Types of awards under the Plan

Stock Options

The Committee may grant awards in the form of options to purchase shares of the Company’s Common Stock. With regard to each such option, the Committee will determine the number of shares subject to the option, the manner and time of the exercise of the option, and the exercise price per share of stock subject to the option; provided however, that the exercise price of any stock option may not be less than the greater of 100% of the fair market value of the shares of Common Stock on the date the option is granted,

7

provided, however, that the Committee may designate a purchase price below fair market value on the date of grant if the option is granted in substitution for a stock option previously granted by an entity that is acquired by or merged with the Company. The term of each option shall be fixed by the Committee at the time but shall not be longer than ten (10) years from the date of grant.

Incentive Stock Options

The Committee will not grant Incentive Stock Options (as defined in the Plan) in which the aggregate fair market value (determined as of the time the option is granted) of the shares with respect to which Incentive Stock Options are exercisable for the first time by any participant during any calendar year (under the Plan and all other plans of the Company and its affiliates) shall exceed $100,000.

All Incentive Stock Options must be granted within ten (10) years from the earlier of the date on which the Plan was adopted by the Board or the date the Plan was approved by the stockholders of the Company.

Unless sooner exercised, all Incentive Stock Options shall expire and no longer be exercisable no later than ten (10) years after the date of grant; provided, however, that in the case of a grant of an Incentive Stock Option to a participant who, at the time such option is granted, owns (within the meaning of Section 422 of the Code) stock possessing more than 10% of the total combined voting power of all classes of stock of the Company or of its affiliates, such Incentive Stock Option shall expire and no longer be exercisable no later than five (5) years from the date of grant.

Common Stock

Under the Plan, the Committee restricted shares of the Company’s Common Stock to eligible persons from time to time and subject to certain restrictions as determined by the Committee. The nature and extent of restrictions or vesting on such shares, the duration of such restrictions or vesting, and any circumstance which could cause the forfeiture of such shares shall be determined by the Committee. The Committee will also determine the effect of the termination of employment of a recipient of shares of Common Stock (by reason of retirement, disability, death or otherwise) prior to the lapse of any applicable restrictions. The Committee may award shares of Common Stock, without any cash payment for such shares of Common Stock or without any restrictions, to designated eligible persons for services rendered to the Company. The stock may be awarded at, above or below the fair market value on the date of grant. The designation of a stock award shall be made by the Committee in writing at any time after such eligible person has provided value to the Company (or within such period as permitted by IRS regulations). The Committee reserves the right to make adjustments in the amount of an award if in its discretion unforeseen events make such adjustment appropriate. The Company may award shares, without any cash payment for such shares without restrictions, to eligible persons for services rendered to the Company.

Limitation on Awards Granted to Non-Employee Directors.

No director who is not also an employee of the Company or an affiliate of the Company may be granted any Plan award or Plan awards denominated in shares of Common Stock that exceed $200,000 value in the aggregate in any calendar year (determined based upon the Black Scholes valuation method).

8

Amendment and Termination of the Plan

The Board may from time to time amend, suspend or terminate the Plan, and the Committee may amend the terms of any previously granted Plan award, provided that no amendment to the terms of any previously granted Plan award may, (except as expressly provided in the Plan) adversely alter or impair the terms or conditions of the Plan award previously granted to a participant under the Plan without the written consent of the participant or holder thereof. Any amendment to the Plan, or to the terms of any award previously granted, is subject to compliance with all applicable laws, rules, regulations and policies of any applicable governmental entity or securities exchange, including receipt of any required approval from the governmental entity or stock exchange. Notwithstanding the foregoing, the Committee may not amend the Plan or a Plan award without prior approval of the stockholders of the Company if such amendment would: (i) require stockholder approval under the rules or regulations of the SEC or any other securities exchange that are applicable to the Company; (ii) increase the number of shares of Common Stock authorized under the Plan; (iii) increase the number of shares of Common Stock or value of the Plan; (iv) permit repricing of options, which is currently prohibited by the Plan; (v) permit the award of options at a price less than 100% of the Fair Market Value (as defined in the Plan) of a share of Common Stock on the date of grant of such option, contrary to the Plan; or (vi) increase the maximum term permitted for options as specified in the Plan.

CERTAIN U.S. FEDERAL TAX CONSEQUENCES APPLICABLE TO THE PLAN

The following is a summary of the principal U.S. federal income tax consequences generally applicable to awards under the Plan

Grant of Options. The grant of a stock option (either an incentive stock option or a non-qualified stock option) is not expected to result in any taxable income for the recipient.

Exercise of Incentive Stock Options. Upon the exercise of an incentive stock option, no taxable income is realized by the optionee for purposes of regular income tax. However, the optionee may be required to recognize income for purposes of the alternative minimum tax (“AMT”). If stock is issued to the optionee pursuant to the exercise of an incentive stock option, and if no disqualifying disposition of such shares is made by such award holder within two years after the date of grant or within one year after the transfer of such shares to such award holder, then (1) upon the sale of such shares of Common Stock, any amount realized in excess of the option price will be taxed to such optionee as a long-term capital gain and any loss sustained will be a long-term capital loss, and (2) our Company will not be entitled to a deduction for federal income tax purposes.

If the Common Stock acquired upon the exercise of an incentive stock option is disposed of prior to the expiration of either holding period described above, generally (1) the optionee will realize ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of such shares of Common Stock at exercise (or, if less, the amount realized on the disposition of such shares) over the option price paid for such shares of Common Stock, and (2) our Company will be entitled to deduct such amount for federal income tax purposes if the amount represents an ordinary and necessary business expense. Any further gain (or loss) realized by the optionee will be taxed as short-term

9

or long-term capital gain (or loss), as the case may be, and will not result in any deduction by our Company.

Exercise of Non-Qualified Stock Options. Upon exercising a non-qualified stock option, the optionee must recognize ordinary income equal to the excess of the fair market value of the shares of Common Stock acquired on the date of exercise over the exercise price, and our Company generally will be entitled at that time to an income tax deduction for the same amount.

The tax consequence upon a disposition of shares acquired through the exercise of a non-qualified stock option will depend on how long the shares have been held.

Restricted Stock. Recipients of grants of restricted stock generally will be required to include as taxable ordinary income the fair market value of the restricted stock at the time it is no longer subject to a substantial risk of forfeiture. However, an award holder who makes an 83(b) election within 30 days of the date of grant of the restricted stock will incur taxable ordinary income on the date of grant equal to the fair market value of such shares of restricted stock (determined without regard to forfeiture restrictions). With respect to the sale of shares after the forfeiture restrictions have expired, the holding period to determine whether the award recipient has long-term or short-term capital gain or loss generally begins when the restrictions expire, and the tax basis for such shares will generally be based on the fair market value of the shares on that date. However, if the award holder made an 83(b) election as described above, the holding period commences on the date of such election, and the tax basis will be equal to the fair market value of the shares on the date of the election (determined without regard to the forfeiture restrictions on the shares). Dividends, if any, which are paid or accrued while the restricted stock is subject to a substantial risk of forfeiture, will also be taxed as ordinary income. Our Company will be entitled to an income tax deduction equal to amounts the award holder includes in ordinary income at the time of such income inclusion.

Income Tax Deduction. Subject to the usual rules concerning reasonable compensation, including our obligation to withhold or otherwise collect certain income and payroll taxes, and any applicable limitations under Section 162(m) of the Internal Revenue Code, our Company generally will be entitled to a corresponding income tax deduction at the time a participant recognizes ordinary income from awards made under the Plan.

Section 409A of the Internal Revenue Code. The Committee will administer and interpret the Plan and all award agreements in a manner consistent with the intent to satisfy the requirements of Section 409A of the Internal Revenue Code to avoid any adverse tax results thereunder to a holder of an award. If any provision of the Plan or any award agreement would result in such adverse consequences, the Committee may amend that provision or take other necessary action to avoid any adverse tax results, and no such action will be deemed to impair or otherwise adversely affect the rights of any holder of an award under the Plan.

Special Rules for Executive Officers and Directors Subject to Section 16 of the Exchange Act. Special rules may apply to individuals subject to Section 16 of the Exchange Act. In particular, shares received through exercise or payout of a non-qualified option, an incentive stock option (for purposes of the AMT only), and any shares of restricted stock that vest, may be treated as

10

restricted property for purposes of Section 83 of the Internal Revenue Code if the recipient has had a non-exempt acquisition of shares of our Company stock within the six months prior to the exercise, payout or vesting. Accordingly, the amount of any ordinary income recognized and the amount of our income tax deduction will be determined as of the end of that period unless a special election is made by the recipient pursuant to Section 83(b) of the Internal Revenue Code to recognize income as of the date the shares are received.

11

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table shows the particulars of compensation paid to our current and former executive officers during the periods ended June 30, 2013 and 2012.

|

Name and Principal Position (a)

|

Year

(b)

|

Salary ($)

(c)

|

Bonus ($)

(d)

|

Stock

Award ($)

(e)

|

Option Award

($)

(f)

|

Non-Equity

Incentive Plan

Compensation

($)

(g)

|

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings ($)

(h)

|

All Other

Compensation

($)

(i)

|

Total ($)

(j)

|

||||||||||||||||

|

Current Named Executive Officers

|

|||||||||||||||||||||||||

|

Nevan Elam (2)

|

2013

|

230,000

|

-

|

-

|

1,181,939

|

-

|

-

|

-

|

1,411,939

|

||||||||||||||||

|

Chief Executive Officer

|

2012

|

8,850

|

-

|

-

|

-

|

-

|

-

|

-

|

8,850

|

||||||||||||||||

|

Sankaram Mantripragada (3)

|

2013

|

285,000

|

-

|

-

|

337,697

|

-

|

-

|

-

|

622,697

|

||||||||||||||||

|

Chief Scientific Officer

|

2012

|

68,750

|

-

|

-

|

-

|

-

|

-

|

35,000

|

103,750

|

||||||||||||||||

|

Former Named Executive Officers

|

|||||||||||||||||||||||||

|

Steve Howe (1)

|

2013

|

250,000

|

-

|

-

|

675,394

|

-

|

-

|

6,152

|

931,546

|

||||||||||||||||

|

Former Executive Chairman

|

2012

|

62,500

|

-

|

-

|

-

|

-

|

-

|

108,462

|

170,962

|

||||||||||||||||

|

Nickolay Kukekov (4)

|

2013

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||

|

Chief Executive Officer

|

2012

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||

|

to January 31, 2013

|

|||||||||||||||||||||||||

|

Nir Bar (5)

|

2013

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||

|

President and Treasurer

|

2012

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||

|

to September 15, 2012

|

|||||||||||||||||||||||||

|

Guy Turnowski (5)

|

2013

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||

|

Secretary

|

2012

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||

|

to September 15, 2012

|

|||||||||||||||||||||||||

|

(1)

|

Mr. Howe was appointed as the Executive Chairman of Antria Delaware, Inc. (“Antria Delaware”) on April 1, 2012 and was appointed the Executive Chairman of AntriaBio on January 31, 2013. Mr. Howe received a base salary of $250,000 begining in April 2012. Prior to the employment agreement, consulting fees were paid to Mr. Howe for services performed for Antria Delaware for the year ended June 30, 2012. Also included is the cost of a corporate country club membership of which Mr. Howe had exclusive use during the time. Subsequent to our year end, on December 13, 2013, Mr. Howe resigned as our Executive Chairman.

|

|

|

|

|

(2)

|

Mr. Elam was appointed as the Chief Executive Officer of Antria Delaware on June 1, 2012 and was appointed the Chief Executive Officer of AntriaBio on January 31, 2013. Mr. Elam received a base salary of $230,000 beginning in June 2012. Prior to June 1, 2012, no compensation was paid to Mr. Elam.

|

12

|

(3)

|

Dr. Mantripragada was appointed as the Chief Scientific Officer of Antria Delaware on April 1, 2012 and was appointed the Chief Scientific Officer of AntriaBio on January 31, 2013. Dr. Mantripragada is to receive a base salary of $275,000 beginning in April 2012 which increased to $295,000 on January 1, 2013. Prior to the employment agreement, consulting fees were paid to Dr. Mantripragada for services performed for Antria Delaware for the year ended June 30, 2012.

|

|

|

|

|

(4)

|

Dr. Kukekov was appointed to these positions on September 4, 2012 and resigned on January 31, 2013. Dr. Kukekov did not receive any compensation for his service as our Chief Executive Officer and Director.

|

|

|

|

|

(5)

|

Mr. Bar and Mr. Turnowski were appointed to these positions on July 26, 2010 and resigned on September 15, 2012. For the years ended June 30, 2013 and 2012 no compensation was paid to either individual.

|

Outstanding Equity Awards

The following table provides a summary of equity awards outstanding for each of the named executive officers as of June 30, 2013:

|

Name (a)

|

Number of

Securities

Underlying

Unexercised

Options

Exerciable (#)

(b)

|

Number of

Securities

Underlying

Unexercised

Options

Unexercisable

(#)

(c)

|

Equity Incentive

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options (#) (d)

|

Option

Exercise

Price ($)

(e)

|

Option

Expiration

Date

(f)

|

|||||||||

|

Steve R. Howe (1)

|

138,890

|

-

|

861,110

|

$

|

0.75

|

1/30/2018

|

||||||||

|

Nevan C. Elam

|

1,993,055

|

-

|

1,506,945

|

$

|

0.75

|

1/30/2018

|

||||||||

|

Sankaram Mantripragada, Ph.D.

|

569,445

|

-

|

430,555

|

$

|

0.75

|

1/30/2018

|

||||||||

|

(1)

|

Mr. Howe was originally granted 2,000,000 options, however, pursuant to a domestic relations order, on April 17, 2013, Mr. Howe transferred 1,000,000 vested shares of Common Stock to Mrs. Howe.

|

Summary of Employment Agreements

The following sets forth a summary of the employment agreements that we have entered into with each of our named executive officers. In connection with Mr. Howe’s resignation as our Executive Chairman on December 13, 2013, Mr. Howe’s employment agreement was terminated as of January 1, 2014. In addition, on March 26, 2014, the Board approved certain amendments to Mr. Elam and Dr. Mantripragada’s employment agreements.

Steve R. Howe

On April 1, 2012, Antria Delaware entered into an agreement with Steve Howe to serve as Executive Chairman of Antria Delaware (the “Howe Employment Agreement”). Under the terms of the Howe Employment Agreement, Mr. Howe would be entitled to receive an annual base of two hundred fifty

13

thousand dollars ($250,000) which was to be raised to three hundred twenty five thousand dollars ($325,000) when the Company raised an aggregate of five million dollars ($5,000,000) in financing. In addition, Mr. Howe was entitled to an annual bonus equal to thirty percent (30%) of his base salary based on criteria set by the Antria Delaware board of directors. Mr. Howe was eligible to receive grants of options to purchase shares of Common Stock of up to 5% of the shares of Common Stock of the company on a fully diluted basis as consideration for services rendered. Mr. Howe was eligible to participate in all benefit programs available to our executives and employees, including any employee incentive option plan, and medical and dental benefit plans. Antria Delaware also agreed to provide life and disability insurance. Also under the terms of the agreement, Mr. Howe was entitled to reimbursement for reasonable travel and business expenses and receives a monthly automobile allowance.

On December 13, 2013, Mr. Howe resigned as our Executive Chairman. Pursuant to this resignation, on March 26, 2014, Mr. Howe and the Company entered into a termination agreement (the “Termination Agreement”) to terminate Mr. Howe’s employment agreement. The Termination Agreement provides for, among other things: (i) the termination of the Howe Employment Agreement; (ii) the waiver of any notice provisions set forth in the Howe Employment Agreement; (iii) the release of any obligations owed to or from either Mr. Howe or the Company under the Howe Employment Agreement; and (iv) the waiver of any amounts due and owing to Mr. Howe under the Howe Employment Agreement.

Sankaram Mantripragada

On April 1, 2012, Antria Delaware entered into an agreement (the “Mantripragada Employment Agreement”) with Sankaram Mantripragada to serve as the Chief Scientific Officer of Antria Delaware. Dr. Mantripragada reports to the Chief Executive Officer and under the terms of the Mantripragada Employment Agreement, Dr. Mantripragada is entitled to receive an annual base salary of two hundred seventy five thousand ($275,000) which increased to two hundred ninety five thousand ($295,000) on January 1, 2013 that is subject to annual adjustment recommended by the Chief Executive Officer and approved by the Board. Dr. Mantripragada is eligible for one-time bonuses when certain clinical testing has begun. Dr. Mantripragada also is entitled to receive an annual cash bonus of up to forty percent (40%) of his base salary, determined based on specified criteria agreed upon in advance. Dr. Mantripragada is eligible to receive grants of options to purchase shares of our Common Stock as consideration for services rendered, at the discretion of our Antria Delaware board of directors. Dr. Mantripragada is eligible to participate in all benefit programs available to our executives and employees, including medical and dental benefit plans. Also under the terms of the agreement, Dr. Mantripragada is entitled to reimbursement for reasonable travel and business expenses and receives a monthly automobile allowance. Additionally, at the age of 65, Dr. Mantripragada is entitled to a pension benefit equal to one month’s salary for each year of his employment. If he is terminated other than for cause or due to or after a change of control, all of Dr. Mantripragada’ unvested options will accelerate, and he will continue to receive his then base salary and health insurance for a period of up to twelve months. The agreement also requires Dr. Mantripragada to undertake certain confidentiality, non-competition and non-solicitation obligations.

On March 26, 2014, we entered into an amended and restated employment agreement with Dr. Mantripragada (the “Mantripragada Amended and Restated Employment Agreement”), amending the Mantripragada Employment Agreement. The Mantripragada Amended and Restated Employment Agreement amends the Mantripragada Employment Agreement to remove the pension benefit owed to Dr. Mantripragada such that Dr. Mantripragada is no longer entitled to a pension benefit at the age of 65 equal to one-month’s salary for each year of employment.

14

Nevan Elam

On June 18, 2012, Antria Delaware entered into an agreement with Nevan Elam to serve as Chief Executive Officer of Antria Delaware (the “Elam Employment Agreement”). Under the terms of the Elam Employment Agreement, Mr. Elam was entitled to receive an annual base of two hundred thirty thousand dollars ($230,000) until he commits full time to the business at which time his salary would increase to three hundred fifty thousand dollars ($350,000). At any time following the date of the Elam Employment Agreement, the Board was entitled to request in writing that Mr. Elam commit one hundred percent (100%) of his time and energy to the business of Antria Delaware and Mr. Elam would have had 60 days to comply with the Antria Delaware board of directors’ request or tender his resignation as an officer of Antria Delaware. Mr. Elam was entitled to an annual bonus equal to forty percent (40%) of his base salary based on criteria set by the Antria Delaware board of directors. Mr. Elam was also eligible for a one-time bonus when the Company raises an aggregate of five million dollars in financing. Mr. Elam was also eligible to receive grants of options to purchase shares of Common Stock as consideration for services rendered. Mr. Elam was eligible to participate in all benefit programs available to our executives and employees, including any employee incentive option plan, and medical and dental benefit plans. Antria Delaware was to provide life and disability insurance. Also under the terms of the Elam Employment Agreement, Mr. Elam was entitled to reimbursement for reasonable travel and business expenses and Mr. Elam would receive a monthly automobile allowance. Additionally, at age 65, Mr. Elam was entitled to a pension benefit equal to one-month's salary for each year of employment. The Elam Employment Agreement also required Mr. Elam to undertake certain confidentiality, non-competition and non-solicitation obligations.

On March 26, 2014, we entered into an amended and restated employment agreement (the “Amended and Restated Employment Agreement”) with Mr. Elam, amending the Elam Employment Agreement. The Amended and Restated Employment Agreement provides, among other things, for: (i) an increase in Mr. Elam’s base salary from $230,000 to $390,000; (ii) a termination of the bonus due to Mr. Elam under the Employment Agreement upon the Company raising at least $5,000,000 in an equity financing; (iii) a termination of the car allowance granted to Mr. Elam under the Employment Agreement; and (iv) the termination of the pension benefit at the age of 65 equal to one-month’s salary for each year of employment.

Equity Compensation Plan Information

The following table displays equity compensation plan information as of June 30, 2013:

|

Number of Securities to be

issued upon exercise of

outstanding options, warrants

and rights

(a)

|

Weighted-average exercise

price of outstanding options,

warrants, and rights

(b)

|

Number of securities remaining

available for future issuance

under equity compensation

plans (excluding securities

reflected in column (a))

(c)

|

|||||||

|

Equity compensation plans approved by security holders

|

-

|

-

|

-

|

||||||

|

Equity compensation plans not approved by security holders (1)

|

9,050,000

|

$

|

0.75

|

-

|

|||||

|

Total

|

9,050,000

|

$

|

0.75

|

-

|

|||||

15

|

|

(1)

|

Upon our acquisition of Antria Delaware, we assumed the option agreements for the issuance of up to nine million shares that had been issued by Antria Delaware (the “Assumed Options”). The Assumed Options are governed by the terms of their respective option agreements. The Assumed Options generally are nontransferable and expire no later than five years from the date of grant. Between 50-66.7% of the shares of Common Stock issuable and/or exercised under the option agreements vest immediately on the grant date with the remainder to vest ratably monthly until the vesting date. The Assumed Options have an exercise price of $0.75 per share. The Assumed Options were duly approved by the Antria Delaware stockholders prior to the closing of the reverse merger transaction by and between the Company and Antria Delaware and were granted to Steve Howe, Hoyoung Huh, Sankaram Mantripragada and Nevan Elam.

In June 2013, the Company also approved the grant of 50,000 stock options to contractors of the Company. The options are governed by the terms of their respective option agreements and expire no later than five years from the date of the grant. The first 25% of the shares of Common Stock issuable and/or exercised under the option agreements vest immediately on the grant date with the remainder to vest in 25% intervals through October 2015. The options have an exercise price of $0.75 per share.

|

DIRECTOR COMPENSATION

The following table shows the particulars of compensation paid to our current and former directors during the periods ending June 30, 2013 and 2012.

|

Name and Principal Position (a)

|

Year

(b)

|

Fees earned

or paid in

Cash ($)

(c)

|

Stock

Award ($)

(d)

|

Option Award

($)

(e) |

Non-Equity

Incentive Plan

Compensation

($)

(f) |

Nonqualified

Deferred

Compensation

Earnings ($)

(g)

|

All Other

Compensation

($)

(h) |

Total ($)

(i)

|

|||||||||||||||

|

Current Named Directors

|

|||||||||||||||||||||||

|

Steve Howe (1)

|

2013

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||

|

2012

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||

|

Nevan Elam (1)

|

2013

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||

|

2012

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||

|

Hoyoung Huh (2)

|

2013

|

108,000

|

-

|

1,482,572

|

-

|

-

|

-

|

1,590,572

|

|||||||||||||||

|

2012

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||

|

Former Named Directors

|

|||||||||||||||||||||||

|

Nir Bar (4)

|

2013

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||

|

Director to September 15, 2012

|

2012

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||

|

Guy Turnowski (4)

|

2013

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||

|

Director to September 15, 2012

|

2012

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||

|

Nickolay Kukekov (3)

|

2013 | - | - | - | - | - | - | - | |||||||||||||||

| Director to September 25, 2013 | 2012 | - | - | - | - | - | - | - | |||||||||||||||

|

(1)

|

The only compensation received by these individuals was for serving as an officer of the company and included in the executive compensation.

|

|

(2)

|

On July 1, 2012, AntriaBio entered into a consulting agreement (the “Consulting Agreement”) with Dr.

|

16

|

|

Huh whereby Dr. Huh agreed to provide AntriaBio services including, but not limited to, serving on AntriaBio’s Board as lead independent director, assisting AntriaBio in efforts to obtain funding and assisting in business development activities. He also received 2,500,000 stock options on January 30, 2013.

On March 26, 2014, Dr. Huh entered into a termination agreement (the “Huh Termination Agreement”). Pursuant to the terms of the Huh Termination Agreement, Dr. Huh and the Company agreed to terminate the Consulting Agreement in accordance with the Huh Termination Agreement. The Huh Termination Agreement provides for the following: (i) the termination of the Consulting Agreement; (ii) the waiver of any notice provisions set forth in the Consulting Agreement; (iii) the release of any obligations owed to or from either Dr. Huh or the Company under the Consulting Agreement; and (iv) the waiver of any amounts due and owing to Dr. Huh under the Consulting Agreement.

|

|

(3)

|

Dr. Kukekov was appointed to this position on September 4, 2012. Dr. Kukekov did not receive any compensation for his service as a Director. Subsequent to our 2013 year end, on September 25, 2013, Dr. Kukekov resigned as a member of our Board.

|

|

(4)

|

Mr. Bar and Mr. Turnowski were appointed to these positions on July 26, 2010 and resigned on September 15, 2012. For the years ended June 30, 2013 and 2012 no compensation was paid to either individual.

|

17

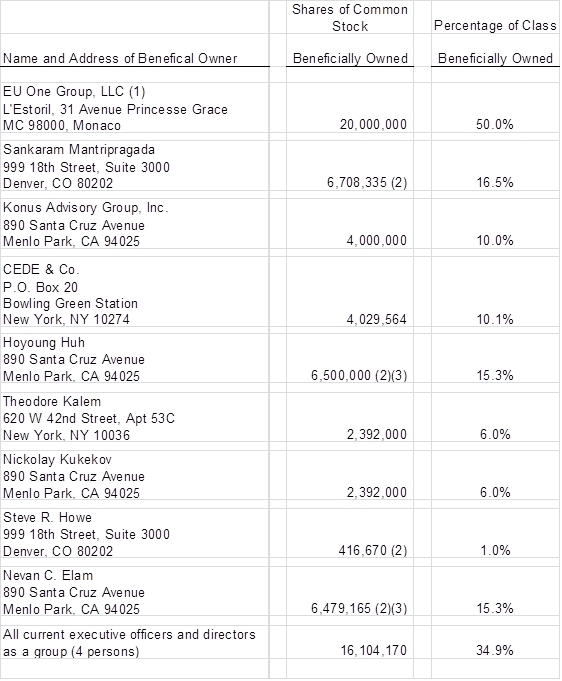

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

As of the date of this Information Statement, there were 40,000,000 shares of the Common Stock issued and outstanding of the Company. Each outstanding share of Common Stock is entitled to one vote per share.

The following table sets forth certain information regarding the beneficial ownership of shares of our Common Stock as of March 31, 2014 by:

|

|

·

|

each person who is known by us to beneficially own more than 5% of our issued and outstanding shares of Common Stock;

|

|

|

·

|

our named executive officers;

|

|

|

·

|

our directors; and

|

|

|

·

|

all of our executive officers and directors as a group.

|

Beneficial ownership as determined in Rule 13d-3 under the Exchange Act includes Common Stock acquirable upon exercise or conversion of securities of the Company within 60 days and Common Stock beneficially owned by an entity or person controlled directly or indirectly, through any contract, arrangement, understanding or otherwise.

18

|

|

(1)

|

EU One Group, LLC is a Nevis limited liability company. Phillip Feller has sole investment power with respect to these securities. Pursuant the Voting Agreement, EU One granted Mr. Howe the Voting Proxy to vote the shares of the Company held by EU One in Mr. Howe’s sole discretion. The Voting Proxy is only revocable upon the sale of the shares subject to the Voting Proxy.

|

|

|

(2)

|

Includes the vested portion of options granted by AntriaBio Delaware, Inc. that were assumed by the Company.

|

19

|

|

(3)

|

Includes shares beneficially owned by Konus Advisory Group, Inc. Konus Advisory Group, Inc. is a Delaware corporation in which Hoyoung Huh and Nevan Elam, members of our Board, have shared voting and investment power with respect to the Konus Advisory Group, Inc. shares.

|

PROPOSALS BY SECURITY HOLDERS

No security holder entitled to vote at a stockholder’s meeting or by written consent has submitted to the Company any proposal for consideration by the Company or its Board.

COSTS AND MAILING

The Company will pay all costs associated with the distribution of this Information Statement, including the costs of printing and mailing. The Company has asked or will ask brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of the Common Stock held of record by such persons and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

No director, executive officer, nominee for election as a director, associate of any director, executive officer or nominee or any other person has any substantial interest, direct or indirect by security holdings or otherwise, in the Reverse Split, which is not shared by all other stockholders.

DISSENTER’S RIGHTS OF APPRAISAL

The Delaware General Corporation Law does not provide for dissenter’s rights of appraisal in connection with the Reverse Split.

ADDITIONAL INFORMATION

The Company files annual and quarterly reports, proxy statements, and other reports and information electronically with the SEC. The Company’s filings are available through the SEC’s website at the following address: http:www.sec.gov.

STOCKHOLDERS SHARING THE SAME LAST NAME AND ADDRESS

The Company will be sending multiple copies of the information statement to the same address if more than one stockholder lives at the same residence.

By Order of the Board of Directors

/s/ Nevan Elam

Chief Executive Officer

April 7, 2014

APPENDIX A

CERTIFICATE OF AMENDMENT

TO

THE CERTIFICATE OF INCORPORATION

OF

ANTRIABIO, INC.

AntriaBio, Inc. (the “Company”), a Company duly organized and existing under the Delaware General Corporation Law (the “DGCL”), does hereby certify:

FIRST: This amendment to the Company’s Certificate of Incorporation set forth below was declared advisable and duly adopted by the board of directors and stockholders of the Company by written consent in lieu of a meeting of such board of directors and stockholders in accordance with the provisions of Sections 141 and 228 of the DGCL.

SECOND: Article V of the Company’s Certificate of Incorporation is hereby amended by adding the following:

“Upon the effectiveness of this Certificate of Amendment to the Certificate of Incorporation of the Company, every six (6) shares of the Company’s issued and outstanding Common Stock, par value $0.001 per share, shall, automatically and without any further action on the part of the Company or the holder thereof, be reclassified and changed into one (1) share of the Company’s Common Stock, par value $0.001 per share (the “Stock Split”).

THIRD: That the aforesaid amendment was duly adopted in accordance with the applicable provisions of Section 242 of the DGCL.

FOURTH: The foregoing amendment shall be effective on April [●], 2014.

FIFTH: Except as herein amended, the Company’s Certificate of Incorporation shall remain in full force and effect.

[Signature page follows]

A-1

IN WITNESS WHEREOF, the Company has caused this Certificate of Amendment to be executed by a duly authorized officer on this [●]th day of April, 2014.

ANTRIABIO, INC.

By:/s/Nevan Elam

Name: Nevan Elam

Title: Chief Executive Officer

A-2

APPENDIX B

ANTRIABIO, INC. 2014 STOCK AND INCENTIVE PLAN

ANTRIABIO, INC.

2014 STOCK AND INCENTIVE PLAN

Section 1. Purpose

The purpose of the Plan is to promote the interests of the Company and its stockholders by aiding the Company in attracting and retaining employees, officers, consultants, advisors and non-employee Directors capable of assuring the future success of the Company, to offer such persons incentives to put forth maximum efforts for the success of the Company’s business and to compensate such persons through various stock-based arrangements and provide them with opportunities for stock ownership in the Company, thereby aligning the interests of such persons with the Company’s stockholders.

Section 2. Definitions

As used in the Plan, the following terms shall have the meanings set forth below:

(a) “Affiliate” shall mean any entity that, directly or indirectly through one or more intermediaries, is controlled by the Company.

(b) “Award” shall mean any Option or Restricted Stock granted under the Plan.

(c) “Award Agreement” shall mean any written agreement, contract or other instrument or document evidencing an Award granted under the Plan (including a document in an electronic medium) executed in accordance with the requirements of Section 9(b).

(d) “Board” shall mean the Board of Directors of the Company.

(e) “Code” shall mean the Internal Revenue Code of 1986, as amended from time to time, and any regulations promulgated thereunder.

(f) “Committee” means a committee or subcommittee of the Board appointed from time to time by the Board. Notwithstanding the foregoing, if, and to the extent that no Committee exists which has the authority to administer this Plan, the functions of the Committee shall be exercised by the Board and all references herein to the Committee shall be deemed to be references to the Board.

(g) “Company” shall mean AntriaBio, Inc., a Delaware corporation and any successor corporation.

(h) “Director” shall mean a member of the Board.

(i) “Eligible Person” shall mean any employee, officer, non-employee Director, consultant, independent contractor or advisor providing services to the Company or any Affiliate, or any such person to whom an offer of employment or engagement with the Company or any Affiliate is extended.

(j) “Exchange Act” shall mean the Securities Exchange Act of 1934, as amended.

(k) “Fair Market Value” with respect to of one Share as of any date shall mean (a) if the Share is listed on any established stock exchange, the price of one Share at the close of the regular trading session of such market or exchange on such date, as reported by The Wall Street Journal or a comparable reporting service, or, if no sale of Shares shall have occurred on such date, on the next preceding date on which there was a sale of Shares; (b) if the Shares are not so listed on any established stock exchange, the average of the closing “bid” and “asked” prices quoted by the OTCQB, the National Quotation Bureau, or any comparable reporting service on such date or, if there are no quoted “bid” and “asked” prices on such date, on the next preceding date for which there are such quotes for a Share; or (c) if the Shares are not publicly traded as of such date, the per share value of a Share, as determined by the Board, or any duly authorized Committee of the Board, in its sole discretion, by applying principles of valuation with respect thereto.

(l) “Incentive Stock Option” shall mean an option granted under Section 6(a) of the Plan that is intended to meet the requirements of Section 422 of the Code or any successor provision.

(m) “Non-Employee Director” shall mean a Director who is not also an employee of the Company or an Affiliate.

(n) “Non-Qualified Stock Option” shall mean an option granted under Section 6(a) of the Plan that is not intended to be an Incentive Stock Option.

(o) “Option” shall mean an Incentive Stock Option or a Non-Qualified Stock Option to purchase shares of the Company.

(p) “Participant” shall mean an Eligible Person designated to be granted an Award under the Plan.

(q) “Person” shall mean any individual or entity, including a corporation, partnership, limited liability company, association, joint venture or trust.

(r) “Plan” shall mean the AntriaBio, Inc. 2014 Stock and Incentive Plan, as amended from time to time.

(s) “Restricted Stock” shall mean any Share granted under Section 6(b) of the Plan.

(t) “Reverse Stock Split” shall mean the one (1) for six (6) reverse stock split the Company plans to effect in 2014 whereby every six (6) Shares pre-split will be automatically converted into one (1) Share post-split.

(u) “Rule 16b-3” shall mean Rule 16b-3 promulgated by the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended, or any successor rule or regulation.

-2-

(v) “Section 409A” shall mean Section 409A of the Code, or any successor provision, and applicable Treasury Regulations and other applicable guidance thereunder.

(w) “Securities Act” shall mean the Securities Act of 1933, as amended.

(x) “Share” or “Shares” shall mean common shares $0.001 par value in the capital of the Company (or such other securities or property as may become subject to Awards pursuant to an adjustment made under Section 4(c) of the Plan).

(y) “Specified Employee” shall mean a specified employee as defined in Section 409A(a)(2)(B) of the Code or applicable proposed or final regulations under Section 409A, determined in accordance with procedures established by the Company and applied uniformly with respect to all plans maintained by the Company that are subject to Section 409A.

Section 3. Administration

(a) Power and Authority of the Committee. The Plan shall be administered by the Committee. Subject to the express provisions of the Plan and to applicable law, the Committee shall have full power and authority to: (i) designate Participants; (ii) determine the type or types of Awards to be granted to each Participant under the Plan; (iii) determine the number of Shares to be covered by (or the method by which payments or other rights are to be calculated in connection with) each Award; (iv) determine the terms and conditions of any Award or Award Agreement, including any terms relating to the forfeiture of any Award and the forfeiture, recapture or disgorgement of any cash, Shares or other amounts payable with respect to any Award; (v) amend the terms and conditions of any Award or Award Agreement, subject to the limitations under Section 7; (vi) accelerate the exercisability of any Award or the lapse of any restrictions relating to any Award, subject to the limitations in Section 7, (vii) determine whether, to what extent and under what circumstances Awards may be exercised in cash, Shares, other securities, other Awards or other property (excluding promissory notes), or canceled, forfeited or suspended, subject to the limitations in Section 7; (viii) determine whether, to what extent and under what circumstances amounts payable with respect to an Award under the Plan shall be deferred either automatically or at the election of the holder thereof or the Committee, subject to the requirements of Section 409A; (ix) interpret and administer the Plan and any instrument or agreement, including an Award Agreement, relating to the Plan; (x) establish, amend, suspend or waive such rules and regulations and appoint such agents as it shall deem appropriate for the proper administration of the Plan; (xi) make any other determination and take any other action that the Committee deems necessary or desirable for the administration of the Plan; and (xii) adopt such modifications, rules, procedures and subplans as may be necessary or desirable to comply with provisions of the laws of non-U.S. jurisdictions in which the Company or an Affiliate may operate, including, without limitation, establishing any special rules for Affiliates, Eligible Persons or Participants located in any particular country, in order to meet the objectives of the Plan and to ensure the viability of the intended benefits of Awards granted to Participants located in such non-United States jurisdictions. Unless otherwise expressly provided in the Plan, all designations, determinations, interpretations and other decisions under or with respect to the Plan or any Award or Award Agreement shall be within the sole discretion of the Committee, may be made

-3-

at any time and shall be final, conclusive and binding upon any Participant, any holder or beneficiary of any Award or Award Agreement, and any employee of the Company or any Affiliate.

(b) Delegation. The Committee may delegate to one or more officers or Directors of the Company, subject to such terms, conditions and limitations as the Committee may establish in its sole discretion, the authority to grant Awards; provided, however, that the Committee shall not delegate such authority (i) with regard to grants of Awards to be made to officers or directors of the Company or (ii) in such a manner as would contravene Section 157 of the Delaware General Corporation Law, as amended.

(c) Power and Authority of the Board. Notwithstanding anything to the contrary contained herein, the Board may, at any time and from time to time, without any further action of the Committee, exercise all the powers and duties of the Committee under the Plan.

Section 4. Shares Available for Awards

(a) Shares Available. Subject to (i) the Reverse Stock Split and (ii) adjustment as provided in Section 4(c) of the Plan, the aggregate number of Shares that may be issued under all Awards under the Plan shall be 3,750,000 Shares which represents post Reverse Stock Split Shares.

(b) Counting Shares. For purposes of this Section 4, if an Award entitles the holder thereof to receive or purchase Shares, the number of Shares covered by such Award or to which such Award relates shall be counted on the date of grant of such Award against the aggregate number of Shares available for granting Awards under the Plan. For purposes of determining the number of Shares covered on the date of grant by an Option, the aggregate number of Shares with respect to which the Option is to be exercised shall be counted against the number of Shares available for Awards under the Plan (without regard to the number of actual Shares issued upon exercise or settlement).

If any Shares covered by an Award or to which an Award relates are not purchased or are forfeited or are reacquired by the Company (including shares of Restricted Stock, whether or not dividends have been paid on such shares), or if an Award otherwise terminates or is cancelled without delivery of any Shares, then the number of Shares counted pursuant to Section 4(b) of the Plan against the aggregate number of Shares available under the Plan with respect to such Award, to the extent of any such forfeiture, reacquisition by the Company, termination or cancellation, shall again be available for granting Awards under the Plan. Notwithstanding anything to the contrary in this Section 4, the following Shares will not again become available for issuance under the Plan: (i) any Shares which would have been issued upon any exercise of an Option but for the fact that the exercise price was paid by a “net exercise” pursuant to Section 6(a)(iii)(B) or any Shares tendered in payment of the exercise price of an Option; (ii) any Shares withheld by the Company or Shares tendered to satisfy any tax withholding obligation with respect to an Option; or (iii) Shares that are repurchased by the Company using Option exercise proceeds.

-4-

(c) Adjustments. In the event that any dividend or other distribution (whether in the form of cash, Shares, other securities or other property), recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase or exchange of Shares or other securities of the Company, issuance of warrants or other rights to purchase Shares or other securities of the Company or other similar corporate transaction or event affects the Shares such that an adjustment is necessary in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Plan, then the Committee shall, in such manner as it may deem equitable, adjust any or all of (i) the number and type of Shares (or other securities or other property) that thereafter may be made the subject of Awards, (ii) the number and type of Shares (or other securities or other property) subject to outstanding Awards and (iii) the purchase price or exercise price with respect to any Award.

Section 5. Eligibility

Any Eligible Person shall be eligible to be designated as a Participant. In determining which Eligible Persons shall receive an Award and the terms of any Award, the Committee may take into account the nature of the services rendered by the respective Eligible Persons, their present and potential contributions to the success of the Company or such other factors as the Committee, in its discretion, shall deem relevant. Notwithstanding the foregoing, an Incentive Stock Option may only be granted to full-time or part-time employees (which term as used herein includes, without limitation, officers and Directors who are also employees), and an Incentive Stock Option shall not be granted to an employee of an Affiliate unless such Affiliate is also a “subsidiary corporation” of the Company within the meaning of Section 424(f) of the Code or any successor provision.

Section 6. Awards

(a) Options. The Committee is hereby authorized to grant Options to Eligible Persons with the following terms and conditions and with such additional terms and conditions not inconsistent with the provisions of the Plan as the Committee shall determine:

|

|

(i)

|

Exercise Price. The purchase price per Share purchasable under an Option shall be determined by the Committee and shall not be less than 100% of the Fair Market Value of a Share on the date of grant of such Option; provided, however, that the Committee may designate a purchase price below Fair Market Value on the date of grant if the Option is granted in substitution for a stock option previously granted by an entity that is acquired by or merged with the Company or an Affiliate.

|

|

|

(ii)

|

Option Term. The term of each Option shall be fixed by the Committee at the time but shall not be longer than 10 years from the date of grant.

|

|

|

(iii)

|

Time and Method of Exercise. The Committee shall determine the time or times at which an Option may be exercised in whole or in part and the method or methods by which, and the form or forms, including, but not limited to, cash, Shares (actually or by attestation), other securities, other

|

-5-

|

|

|

Awards or other property, or any combination thereof, having a Fair Market Value on the exercise date equal to the applicable exercise price, in which, payment of the exercise price with respect thereto may be made or deemed to have been made.

|

|

|

(A)

|

Promissory Notes. Notwithstanding the foregoing, the Committee may not accept a promissory note as consideration.

|

|

|

(B)

|

Net Exercises. The Committee may, in its discretion, permit an Option to be exercised by delivering to the Participant a number of Shares having an aggregate Fair Market Value (determined as of the date of exercise) equal to the excess, if positive, of the Fair Market Value of the Shares underlying the Option being exercised on the date of exercise, over the exercise price of the Option for such Shares.

|

|

|

(iv)

|

Incentive Stock Options. Notwithstanding anything in the Plan to the contrary, the following additional provisions shall apply to the grant of stock options which are intended to qualify as Incentive Stock Options:

|

|

|

(A)