UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| SCHEDULE 14C |

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

|

o

|

Preliminary Information Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

x

|

Definitive Information Statement

|

FITS MY STYLE INC.

(Exact Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required

|

|

o

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

(5)

|

Total fee paid:

|

|

o

|

Fee paid previously with preliminary materials.

|

1

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

(3)

|

Filing Party:

|

|

(4)

|

Date Filed:

|

2

FITS MY STYLE INC.

305 W 50 Street, Apt 25A,

New York, NY 10019

Notice of Action by Written Consent

To all Stockholders of Fits My Style Inc.:

The purpose of this letter is to inform you that on December 3, 2012, the board of directors (the “Board”) of Fits My Style Inc., a Nevada corporation (the “Company”) and the holders of a majority of the Company’s voting capital stock by written consent in lieu of a meeting, approved the following corporate actions:

|

|

1.

|

To change the Company’s name from Fits My Style Inc. to AntriaBio, Inc. (the “Name Change”);

|

|

|

2.

|

To change the state of incorporation of the Company from the State of Nevada to the State of Delaware pursuant to a plan of conversion (the “Reincorporation”), in connection with which the Company will adopt a new certificate of incorporation and bylaws under the laws of the State of Delaware; and

|

|

|

3.

|

To authorize the Board to effect a forward split of the Company’s common stock, par value $0.001 per share at an exchange ratio of six (6) for one (1) (the “Forward Split”) so that every one (1) outstanding share of the Company’s common stock before the Forward Split, shall represent six (6) shares of the Company’s common stock after the Forward Split.

|

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

THIS IS NOT A NOTICE OF AN ANNUAL MEETING OR SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER WHICH WILL BE DESCRIBED HEREIN.

The accompanying Information Statement, which we urge you to read carefully, describes the Name Change, the Reincorporation and the Forward Split in more detail, and is being furnished to our stockholders for informational purposes only, pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations prescribed thereunder. Pursuant to 14c-2 under the Exchange Act, the Name Change, Reincorporation and the Forward Split may not be effected until at least 20 calendar days after the mailing of the accompanying Information Statement to the Company’s stockholders. Notwithstanding the foregoing, we must notify the Financial Industry Regulatory Authority of the Name Change, Reincorporation and Forward Split by filing the Issuer Company Related Action Notification Form no later than ten (10) days prior to the anticipated record date of such actions.

BY ORDER OF THE BOARD OF DIRECTORS

December 19, 2012

/s/ Nickolay Kukekov

Nickolay Kukekov, Chief Executive Officer

3

FITS MY STYLE INC.

305 W 50 Street, Apt 25A,

New York, NY 10019

Information Statement

December 19, 2012

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Introduction

This Information Statement is being mailed to the stockholders of Fits My Style Inc., a Nevada corporation (hereinafter referred to as the “Company”, “we”, “our”, “us”), on or about December 20, 2012 in connection with the corporate actions described below. The Company’s board of directors (the “Board”) and holders (collectively, the “Consenting Stockholders”) of a majority of the issued and outstanding shares of common stock (the “Common Stock”) of the Company, acting by written consent in lieu of a meeting, approved a change of the Company’s name from Fits My Style, Inc. to AntriaBio, Inc (the “Name Change”). In addition, the Board and the Consenting Stockholders approved a plan of conversion (the “Plan of Conversion”), pursuant to which the Company will convert from a corporation incorporated under the laws of the State of Nevada to a corporation incorporated under the laws of the State of Delaware (the “Reincorporation”), and such approval includes the adoption of the certificate of incorporation (the “Delaware Certificate”) and the bylaws (the “Delaware Bylaws”) for the Company under the laws of the State of Delaware, each to become effective concurrently with the effectiveness of the Reincorporation. The Board and the Consenting Stockholders also approved a six (6) for one (1) forward stock split (the “Forward Split”) so that every one (1) outstanding share of the Common Stock before the Forward Split, shall represent six (6) shares of Common Stock after the Forward Split. Accordingly, this Information Statement is furnished solely for the purpose of informing stockholders, in the manner required under Regulation 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), of these corporate actions. No other stockholder approval is required. The record date for determining stockholders entitled to receive this Information Statement has been established as the close of business on December 19, 2012 (the “Record Date”). The Name Change, the Reincorporation and the Forward Split are referred to collectively herein as the “Actions.”

The Nevada Revised Statutes permit any action that can be taken at an annual or special meeting of stockholders to be taken without a meeting, without prior notice and without a vote, if the holders of outstanding stock having not less than the minimum number of votes that will be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted consent to such action in writing. The approval the Reincorporation requires the affirmative vote or written consent of the majority of the issued and outstanding shares of the Common Stock.

Common Stock

On December 19, 2012, there were 4,101,000 shares of the Common Stock issued and outstanding, of which the Consenting Stockholder held approximately 80.8%, or 3,315,000 shares. Each share of the Common Stock entitles the holder to one vote per share. On the Record Date we had outstanding 4,101,000 shares of the Common Stock for 4,101,000 votes.

4

The following table sets forth the names of the Consenting Stockholders, the number of shares of the Common Stock held by each Consenting Stockholder, the total number of votes in favor of the Actions and the percentage of the issued and outstanding voting equity of the Company that voted in favor thereof.

|

Name of Consenting

Stockholder

|

Number of Shares of

Common Stock Held

|

Number of

Votes held by

such

Consenting

Stockholder

|

Number of

Votes that

Voted in Favor

of the Actions

|

Percentage of

voting equity

that voted in

favor of the

Reincorporation

|

|

Tungsten 74 LLC

464 Gorge Road, #3E, Cliffside Park, NJ 07910 (1)

|

3,315,000

|

3,315,000

|

3,315,000

|

80.8%

|

(1) Tungsten 74 LLC is a New York limited liability company. Viacheslav Kriventsov has sole voting and investment power with respect to these securities.

CORPORATE ACTION TO BE TAKEN

Under Exchange Act Rule 10b-17, we must notify the Financial Industry Regulatory Agency (“FINRA”) no later than ten (10) days prior to the anticipated effective date of the Name Change and the Forward Split. The following actions were approved by written consent of the Consenting Stockholders upon the unanimous recommendation of the Board.

CORPORATE ACTION #1

NAME CHANGE TO ANTRIABIO, INC.

Overview

We are currently a “shell” company as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, with limited assets and nominal operations and our current name, Fits My Style, Inc., does not have any significance to our Company, our operations or our future plans. During the third quarter of 2012, we entered into preliminary negotiations with AntriaBio, Inc., a Delaware corporation and privately-owned company (“AntriaBio”), with respect to the principal terms and conditions pursuant to which we would purchase all of the issued and outstanding capital stock of AntriaBio and AntriaBio would become our wholly-owned operating subsidiary (the “Merger”) pursuant to a share exchange and reorganization agreement (the “Share Exchange and Reorganization Agreement”) between us, AntriaBio and the beneficial holders of AntriaBio’s issued and outstanding capital stock. We and AntriaBio anticipate entering into the Share Exchange and Reorganization Agreement and completing the Merger transaction during the first quarter of 2013, although the parties have not entered into a definitive Share Exchange and Reorganization Agreement as of the date of this Information Statement and there can be no assurances that the Merger transaction will be consummated. The approval of the Company’s stockholders is not required. Assuming we complete the Merger transaction, AntriaBio stockholders will hold approximately 88.2% of our issued and outstanding Common Stock.

5

AntriaBio is a biopharmaceutical company focused on developing proprietary products based largely on established active pharmaceutical ingredients in sustained release injectable formulations.

Reasons for Name Change

In connection with the Merger we will change our name to AntriaBio, Inc. prior to the consummation of the Merger. We believe that changing our name to AntriaBio, Inc. is more in line with AntriaBio’s line of business and will aid us in achieving brand recognition and better position us to obtain future sources of financing.

Effects of the Name Change

The Name Change will be effective when we file the Certificate of Conversion and the Certificate of Incorporation with the Secretary of State of the State of Delaware. In the event that the Merger is not consummated with AntriaBio after we have changed our name to AntriaBio, Inc., we will change our name to a new name not related with AntriaBio, Inc.

Dissenters’ Rights

Pursuant to the Nevada Revised Statutes (the “NRS”), our stockholders are not entitled to dissenters’ rights with respect to the Name Change.

CORPORATE ACTION #2

CHANGE IN OUR STATE OF INCORPORATION

FROM NEVADA TO DELAWARE

Overview

On December 3, 2012, the Board unanimously approved and, by written consent, the Consenting Stockholders approved, the Plan of Conversion pursuant to which the Company will effect the Reincorporation, in compliance with the Delaware General Corporation law and the NRS.

Principal Reasons for the Reincorporation Under Delaware Law

Corporate Law

As we plan for the future, the Board and management believe that it is essential to be able to draw upon well-established principles of corporate governance in making legal and business decisions. The prominence and predictability of Delaware corporate law provide a reliable foundation on which the Company's governance decisions can be based. The Board believes that the stockholders will benefit from the responsiveness of the Delaware corporate law.

For many years, Delaware has followed a policy of encouraging incorporation in Delaware and, in furtherance of that policy, has been the leader in adopting, construing and implementing comprehensive, flexible corporate laws that are responsive to the legal and business needs of the corporations organized under Delaware law. Unlike most states, including Nevada, Delaware has established progressive

6

principles of corporate governance that the Company could draw upon when making business and legal decisions.

To take advantage of Delaware’s flexible and responsive corporate laws, many corporations choose to incorporate initially in Delaware or choose to reincorporate into Delaware, as the Company proposes to do. In general, the Board believes that Delaware provides a more appropriate and flexible corporate and legal environment in which to operate than currently exists in the State of Nevada and that the Company and its stockholders would benefit from such an environment. The Board has considered the following benefits available to Delaware corporations in deciding to propose reincorporation in Delaware:

|

|

●

|

the General Corporation Law of the State of Delaware, which is generally acknowledged to be the most advanced and flexible corporate statute in the country;

|

|

|

●

|

the responsiveness and efficiency of the Division of Corporations of the Secretary of State of Delaware;

|

|

|

●

|

the Delaware General Assembly, which each year considers and adopts statutory amendments that the Corporation Law Section of the Delaware State Bar Association proposes in an effort to ensure that the corporate statute continues to be responsive to the changing needs of businesses;

|

|

|

●

|

the Delaware Court of Chancery, which handles complex corporate issues with a level of experience and a degree of sophistication and understanding unmatched by any other court in the country, and the Delaware Supreme Court, which is highly regarded; and

|

|

|

●

|

the well-established body of case law construing Delaware law, which has developed over the last century and which provides businesses with a greater degree of predictability than most, if not all, other jurisdictions provide.

|

Additionally, management believes that, as a Delaware corporation, the Company would be better able to continue to attract and retain qualified directors and officers than it would be able to as an Nevada corporation, in part, because Delaware law provides more predictability with respect to the issue of liability of directors and officers than Nevada law does. The increasing frequency of claims against directors and officers that are litigated has greatly expanded the risks to directors and officers of exercising their respective duties. The amount of time and money required to respond to and litigate such claims can be substantial. Although Nevada law and Delaware law both permit a corporation to include a provision in the corporation’s articles or certificate, as the case may be, of incorporation that in certain circumstances reduces or limits the monetary liability of directors for breaches of their fiduciary duty of care, Delaware law, as stated above, provides to directors and officers more predictability than Nevada law does and, therefore, provides directors and officers of a Delaware corporation a greater degree of comfort as to their risk of liability than that afforded under Nevada law. As the Company plans for the future, the board of directors and management believe that it is essential to be able to draw upon well-established principles of corporate governance in making legal and business decisions. The prominence and predictability of Delaware corporate law provide a reliable foundation on which the Company's governance decisions can be based.

7

Capital Raising

Delaware is a recognized and understood jurisdiction throughout the international financial community. The Company would be better positioned to raise capital both within and outside of the United States by being incorporated in Delaware. Many international investment funds, sophisticated investors, and brokerage firms are more comfortable and more willing to invest in a Delaware corporation than in a corporation incorporated in another U.S. jurisdiction whose corporate laws may be less understood and perceived to be outdated and unresponsive to stockholder rights.

As the Company moves towards advancing its projects, the Board believes that the Company will be best suited to pursue all available financing options in the best interests of its stockholders if the Company is incorporated in Delaware versus Nevada. The Board believes that the Reincorporation will represent a better opportunity for the Company to increase stockholder value.

Any stockholders that votes against the Reincorporation may, under certain conditions, become entitled to be paid for his or her shares of the Corporation's capital stock in lieu of receiving shares of the Delaware Corp. Under Nevada Law Section 92A.380, you, the Company’s stockholder, have the right to dissent from the Reincorporation and demand payment of the fair value of your shares of the Company’s capital stock and are urged to read the full text of the Nevada dissenters' rights statute, which is reprinted in its entirety and attached as Appendix F to this Information Statement.

Disadvantages of Reincorporation in Delaware

While our Board believe that the foregoing benefits and advantages of the Reincorporation into Delaware are significant, you may find the Reincorporation disadvantageous. The Delaware General Corporation Law permits a corporation to adopt a number of measures, through amendment of the corporate certificate of incorporation or bylaws or otherwise, designed to reduce a corporation's vulnerability to unsolicited takeover attempts. There is substantial judicial precedent in the Delaware courts as to the legal principles applicable to such defensive measures with respect to the conduct of the board of directors under the business judgment rule, and the related enhanced scrutiny standard of judicial review, with respect to unsolicited takeover attempts. The substantial judicial precedent in the Delaware courts may potentially be disadvantageous to you to the extent it has the effect of providing greater certainty that the Delaware courts will sustain the measures the Company has in place or implements to protect stockholder interests in the event of unsolicited takeover attempts. Such measures may also tend to discourage a future attempt to acquire control of the Company that is not presented to and approved by the Company’s Board, but that a substantial number and perhaps even a majority of the stockholders might believe to be in their best interests or in which stockholders might receive a substantial premium for their shares over then current market prices. As a result of such effects, stockholders who might desire to participate in such a transaction may not have an opportunity to do so.

We intend to effect the Reincorporation pursuant to the Plan of Conversion in substantially the form attached hereto as Appendix A. The Plan of Conversion provides that the Company will convert from a Nevada corporation to a Delaware corporation (“Delaware Corp”) and thereafter be subject to the laws of the State of Delaware. The Reincorporation would be considered, in effect, a continuation of existence of the Company, with the existence of Delaware Corp deemed to have commenced when the Company was first formed in Nevada.

General actions that will occur pursuant to the Plan of Conversion

Pursuant to the Plan of Conversion, Delaware General Corporate Law, as amended (the “DGCL”), and the NRS, upon conversion:

|

|

●

|

The Company will cease to be governed by the NRS and will be deemed a Delaware corporation subject to the DGCL;

|

8

|

|

●

|

Delaware Corp will be deemed to be the same entity as the Company for all purposes under the laws of Delaware, with the Company’s existence deemed to have commenced when the Company was first formed in Nevada;

|

|

|

●

|

Delaware Corp will continue to have all of the assets of the Company;

|

|

|

●

|

Delaware Corp will continue to have all the debts, liabilities and duties of the Company; and

|

|

|

●

|

Each director and officer of the Company will continue to hold their respective offices with Delaware Corp.

|

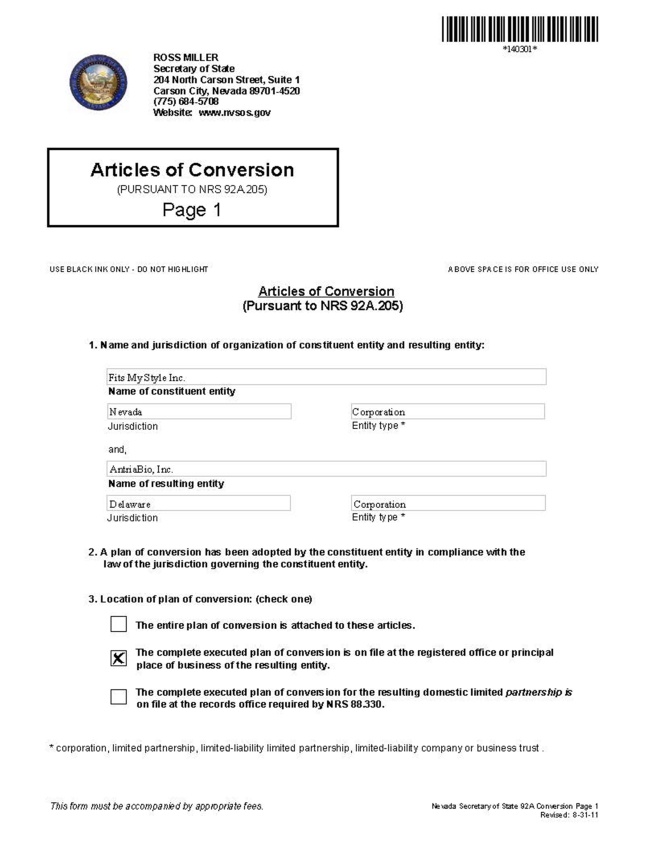

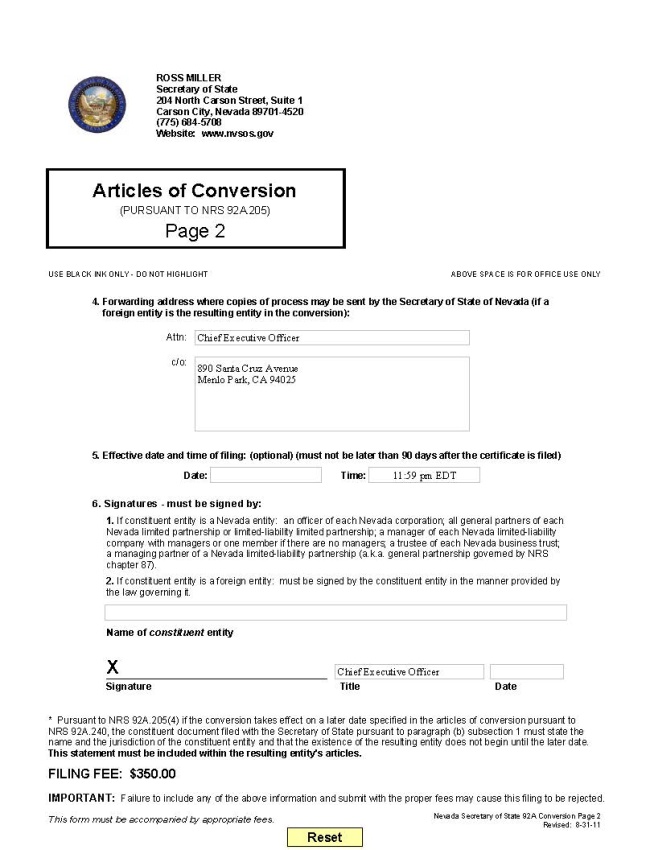

Pursuant to the Plan of Conversion and in connection with the Reincorporation, the Board and the Consenting Stockholders approved the filing: (1) with the Secretary of State of the State of Nevada articles of conversion, in substantially the form attached hereto as Appendix B (“Articles of Conversion”); (2) with the Secretary of State of the State of Delaware a certificate of conversion in substantially the form attached hereto as Appendix C (the “Certificate of Conversion”); and (3) the Certificate of Incorporation, substantially in the form attached hereto as Appendix D.

Adoption of Delaware Certificate of Incorporation and Bylaws

In connection with the Reincorporation, the Board and the Consenting Stockholders adopted the Certificate of Incorporation in substantially the form attached hereto as Appendix D and the Delaware Bylaws substantially in the form attached hereto as Appendix E, each to become effective concurrently with the effectiveness of the Reincorporation. At the time they become effective, the Certificate of Incorporation will supersede the Company’s current articles of incorporation and the Delaware Bylaws will supersede the Company’s current bylaws. The Certificate of Incorporation and the Delaware Bylaws were adopted in order to reflect the Reincorporation of the Company in the State of Delaware and to implement provisions deemed by the Board to be in the best interests of the Company and its stockholders.

Effect on the Company’s Securities

Common Stock

The authorized capital stock of the Company currently consists of 200,000,000 shares of common stock, par value $0.001 per share, and 20,000,000 shares of preferred stock, par value $0.001 per share. Upon effectiveness of the Reincorporation, the authorized capital of Delaware Corp will remain 200,000,000 shares of common stock, par value $0.001 per share, and 20,000,000 shares of preferred stock, par value $0.001 per share. Pursuant to the Plan of Conversion, each share of common stock of the Company, $0.001 par value per share, that is issued and outstanding immediately prior to the Reincorporation will automatically convert into one share of common stock, $0.001 par value per share of Delaware Corp, and each share of preferred stock of the Company, $0.001 par value per share, that is issued and outstanding immediately prior to the Reincorporation shall convert into one share of preferred stock of Delaware Corp, $0.001 par value per share.

9

Anti-Takeover Implications

Both Nevada and Delaware permit a corporation to include in its certificate of incorporation or bylaws or to otherwise adopt measures designed to reduce a corporation’s vulnerability to unsolicited takeover attempts. The Board, however, is not proposing the Reincorporation to prevent a change in control of the Company.

With respect to implementing defensive strategies, Delaware law is preferable to Nevada law because of the substantial judicial precedent on the legal principles applicable to defensive strategies. As a Nevada corporation or a Delaware corporation, the Company could implement some of the same defensive measures. As a Delaware corporation, however, the Company would benefit from the predictability of Delaware law on such matters.

For a discussion of differences between Nevada and Delaware law see “Changes to Stockholder Rights Before and After the Reincorporation–Changes from Nevada to Delaware Law–Business Combinations; – Control Share Acquisitions” below.

Changes to Stockholder Rights Before and After the Reincorporation

As previously noted, the Certificate of Incorporation and Delaware Bylaws will be the governing instruments of the Company following the Reincorporation, resulting in some changes from the Company’s current articles of incorporation and bylaws, which are primarily procedural in nature, such as a change in the registered office and agent of the Company from an office and agent in Nevada to an office and agent in Delaware. There are also material differences between the DGCL and the NRS. Certain changes to the articles of incorporation and bylaws of the Company, as well as the material differences between Delaware and Nevada law are discussed below. The following summary does not purport to be complete and is qualified in its entirety by reference to Delaware and Nevada corporate laws, the Certificate of Incorporation and Delaware Bylaws, copies of which are attached hereto as Appendix D and Appendix E, respectively.

Changes From Nevada Law to Delaware Law

Set forth below is a table summarizing the material differences in the rights of the stockholders of the Company before and after the Reincorporation is effective, as a result of the differences between Nevada law and Delaware law. This chart does not address each difference between Delaware law and Nevada law, but focuses on some of those differences which the Company believes are most relevant to the existing stockholders. This chart is not intended as an exhaustive list of all differences, and is qualified in its entirety by reference to Delaware and Nevada law.

|

Provision

|

Nevada Law

|

Delaware Law

|

||

|

Filling Vacancies on

the Board of Directors |

Nevada corporate law provides that all vacancies, including those caused by an increase in the number of directors, may be filled by a majority of the remaining directors, though less than a

|

Delaware law provides that, unless otherwise provided in the certificate of incorporation or bylaws of a corporation, vacancies may be filled by a majority of the directors then in office, although less than a quorum, or by a sole remaining director. Further, if, at the time of filling any vacancy, the

|

||

10

| Provision | Nevada Law | Delaware Law | ||

|

|

quorum, unless it is otherwise provided in the articles of incorporation. Unless otherwise provided in the articles of incorporation, pursuant to a resignation by a director, the board may fill the vacancy or vacancies with each director so appointed to hold office during the remainder of the term of office of the resigning director or directors.

|

directors then in office shall constitute less than a majority of the whole board, the Delaware Court of Chancery may, upon application of any stockholder or stockholders holding at least 10% of the total number of the shares at the time outstanding having the right to vote for such directors, summarily order an election to be held to fill any such vacancies or newly created directorships, or to replace the directors chosen by the directors then in office.

|

||

|

Special Meetings of

Stockholders |

Under Nevada law, unless otherwise provided in the articles of incorporation or bylaws, the entire board of directors, any two directors or the president may call annual and special meetings of the stockholders and directors.

|

Under Delaware law, a special meeting of stockholders may be called by the board of directors or by such persons as may be authorized by the certificate of incorporation or by the bylaws.

|

|

Failure to Hold an Annual

Meeting of Stockholders

|

Nevada law provides that if a corporation fails to elect directors within 18 months after the last election of directors, a Nevada district court will have jurisdiction in equity and may order an election upon petition of one or more stockholders holding at least 15% of the voting power.

|

Delaware law provides that if an annual meeting for election of directors is not held on the date designated or an action by written consent to elect directors in lieu of an annual meeting has not been taken within 30 days after the date designated for the annual meeting, or if no date has been designated, for a period of 13 months after the latest to occur of the organization of the corporation, its last annual meeting or the last action by written consent to elect directors in lieu of an annual meeting, the Court of Chancery may summarily order a meeting to be held upon the application of any stockholder or director.

|

||

|

Limitation on Director

Liability

|

Under Nevada law, unless the articles of incorporation or an amendment thereto (filed on or after October 1, 2003) provides for greater individual liability, a director or officer is not individually liable to the corporation or its stockholders or creditors for any damages as a result of any act or failure to act in his or her capacity as a director or officer unless it is proven that: (a) the director’s or officer’s act or

|

Under Delaware law, if a corporation’s certificate of incorporation so provides, the personal liability of a director for breach of fiduciary duty as a director may be eliminated or limited. A corporation’s certificate of incorporation, however, may not limit or eliminate a director’s personal liability (a) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (b) for acts or omissions not in good faith or involving intentional misconduct or a knowing violation of law, (c) for the payment of unlawful dividends, stock repurchases or redemptions, or (d) for any transaction in which the director received an

|

||

11

| Provision | Nevada Law | Delaware Law | ||

| failure to act constituted a breach of his or her fiduciary duties as a director or officer; and (b) the breach of those duties involved intentional misconduct, fraud or a knowing violation of law. | improper personal benefit. | |||

|

Indemnification

|

Under Nevada law, a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in the right of the corporation, by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with the action, suit or proceeding if the person: (a) is not liable pursuant to NRS 78.138; or (b) acted in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the conduct was unlawful. However, indemnification may not be made for any claim, issue or matter as to which such a person has been adjudged to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court in which the action or suit was brought

|

Under Delaware law, a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys' fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if: the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person's conduct was unlawful. With respect to actions by or in the right of the corporation, no indemnification shall be made with respect to any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or the court in which such action or suit is brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which such court shall deem proper. A director or officer who is successful, on the merits or otherwise, in defense of any proceeding subject to the Delaware corporate statutes’ indemnification provisions shall be indemnified against expenses (including attorneys' fees) actually and reasonably incurred by such person in connection therewith.

|

||

12

| Provision | Nevada Law | Delaware Law | ||

| determines upon application that in view of all the circumstances of the case, the person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper. To the extent that such person has been successful on the merits or otherwise in defense of any proceeding subject to the Nevada indemnification laws, the corporation shall indemnify him or her against expenses, including attorneys’ fees, actually and reasonably incurred by him or her in connection with the defense. | ||||

|

Advancement of

Expenses

|

Nevada law provides that the articles of incorporation, the bylaws or an agreement made by the corporation may provide that the expenses of officers and directors incurred in defending a civil or criminal action, suit or proceeding must be paid by the corporation as they are incurred and in advance of the final disposition of the action, suit or proceeding, upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that the director or officer is not entitled to be indemnified by the corporation.

|

Delaware law provides that expenses incurred by an officer or director of the corporation in defending any civil, criminal, administrative or investigative action, suit or proceeding may be paid by the corporation in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such director or officer to repay such amount if it is ultimately determined that such person is not entitled to be indemnified by the corporation as authorized under the indemnification laws of Delaware. Such expenses may be so paid upon such terms and conditions as the corporation deems appropriate. Under Delaware law, unless otherwise provided in its certificate of incorporation or bylaws, a corporation has the discretion whether or not to advance expenses.

|

||

|

Declaration and Payment

of Dividends

|

Under Nevada law, except as otherwise provided in the articles of incorporation, a board of directors may authorize and the corporation may make distributions to its stockholders, including distributions on shares that are partially paid. However, no distribution may be made if, after giving effect to such distribution: (a) the corporation

|

Under Delaware law, subject to any restriction contained in a corporation's certificate of incorporation, the board of directors may declare, and the corporation may pay, dividends or other distributions upon the shares of its capital stock either (a) out of "surplus" or (b) in the event that there is no surplus, out of the net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal year, unless net assets (total assets in excess of total liabilities) are less than the capital of all outstanding preferred stock. "Surplus"

|

||

13

| Provision | Nevada Law | Delaware Law | ||

| would not be able to pay its debts as they become due in the usual course of business; or (b) except as otherwise specifically allowed by the articles of incorporation, the corporation’s total assets would be less than the sum of its total liabilities plus the amount that would be needed, if the corporation were to be dissolved at the time of distribution, to satisfy the preferential rights upon dissolution of stockholders whose preferential rights are superior to those receiving the distribution. | is defined as the excess of the net assets of the corporation over the amount determined to be the capital of the corporation by the board of directors (which amount cannot be less than the aggregate par value of all issued shares of capital stock). | |||

|

Business Combinations

|

Nevada law prohibits certain business combinations between a Nevada corporation and an interested stockholder for three years after such person becomes an interested stockholder. Generally, an interested stockholder is a holder who is the beneficial owner of 10% or more of the voting power of a corporation’s outstanding stock and at any time within three years immediately before the date in question was the beneficial owner of 10% or more of the then outstanding stock of the corporation. After the three year period, business combinations remain prohibited unless they are (a) approved by the board of directors prior to the date that the person first became an interested stockholder or a majority of the outstanding voting power not beneficially owned by the interested party, or (b) the interested stockholder satisfies certain fair-value requirements. An interested stockholder is (i) a person that beneficially owns, directly or indirectly, 10% or more of the voting power of the outstanding voting shares of a corporation, or (ii) an affiliate or associate of the corporation who,

|

Delaware law prohibits, in certain circumstances, a “business combination” between the corporation and an “interested stockholder” within three years of the stockholder becoming an “interested stockholder.” Generally, an “interested stockholder” is a holder who, directly or indirectly, controls 15% or more of the outstanding voting stock or is an affiliate of the corporation and was the owner of 15% or more of the outstanding voting stock at any time within the three-year period prior to the date upon which the status of an “interested stockholder” is being determined. A “business combination” includes a merger or consolidation, a sale or other disposition of assets having an aggregate market value equal to 10% or more of the consolidated assets of the corporation or the aggregate market value of the outstanding stock of the corporation and certain transactions that would increase the interested stockholder’s proportionate share ownership in the corporation. This provision does not apply where, among other things, (i) the transaction which resulted in the individual becoming an interested stockholder is approved by the corporation’s board of directors prior to the date the interested stockholder acquired such 15% interest, (ii) upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the outstanding voting stock of the corporation at the time the transaction commenced, or (iii) at or after the date the person becomes an interested stockholder, the business combination is approved by a majority of the board of directors of the corporation and an affirmative

|

||

14

| Provision | Nevada Law | Delaware Law | ||

| at any time within the past three years, was an interested stockholder of the corporation. | vote of at least 66 2/3% of the outstanding voting stock at an annual or special meeting and not by written consent, excluding stock not owned by the interested stockholder. This provision also does not apply if a stockholder acquires a 15% interest inadvertently and divests itself of such ownership and would not have been a 15% stockholder in the preceding three years but for the inadvertent acquisition of ownership. | |||

|

Control Share Acquisition

Statute

|

Under Nevada law, an acquiring person who acquires a controlling interest in an issuing corporation is prohibited from exercise voting rights on any control shares unless such voting rights are conferred by a majority vote of the disinterested stockholders of the issuing corporation at a special or annual meeting of stockholders. Unless otherwise provided in the articles of incorporation or the bylaws, if the control shares are accorded full voting rights and the acquiring person acquires control shares with a majority or more of all the voting power, any stockholder, other than the acquiring person, who does not vote in favor of authorizing voting rights for the control shares is entitled to dissent and demand payment of the fair value of his or her shares.

A controlling interest means the ownership of outstanding voting shares of an issuing corporation sufficient to enable the acquiring person, directly or indirectly and individually or in association with others, to exercise: (i) one-fifth or more but less than one-third; (ii) one-third or more but less than a majority; or (iii) a majority or more, of all the voting power of the corporation in the election of directors. Control shares means those outstanding voting shares of an issuing corporation which an acquiring person: (a) acquires in an

|

Delaware’s control share acquisition statute generally provides that shares acquired in a “control share acquisition” will not possess any voting rights unless either the board of directors approves the acquisition or such voting rights are approved by a majority of the corporation’s voting shares, excluding interested shares. Interested shares are those held by a corporation’s officers and inside directors and by the acquiring party. A “control share acquisition” is an acquisition, directly or indirectly, by any person of ownership of, or the power to direct the exercise of voting power with respect to, issued and outstanding “control shares” of a publicly held Delaware corporation. “Control shares” are shares that, except for Delaware’s control share acquisition statute, would have voting power that, when added to all other shares that can be voted by the acquiring party, would entitle the acquiring party, immediately after the acquisition of such shares, directly or indirectly, to exercise voting power in the election of directors within any of the following ranges: (1) at least 20% but less than 33 1/3% of all voting power; (2) at least 33 1/3% but less than a majority of all voting power; or (3) a majority or more of all voting power.

|

||

15

| Provision | Nevada Law | Delaware Law | ||

| acquisition or offer to acquire in an acquisition; and (b) acquires within 90 days immediately preceding the date when the acquiring person became an acquiring person.

The control share acquisition statute applies to any acquisition of a controlling interest in an issuing corporation unless the articles of incorporation or bylaws of the corporation in effect on the 10th day following the acquisition of a controlling interest by an acquiring person provide that the provisions of those sections do not apply.

|

||||

|

Taxes and Fees

|

Nevada charges corporations incorporated in Nevada nominal annual corporate fees based on the value of the corporation’s authorized stock with a maximum fee of $35,000, as well as a $200 business license fee, and does not impose any franchise taxes on corporations.

|

Delaware imposes annual franchise tax fees on all corporations incorporated in Delaware. The annual fee ranges from a nominal fee to a maximum of $180,000, based on an equation consisting of the number of shares authorized, the number of shares outstanding and the net assets of the corporation.

|

||

Changes to Articles of Incorporation

Set forth below is a table summarizing the material differences in the rights of the stockholders of the Company before and after the Reincorporation is effective, as a result of the differences between the Company’s Articles of Incorporation and the Certificate of Incorporation. This chart does not address each difference between the Articles of Incorporation and the Certificate of Incorporation, but focuses on some of those differences which the Company believes are most relevant to the existing stockholders.

|

Provision

|

Articles of Incorporation

|

Certificate of Incorporation

|

Impact on Stockholders

|

|

Removal of Directors

|

Not Addressed

|

The Certificate of Incorporation states that any director of the Company’s board of directors or the entire board of directors may be removed at any time, with or without cause, by the holders of at least sixty-six and two-thirds percent (66 2/3%) of the shares entitled to vote at an election of

|

Under Delaware law, the default provision for the removal of directors of a corporation is that directors may be removed with or without cause upon the affirmative vote of a majority of all of the votes of the class entitled to elect that director unless the charter or certificate of incorporation provides

|

16

|

Provision

|

Articles of Incorporation

|

Certificate of Incorporation

|

Impact on Stockholders

|

| directors. |

otherwise.

The Certificate of Incorporation increases the threshold for the removal of directors to sixty-six and two-thirds percent (66 2/3%) which will impact our stockholders by making it more difficult for them to change the Board’s composition.

|

||

|

Indemnification and Advancement of Expenses

|

Not Addressed in Articles of Incorporation

|

The Certificate of Incorporation states that the Company shall indemnify, advance expenses, and hold harmless, to the fullest extent permitted by applicable law as it presently exists or may hereafter be amended, any person (a “Covered Person”) who was or is made or is threatened to be made a party or is otherwise involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative (a “Proceeding”), by reason of the fact that he or she, or a person for whom he or she is the legal representative, is or was a director or officer of the Company or, while a director or officer of the Company, is or was serving at the request of the Company as a director, officer, employee or agent of another Company or of a partnership, joint venture, trust, enterprise or nonprofit entity, including service with respect to employee benefit plans, against all liability and loss suffered and expenses (including attorneys' fees) reasonably incurred by such Covered Person. Notwithstanding the preceding sentence, except for claims for indemnification (following the final disposition of such Proceeding) or advancement of expenses not paid in full, the Company shall be required to indemnify a Covered Person in connection with a Proceeding (or

|

Section 145(e) of the DGCL permits, but does not require Delaware corporations to pay, prior to final disposition, the expenses, including attorneys’ fees, incurred by a corporate representative in defending a proceeding. The provision in Delaware Bylaws and the Certificate of Incorporation permitting such advances of fees associated with indemnification is not the default provision under the DGCL.

Advancing expenses to Covered Persons prior to the final disposition of a proceeding could impact our stockholders to the extent that we would use Company assets, which could otherwise be used to grow our business and increase stockholder equity, to cover the costs of litigation without the certainty that the Covered Person will be successful on the merits of the suit.

|

17

|

Provision

|

Articles of Incorporation

|

Certificate of Incorporation

|

Impact on Stockholders

|

| part thereof) commenced by such Covered Person only if the commencement of such Proceeding (or part thereof) by the Covered Person was authorized in the specific case by the Board of the Company. |

|

||

|

Choice of Forum

|

Not Addressed

|

The Certificate of Incorporation states that unless the Company consents in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware shall be the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the Company, (ii) any action asserting a claim for breach of a fiduciary duty owed by any director, officer, employee or agent of the Company to the Company or the Company's stockholders, (iii) any action asserting a claim arising pursuant to any provision of the DGCL, the Certificate of Incorporation or the Delaware Bylaws or (iv) any action asserting a claim governed by the internal affairs doctrine, in each case subject to said Court of Chancery having personal jurisdiction over the indispensable parties named as defendants therein.

|

The Delaware Chancery Court is widely regarded as the country’s preeminent business court, with experienced jurists who have deep understanding of Delaware corporate law and long standing precedent regarding corporations’ governance. The inclusion of the provision in the Certificate of Incorporation designating the Delaware Chancery Court as the forum for actions against the Company, may make it more difficult for small stockholders that reside in states other than Delaware to initiate suits against the Company or any director, officer or employee of the Company

The inclusion of a choice of forum provision in a corporation’s certificate of incorporation is not a default provision under the DGCL.

|

|

Amendment to Bylaws

|

Not Addressed

|

The Certificate of Incorporation states that in furtherance of, and not in limitation of, the powers conferred by statute, the Board is expressly authorized to adopt, amend or repeal the Bylaws or adopt new Bylaws without any action on the part of the stockholders; provided that any Bylaw adopted or amended by the Board, and any powers thereby conferred, may be amended, altered or repealed by the stockholders.

|

Section 109(a) of the DGCL permits, but does not require Delaware corporations to confer the power to adopt, amend or repeal bylaws upon the board of directors.

The Certificate of Incorporation grants the Board with the power to amend the Delaware Bylaws without any action of the Company’s stockholders. This provision will impact our stockholders in that it will make it more difficult to change provisions in the Delaware Bylaws that may be unpopular to a majority

|

18

|

Provision

|

Articles of Incorporation

|

Certificate of Incorporation

|

Impact on Stockholders

|

|

|

|

|

of our stockholders without first amending the powers conferred to the Board to amend or repeal the Delaware Bylaws.

Conferring the power to amend or repeal the Delaware Bylaws to the Board is not the default under the DGCL.

|

Changes to Bylaws

Set forth below is a table summarizing the material differences in the rights of the stockholders of the Company before and after the Reincorporation is effective, as a result of the differences between the Company’s current bylaws and the Delaware Bylaws. This chart does not address each difference between the current bylaws and the Delaware Bylaws, but focuses on some of those differences which the Company believes are most relevant to the existing stockholders.

|

Provision

|

Company Bylaws

|

Delaware Bylaws

|

Impact on Stockholders

|

|

Annual Meeting of Stockholders

|

The annual meeting of the Board of Directors shall be held either (a) without notice immediately after the annual meeting of stockholders and in the same place, or (b) as soon as practicable after the annual meeting of stockholders on such date and at such time and place as the Board determines.

|

An annual meeting of the stockholders shall be held for the election of directors at such date and time as may be designated by resolution of the Board from time to time, which date shall be within 13 months of the last annual meeting of stockholders. Any other proper business may be transacted at the annual meeting.

|

The Delaware Bylaws do not depart from the default provisions regarding annual meetings as set forth in Section 211(c) of the DGCL.

|

|

Removal of Directors

|

At any meeting of stockholders of the Corporation called for that purpose, the holders of a majority of the shares of capital stock of the Corporation entitled to vote at such meeting may remove from office any or all Directors with or without cause

|

Unless otherwise restricted by statute, the certificate of incorporation or these bylaws, any director or the entire Board may be removed, with or without cause, by the holders of at least sixty-six and two-thirds percent (66 2/3%) of the shares then entitled to vote at an election of directors. Any directorship to be filed by reason of removal of one or more directors by the stockholders may

|

Under Delaware law, the default provision regarding the removal of directors is that a director may be removed with or without cause upon the affirmative vote of a majority of all of the votes of the class entitled to elect that director unless the charter or certificate of incorporation provides otherwise.

The Certificate of Incorporation and the Delaware Bylaws increase the

|

19

|

Provision

|

Company Bylaws

|

Delaware Bylaws

|

Impact on Stockholders

|

| be filled by the stockholders at the special meeting at which the director or directors are so removed. | threshold for the removal of directors to sixty-six and two-thirds percent (66 2/3%) which will make it more difficult for the stockholders to change the Board’s composition. | ||

|

Proxies

|

Every proxy shall be executed in writing by the stockholder or by his or her attorney-in-fact.

|

Each stockholder entitled to vote at a meeting of the stockholders or to express consent or dissent to corporate action in writing without a meeting may authorize another person or persons to act for such stockholder by proxy authorized by an instrument in writing or by a transmission permitted by law filed in accordance with the procedure established for the meeting, but no such proxy shall be voted or acted upon after three years from its date, unless the proxy provides for a longer period. The revocability of a proxy that states on its face that it is irrevocable shall be governed by the provisions of Section 212 of the DGCL.

|

The Delaware Bylaws do not depart from the default provisions regarding proxies as set forth in Section 212(b) of the DGCL.

|

|

Advancement of Indemnification Expenses

|

The Corporation shall indemnify any person who was, or is threatened to be made, a party to a proceeding (as hereinafter defined) by reason of the fact that he or she (i) is or was a director, officer, employee or agent of the Corporation, or (ii) while a director, officer, employee or agent of the Corporation, is or was serving at the request of the Corporation as a director, officer, employee, agent or similar functionary of another corporation, partnership, joint venture, trust or other enterprise, to the fullest extent permitted under the

|

The Certificate of Incorporation states that the Company shall indemnify, advance expenses, and hold harmless, to the fullest extent permitted by applicable law as it presently exists or may hereafter be amended, any Covered Person who was or is made or is threatened to be made a party or is otherwise involved in any action, Proceeding , by reason of the fact that he or she, or a person for whom he or she is the legal representative, is or was a director or officer of the Company or, while a director or officer of the Company, is or was serving at the request of the Company as a director, officer, employee or agent of another Company or of a partnership, joint venture, trust, enterprise or nonprofit entity,

|

Section 145(e) of the DGCL permits, but does not require, Delaware corporations to pay, prior to final disposition, the expenses, including attorneys’ fees, incurred by a corporate representative in defending the proceeding. The provision in Delaware Bylaws and the Certificate of Incorporation permitting such advances is not the default provision under the DGCL.

Advancing expenses to Covered Persons prior to the final disposition of a proceeding could impact our stockholders to the extent that we would use Company assets, which could be used to grow our business, to cover the costs of litigation without the certainty that the Covered Person will be successful on

|

20

|

Provision

|

Company Bylaws

|

Delaware Bylaws

|

Impact on Stockholders

|

| Revised Statutes of the State of Nevada, as the same exists or may hereafter be amended. Such right shall be a contract right and as such shall run to the benefit of any director or officer who is elected and accepts the position of director or officer of the Corporation or elects to continue to serve as a director or officer of the Corporation while this Article VII is in effect. The rights conferred above shall not be exclusive of any other right which any person may have or hereafter acquire under any statute, bylaw, resolution of stockholders or directors, agreement or otherwise. | including service with respect to employee benefit plans, against all liability and loss suffered and expenses (including attorneys' fees) reasonably incurred by such Covered Person. Notwithstanding the preceding sentence, except for claims for indemnification (following the final disposition of such Proceeding) or advancement of expenses not paid in full, the Company shall be required to indemnify a Covered Person in connection with a Proceeding (or part thereof) commenced by such Covered Person only if the commencement of such Proceeding (or part thereof) by the Covered Person was authorized in the specific case by the Board of the Company. | the merits of the suit. | |

|

Amendments to the Bylaws

|

These Bylaws may be adopted, altered, amended or repealed or new Bylaws may be adopted by the stockholders, or by the Board of Directors, at any regular meeting of the stockholders or of the Board of Directors or at any special meeting of the stockholders or of the Board of Directors if notice of such alteration, amendment, repeal or adoption of new Bylaws be contained in the notice of such special meeting

|

These bylaws may be adopted, amended or repealed by the stockholders entitled to vote. However, the Company may, in its certificate of incorporation, confer the power to adopt, amend or repeal bylaws upon the directors. The fact that such power has been so conferred upon the directors shall not divest the stockholders of the power, nor limit their power to adopt, amend or repeal bylaws.

The Board may not alter or repeal bylaws adopted or amended by the stockholders, including any bylaw amendment adopted by stockholders which specifies the votes that shall be necessary for the election of directors and (ii) no bylaws shall be adopted by the Board which shall require more than a majority of the voting shares for a quorum at a

|

Section 109(a) of the DGCL permits, but does not require Delaware corporations to confer the power to adopt, amend or repeal bylaws upon the board of directors.

The Certificate of Incorporation grants the Board with the power to amend the Delaware Bylaws without any action of the Company’s stockholders. This provision will impact our stockholders in that it will make it more difficult to change provisions in the Delaware Bylaws that may be unpopular to a majority of our stockholders without first amending the powers conferred to the Board to amend or repeal the Delaware Bylaws.

Conferring the power to amend or repeal the Delaware Bylaws to the Board is not the default under the

|

21

|

Provision

|

Company Bylaws

|

Delaware Bylaws

|

Impact on Stockholders

|

| stockholder meeting, or more than a majority of the stockholder votes for an action of the stockholders at a meeting of the stockholders. | DGCL. |

CORPORATE ACTION #3

6 FOR 1 FORWARD SPLIT OF THE COMPANY’S COMMON STOCK ISSUED AND

OUTSTANDING

As approved unanimously by the Board and by the Consenting Shareholders consent on December 3, 2012, the Company’s management is authorized and directed to implement a Forward Split of our Common Stock issued and outstanding as of the Record Date on the basis of six (6) post-split shares for every one (1) pre-split share. The effective date of the Forward Split will be the later of: (i) twenty days following the date of the mailing of this Information Statement; or (ii) FINRA’s approval of the Forward Split (the “Effective Date”).

Reasons for Forward Stock Split

The primary objective of the Forward Split is to increase the liquidity of the Common Stock. The Board believes that the Forward Split would improve the liquidity of the Common Stock and better enable the Company to raise funds. The Board believes that improved liquidity may encourage investor interest and improve the marketability of the Common Stock to a broader range of investors, and thus improve liquidity. Once we implement the Forward Spit, there is no assurance that the marketability of our Common Stock and thus the liquidity of our Common Stock will improve after the Forward Split. There is no guarantee to stockholders that the Common Stock will have any improved liquidity or will reach or sustain any price level in the future, and it is possible the proposed Forward Split will have no lasting impact on the liquidity of our Common Stock or any fund raising efforts undertaken by the Company.

Material Effects of Forward Split

The Forward Split will not affect the registration of our Common Stock under the Securities Exchange Act of 1934, as amended, nor will it change our periodic reporting and other obligations thereunder. The number of stockholders of record will not be affected by the Forward Split. The number of shares of our Common Stock under the articles of incorporation and the Delaware Certificate of Incorporation will remain the same following the Effective Date of the Forward Split. The number of shares of our Common Stock issued and outstanding on the Effective Date will be increased following the Effective Date of the Forward Split in accordance with the following formula: every one (1) share of our Common Stock owned by a stockholder will automatically be changed into and become six (6) new shares of our Common Stock. Any shares issued and outstanding after the Effective Date would be unaffected. In addition, there shall be no change in each stockholder’s percentage of ownership in the Company as a result of the Forward Split.

Procedure for Effecting Exchange of Stock Certificates

Commencing on the Effective Date, each certificate evidencing shares of the Common Stock will be deemed for all corporate purposes to evidence ownership of the increased number of shares of Common Stock resulting from the Forward Split. We will obtain a new CUSIP number for the Common Stock at the time of the Forward Split. As soon as practicable after the Effective Date, stockholders should contact

22

our transfer agent, VStock Transfer, Yoel Goldfeder, Phone: 212-363-0825 to arrange to surrender their certificates representing shares of pre-Forward Split Common Stock in exchange for certificates representing shares of post-Forward Split Common Stock. No new certificates will be issued to a stockholder until that stockholder has surrendered the stockholder's outstanding certificate(s) to our transfer agent.

STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE.

Fractional Shares

No fractional shares of post-Forward Split Common Stock will be issued to any stockholder in connection with the Forward Split. In order to avoid the expense and inconvenience of issuing and transferring fractional shares of Common Stock to stockholders who would otherwise be entitled to receive fractional shares of Common Stock following the Forward Split, any fractional shares which result from the Forward Split will be rounded to the next whole share.

Federal Income Tax Consequences of the Forward Split

The following is a summary of certain material federal income tax consequences of the Forward Split. It does not purport to be a complete discussion of all of the possible federal income tax consequences of the Forward Split and is included for general information only. Further, it does not address any state, local or foreign income or other tax consequences. Also, it does not address the tax consequences to holders that are subject to special tax rules, such as banks, insurance companies, regulated investment companies, personal holding companies, foreign entities, non-resident alien individuals, broker-dealers and tax-exempt entities. The discussion is based on the provisions of the United States federal income tax law as of the date hereof, which is subject to change retroactively as well as prospectively. This summary also assumes that the shares of common stock were, prior to the Forward Split, and will be, after the Forward Split, held as a “capital asset,” as defined in the Internal Revenue Code of 1986, as amended (i.e., generally, property held for investment). The tax treatment of a stockholder may vary depending upon the particular facts and circumstances of such stockholder. Each stockholder is urged to consult with such stockholder’s own tax advisor with respect to the tax consequences of the Forward Split.

No gain or loss should be recognized by a stockholder upon such stockholder’s exchange of pre-Forward Split shares of common stock for post-Forward Split shares of common stock pursuant to the Forward Split. The aggregate tax basis of the new shares of common stock received in the Forward Split will be the same as the stockholder’s aggregate tax basis in the pre-Forward Split shares of common stock exchanged therefor. The stockholder’s holding period for the post- Forward Split shares will include the period during which the stockholder held the pre-Forward Split shares of common stock surrendered in the Forward Split.

TO ENSURE COMPLIANCE WITH TREASURY DEPARTMENT CIRCULAR 230, STOCKHOLDERS ARE HEREBY NOTIFIED THAT: (A) ANY DISCUSSION OF FEDERAL TAX ISSUES IN THIS INFORMATION STATEMENT IS NOT INTENDED OR WRITTEN TO BE RELIED UPON, AND CANNOT BE RELIED UPON BY STOCKHOLDERS FOR THE PURPOSE OF AVOIDING PENALTIES THAT MAY BE IMPOSED ON STOCKHOLDERS UNDER THE INTERNAL REVENUE CODE; (B) SUCH DISCUSSION IS INCLUDED HEREIN BY US IN CONNECTION WITH OUR PROMOTION OR MARKETING (WITHIN THE MEANING OF CIRCULAR 230) OF THE TRANSACTIONS OR MATTERS ADDRESSED HEREIN; AND (C) STOCKHOLDERS SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

23

Our view regarding the tax consequences of the Forward Split is not binding on the Internal Revenue Service or the courts. Accordingly, each stockholder should consult with his or her own tax advisor with respect to all of the potential tax consequences to him or her of the Forward Split.

24

INFORMATION TO BE FURNISHED BY ITEMS OF SCHEDULE 14A

Dissenters’ and Appraisal Rights

Any stockholders who vote shares against the Reincorporation may, under certain conditions, become entitled to be paid for his or her shares of the Corporation's capital stock in lieu of receiving shares of the Delaware Corp. Under Nevada Law Section 92A.380, you, the Corporation's stockholder, have the right to dissent from the Reincorporation and demand payment of the fair value of your shares of the Corporation's capital stock and are urged to read the full text of the Nevada dissenters' rights statute, which is reprinted in its entirety and attached as Appendix F to this Information Statement. Under Nevada Law, “fair value” is defined with respects to dissenter's shares, as “the value of the shares immediately before the effectuation of the corporate action to which he objects, excluding any appreciation or depreciation in anticipation of the corporate action unless exclusion would be inequitable.”

The following is a brief summary of the relevant portions of Nevada Law Sections 92A.300 to 92A.500, attached hereto in its entirety as Appendix F to this Information Statement, which sets forth the procedure for exercising dissenters' rights with respect to the change in domicile and demanding statutory appraisal rights. This discussion and Appendix F should be reviewed carefully by you if you wish to exercise statutory dissenters' rights or wish to preserve the right to do so, because failure to strictly comply with any of the procedural requirements of the Nevada dissenters' rights statute may result in a termination or waiver of dissenters' rights under the Nevada dissenters' rights statute. If you elect to assert dissenters' rights in connection with the reincorporation merger, you must comply with the following procedures: (1) within 30 days after the effective time of the Reincorporation, we will give written notice of the effective time of the change in domicile by certified mail to each stockholder. The notice provided by us will also state where demand for payment must be sent and where share certificates shall be deposited, among other information. Within the time period set forth in the notice, which may not be less than 30 days nor more than 60 days following the date notice is delivered, the dissenting stockholder must make a written demand on us for payment of the fair value of his or her shares and deposit his or her share certificates in accordance with the notice.

Within 30 days after the receipt of demand for the fair value of the dissenters' shares, we will pay each dissenter who complied with the required procedures the amount it estimates to be the fair value of the dissenters' shares, plus accrued interest. Additionally, we shall mail to each dissenting stockholder a statement as to how fair value was calculated, a statement as to how interest was calculated, a statement of the dissenters' right to demand payment of fair value under Nevada law, and a copy of the relevant provisions of Nevada law. A dissenting stockholder, within 30 days following receipt of payment for the shares, may send us a notice containing such stockholder's own estimate of fair value and accrued interest, and demand payment for that amount less the amount received pursuant to our payment of fair value to such stockholder. If a demand for payment remains unsettled, we will petition the court to determine fair value and accrued interest. If we fail to commence an action within 60 days following the receipt of the stockholder's demand, we will pay to the stockholder the amount demanded by the stockholder in the stockholder's notice containing the stockholder's estimate of fair value and accrued interest. All dissenting stockholders, whether residents of Nevada or not, must be made parties to the action and the court will render judgment for the fair value of their shares. Each party must be served with the petition. The judgment shall include payment for the amount, if any, by which the court finds the fair value of such shares, plus interest, exceeds the amount already paid. If the court finds that the demand of any dissenting stockholder for payment was arbitrary, vexatious or otherwise not in good faith, the court may assess costs, including reasonable fees of counsel and experts, against such stockholder. Otherwise the costs and expenses of bringing the action will be determined by the court. In addition, reasonable fees

25

and expenses of counsel and experts may be assessed against us if the court finds that it did not substantially comply with the requirements of the Nevada dissenters' rights statute or that it acted arbitrarily, vexatiously, or not in good faith with respect to the rights granted to dissenters under Nevada law.

The foregoing summary of the relevant portions of Nevada Law Sections 92A.300 to 92A.500 is not intended to be a complete statement of the law pertaining to dissenters’ rights thereunder, which, is attached hereto in its entirety as Appendix F

Voting Securities and Principal Holders Thereof

As of the date of this Information Statement, there were 4,101,000 shares of the Common Stock issued and outstanding of the Company. Each outstanding share of Common Stock is entitled to one vote per share.

The following table sets forth certain information regarding the beneficial ownership of shares of our Common Stock as of December 19, 2012 by:

|

|

●

|

each person who is known by us to beneficially own more than 5% of our issued and outstanding shares of Common Stock;

|

|

|

●

|

our named executive officers;

|

|

|

●

|

our directors; and

|

|

|

●

|

all of our executive officers and directors as a group.

|

Beneficial ownership as determined in Rule 13d-3 under the Exchange Act includes common stock acquirable upon exercise or conversion of securities of the Company within 60 days and common stock beneficially owned by an entity or person controlled directly or indirectly, through any contract, arrangement, understanding or otherwise.

|

Name and Address of Beneficial Owner

|

Amount and Nature

of Beneficial

Ownership

|

Percentage of

Class

|

|

Tungsten 74 LLC

464 Gorge Road, #3E,

Cliffside Park, NJ 07910 (1)

|

3,315,000

|

80.8%

|

|

Chromium 24 LLC

135 East 18th St

. New York, NY 10003(2)

|

266,179

|

6.49%

|

|

Nickolay Kukekov(3)

|

nil

|

nil

|

|

All current executive officers and directors as a group (1 person) (3)

|

nil

|

nil

|

26

(1) Tungsten 74 LLC is a New York limited liability company. Viacheslav Kriventsov has voting and investment power with respect to these shares. Dr. Kukekov, is a non-controlling member of Tungsten 74 LLC, and disclaims beneficial ownership in Tungsten 74 LLC except to the extent of his pecuniary interest therein

(2) Chromium 24 LLC is a Delaware limited liability company. John H. Kalem has voting and investment power with respect to these shares. Dr. Kukekov is a non-controlling member of Chromium 24 LLC, and disclaims beneficial ownership in Chromium 24 LLC except to the extent of his pecuniary interest therein.

(3)Dr. Kukekov is our Chief Executive Officer and director. Does not include the shares held by Tungsten 74 LLC or Chromium 24 LLC, of each of which Dr. Kukekov is a member.

PROPOSALS BY SECURITY HOLDERS

No security holder entitled to vote at a stockholder’s meeting or by written consent has submitted to the Company any proposal for consideration by the Company or its Board.

COSTS AND MAILING

The Company will pay all costs associated with the distribution of this Information Statement, including the costs of printing and mailing. The Company has asked or will ask brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of the Common Stock held of record by such persons and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material

ADDITIONAL INFORMATION

The Company files annual and quarterly reports, proxy statements, and other reports and information electronically with the SEC. The Company’s filings are available through the SEC’s website at the following address: http:www.sec.gov.

Stockholders Sharing the Same Last Name and Address

The Company will be sending multiple copies of the information statement to the same address if more than one stockholder lives at the same residence.

| By Order of the Board of Directors | |

|

/s/Nickolay Kukekov

Chief Executive Officer

|

December 19, 2012

27

APPENDIX A

PLAN OF CONVERSION

FOR CONVERTING

FITS MY STYLE INC.,

a Nevada corporation

TO

ANTRIABIO, Inc

a Delaware corporation